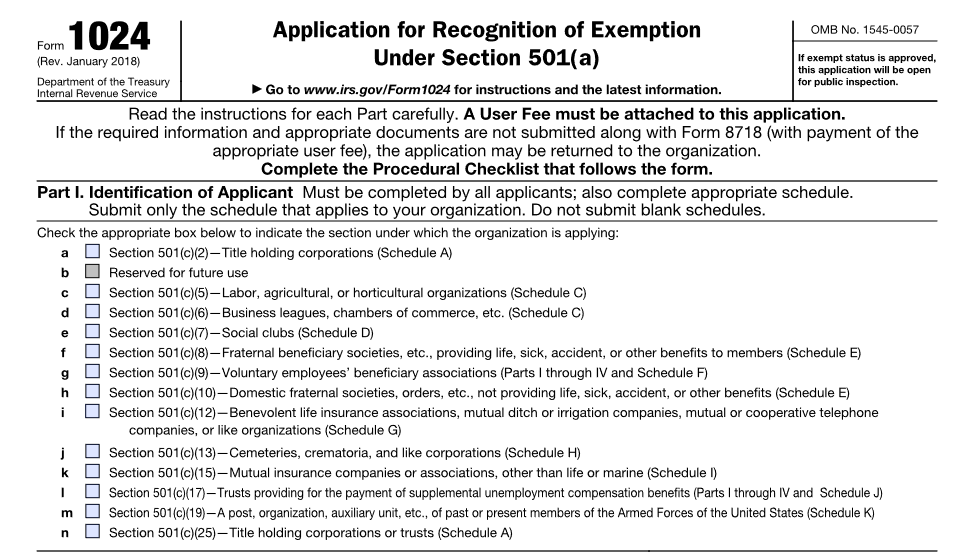

The IRS has revised Form 1024, Application for Recognition of Exemption Under Section 501(a) or Section 521 of the Internal Revenue Code, to allow electronic filing.

Beginning Jan. 3, 2022, applications for recognition of exemption on Form 1024 must be submitted electronically online at Pay.gov. The IRS will provide a 90-day grace period during which it will continue to accept paper versions of Form 1024 (Rev. 01-2018) and letter applications.

“Electronic filing makes it easier to complete an application for tax-exempt status while reducing errors,” said Sunita Lough, commissioner of the IRS Tax Exempt and Government Entities division. “Electronic filing also shortens IRS processing time so applicants won’t wait as long for a response.”

Organizations requesting determinations under Section 521 are now also able to use the electronic Form 1024 instead of Form 1028, Application for Recognition of Exemption Under Section 521 of the Internal Revenue Code.

The required user fee for Form 1024 will remain $600 for 2022. Applicants must pay the fee through Pay.gov when submitting the form. Payment can be made directly from a bank account or by credit or debit card.

Organizations are encouraged to subscribe to Exempt Organizations Update, a free IRS e-Newsletter, for form updates and other exempt organization news.

As part of the revision, applications for recognition of exemption under Sections 501(c)(11), (14), (16), (18), (21), (22), (23), (26), (27), (28), (29) and 501(d) can no longer be submitted as letter applications. Instead, these requests must be made on the electronic Form 1024. Accordingly, organizations that are described in Section 501(c) (other than 501(c)(3) and (c)(4)) and 501(d) applying for tax-exempt status must now use the electronic Form 1024. Section 501(c)(3) organizations must continue to use Form 1023 or Form 1023-EZ, and Section 501(c)(4) organizations must continue to use Form 1024-A. Those forms also must be filed electronically.

Additional information on how to apply for IRS recognition of tax-exempt status: • Applying for Tax-Exempt Status on IRS.gov • Revenue Procedure 2022-08

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs