Accounting Technology Lab Podcast February 6, 2026

Randy Johnston and Brian Tankersley recap their firsthand experience at Acumatica Summit 2026 in Seattle, framing it as a year of evolution rather than revolution for the cloud ERP platform.

Firm Management February 6, 2026

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The IRS this week announced tax relief for individuals and businesses in Montana affected by severe wind storms and flooding that occurred the second and third weeks of December 2025.

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Staffing February 6, 2026

Professionals on the Move is a periodic roundup of recent staffing announcements, promotions and recognitions from around the profession.

Taxes February 6, 2026

The Idaho Supreme Court rejected a challenge to Idaho’s $50 million tax credit program that directs public money toward private schools and homeschooling expenses.

Artificial Intelligence February 6, 2026

A workplace expert warns of emerging skills gap as employees become overreliant on AI tools, creating division between critical thinkers and copy-paste workers.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The IRS this week announced tax relief for individuals and businesses in Montana affected by severe wind storms and flooding that occurred the second and third weeks of December 2025.

Taxes February 6, 2026

The Idaho Supreme Court rejected a challenge to Idaho’s $50 million tax credit program that directs public money toward private schools and homeschooling expenses.

Taxes February 5, 2026

The revelation came Thursday during a Senate Banking Committee hearing where Treasury Secretary and Acting Commissioner of the Internal Revenue Service Scott Bessent testified.

Mergers and Acquisitions February 5, 2026

The Dallas-based tax services and software firm said Thursday it has acquired Meritax Advisors, a commercial property tax consulting firm with offices in Frisco and Austin, TX.

Sales Tax February 5, 2026

If a proposed constitutional amendment abolishing property taxes were to pass, Ohioans may see sales taxes skyrocket into the double digits, Gov. Mike DeWine said Thursday morning.

Taxes February 5, 2026

“What I would do? Tell them to pay me, but I’ll give 100% of the money to charity,” President Donald Trump said in an interview with NBC News, floating the American Cancer Society as a potential beneficiary.

Taxes February 5, 2026

Congress took steps on Wednesday toward blocking changes to D.C.’s local tax code, even as District officials warned it could wreak havoc on tax season and smash a hole in the city’s budget.

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Technology February 5, 2026

The San Francisco-based startup says its platform's AI-native infrastructure is built to unify tax preparation and review into a single system for accounting firms.

Mergers and Acquisitions February 5, 2026

The Los Angeles-based top 100 accounting firm announced this week that it has joined forces with Blueprint CFO, a tenured fractional CFO services firm in Newport Beach, CA, effective Nov. 1, 2025.

Auditing February 5, 2026

The proposed changes reflect the ongoing evolution in attestation services, in which practitioners are increasingly asked to provide services beyond audits of the financial statements, the AICPA said.

Technology February 4, 2026

Pilot said Feb. 4 that its AI Accountant is a fully autonomous system that runs the entire bookkeeping process, from onboarding to monthly close, with zero human intervention.

Technology February 4, 2026

Rillet recently announced its Continuous Close Accruals module, which the San Francisco-based company said is "taking accruals out of spreadsheet chaos and bringing them into the future."

Technology February 4, 2026

FlexTecs said the strategic investment positions the company to drive even further value for clients, expand its services and software offering, and accelerate its next phase of growth.

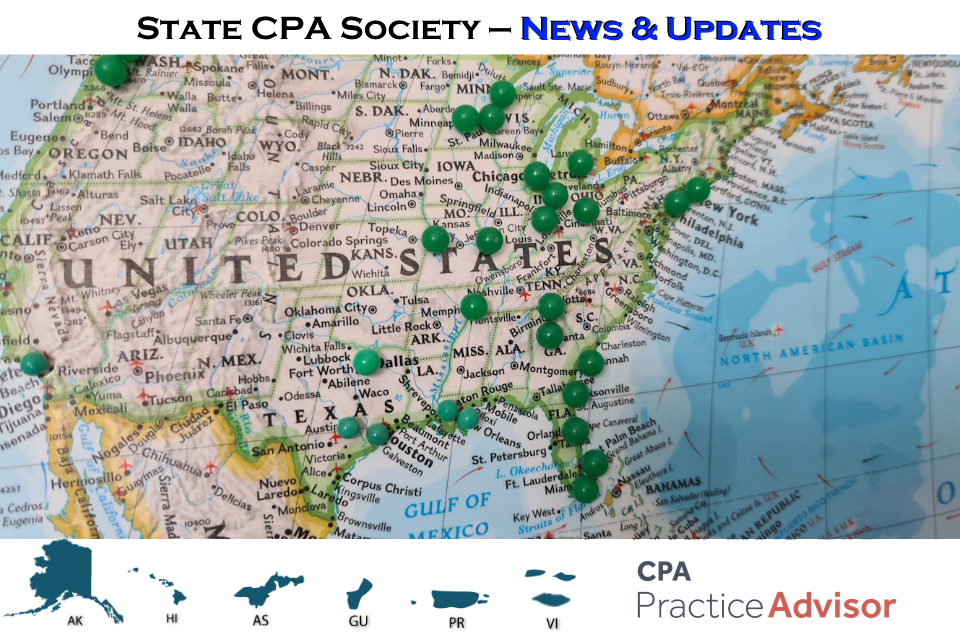

State CPA Societies February 4, 2026

State CPA Society News & Updates is a selection of recent announcements and initiatives by CPA associations in the United States and its territories.

Artificial Intelligence February 6, 2026

A workplace expert warns of emerging skills gap as employees become overreliant on AI tools, creating division between critical thinkers and copy-paste workers.

Payroll February 5, 2026

Money is an uncomfortable topic for many, yet it’s an important ongoing conversation to have in a relationship. Financial secrets undermine trust. And for many, it may even feel like betrayal.

Payroll February 5, 2026

Making a major purchase is different from shopping for groceries. Budgeting for big purchases is different, too.

Payroll February 5, 2026

Visa and Mastercard currently control over 80% of the credit card market and each centrally sets the swipe fee rates charged by all banks issuing cards under their brands.

Payroll February 4, 2026

Of the 18% of employees who've admitted to playing hooky from work following Super Bowl celebrations, 7.5% say they've done it more than once, according to new data from TopResume.

Benefits February 4, 2026

While Social Security recipients are now receiving a monthly payment surpassing $2,000 for the first time after a 2.8% cost-of-living adjustment, many seniors and advocacy groups are already looking ahead.

Payroll February 4, 2026

A net worth statement isn’t just a financial exercise—it’s an act of consideration. And like many of the best gifts, its true value may only be realized when it’s needed most.

Staffing February 3, 2026

The research highlights a trend it calls “AI limbo,” where rapid AI adoption is outpacing the training, governance, and communication needed for employees to use AI effectively and responsibly.

Artificial Intelligence February 6, 2026

A workplace expert warns of emerging skills gap as employees become overreliant on AI tools, creating division between critical thinkers and copy-paste workers.

Technology February 5, 2026

The San Francisco-based startup says its platform's AI-native infrastructure is built to unify tax preparation and review into a single system for accounting firms.

Technology February 5, 2026

Tolley+ with Protégé enhances precision, streamlines complex tax workflows, and empowers tax professionals to deliver faster, more accurate results, LexisNexis says.

Technology February 4, 2026

Pilot said Feb. 4 that its AI Accountant is a fully autonomous system that runs the entire bookkeeping process, from onboarding to monthly close, with zero human intervention.

Technology February 4, 2026

RSM US said it has expanded direct licensing of its PartnerSight platform, giving financial institutions, private equity, and family offices access to the top five firm's cloud-native tax allocation platform.

Technology February 4, 2026

Rillet recently announced its Continuous Close Accruals module, which the San Francisco-based company said is "taking accruals out of spreadsheet chaos and bringing them into the future."

Technology February 4, 2026

FlexTecs said the strategic investment positions the company to drive even further value for clients, expand its services and software offering, and accelerate its next phase of growth.

Technology February 4, 2026

Through a partnership with tax technology platform april, OnePay Cash customers can now file federal and state taxes with confidence at no cost, OnePay says.

Firm Management February 6, 2026

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Staffing February 6, 2026

Professionals on the Move is a periodic roundup of recent staffing announcements, promotions and recognitions from around the profession.

Mergers and Acquisitions February 5, 2026

The Dallas-based tax services and software firm said Thursday it has acquired Meritax Advisors, a commercial property tax consulting firm with offices in Frisco and Austin, TX.

Mergers and Acquisitions February 5, 2026

The Los Angeles-based top 100 accounting firm announced this week that it has joined forces with Blueprint CFO, a tenured fractional CFO services firm in Newport Beach, CA, effective Nov. 1, 2025.

Firm Management February 4, 2026

Partners transform firms by modeling the mindset, reinforcing priorities, and supporting the roles that turn ideas into action.

Staffing February 4, 2026

Professionals on the Move is a periodic roundup of recent staffing announcements, promotions and recognitions from around the profession.

Mergers and Acquisitions February 3, 2026

Arax Investment Partners, a premier wealth management firm, has acquired GFP Private Wealth, a registered investment advisor with $1.5 billion in AUM.

January 20, 2026

Most firms focus on efficiency, automation, and AI, but the real challenges inside a tax workflow are often simpler and more human: unclear expectations, too many handoffs, information scattered across tools, and clients or staff feeling unsure about what comes next.

January 5, 2026

Filing corrected returns can be confusing—but it doesn’t have to be. Join Amanda Watson, EA, for a practical session designed to help you confidently navigate amended and superseded returns.

December 16, 2025

Manual processes slow your firm—and cost time, money, and talent. Firms that embrace automation and modern technology save hours, reduce costs, and build a workplace that attracts the next generation of CPAs.

December 4, 2025

Discover the roadmap to achieving future-ready success for your tax and accounting firm by joining us at our The Future of Your Firm: Unlocking Growth Through Integration, Innovation, and Insight webinar.