January 10, 2022

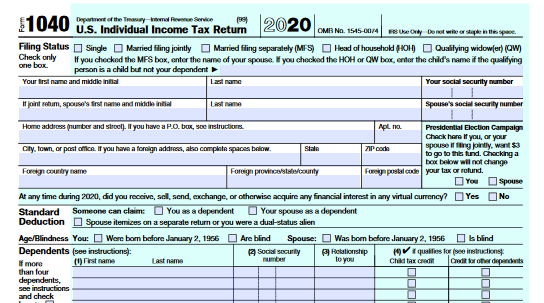

2022 Estimated Income Tax Refund Date Chart – When Will You Get Your Tax Refund?

The below chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on the information we have now, and using projections based on previous years- and depending on when a person files their return.