Firm Management February 6, 2026

Wipfli Partners with The Caddie Network

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

Firm Management February 6, 2026

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

February 6, 2026

February 6, 2026

February 6, 2026

February 6, 2026

October 20, 2017

There was a time when I wanted all my passwords to be the same, but that was way way back when we weren’t so worried about identity theft and hackers. So it’s time to move into the 21st century and learn about options for password management.

October 20, 2017

The IRS has provided real estate owners with a juicy tax deduction. The de minimis safe harbor election is an annual tax return election that permits a taxpayer to deduct, as ordinary and necessary business expenses, purchases of items that would normally have to be capitalized. Yet this advantageous election is often overlooked by taxpayers....…

October 20, 2017

Wouldn’t it be great to simply retrieve client documents in the portal, process their tax returns, upload the return to the portal for the client to access and sign, and simply efile the signed return? Wouldn’t it be great to have a repository of ...

October 20, 2017

Today, business owners and employees alike use a variety of methods to access software, including iOS and Android smartphones. IT staff has been pared down or eliminated as the need to install and maintain multiple software products on a local ...

October 19, 2017

More than 25 states allow the sale of marijuana for medicinal use; eight states permit the sale for recreational use. This activity has created new business opportunities for many public accounting firms, but there are unique challenges and risks in ...

October 19, 2017

Digital badges appear as an icon or a logo online. Clicking on the badge takes you to a website that validates and explains the certificate. Badges can be used with any online communication like websites, email signatures, resumes and LinkedIn profiles.

October 19, 2017

Have you ever made a mistake and then tried to cover it up, hoping no one would notice, hoping you could fix the problem on your own, or counting on it not being an issue relevant enough to worry about? Put yourself in the shoes of the person most ...

October 19, 2017

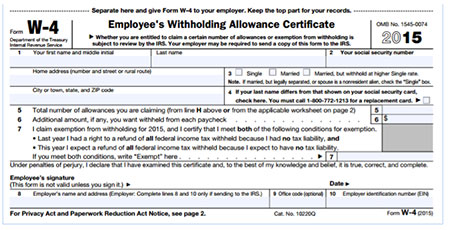

When you hire employees, you should have them complete Form W-4 when they start work. The form lets you know how much federal income tax to withhold from employees’ wages.

October 19, 2017

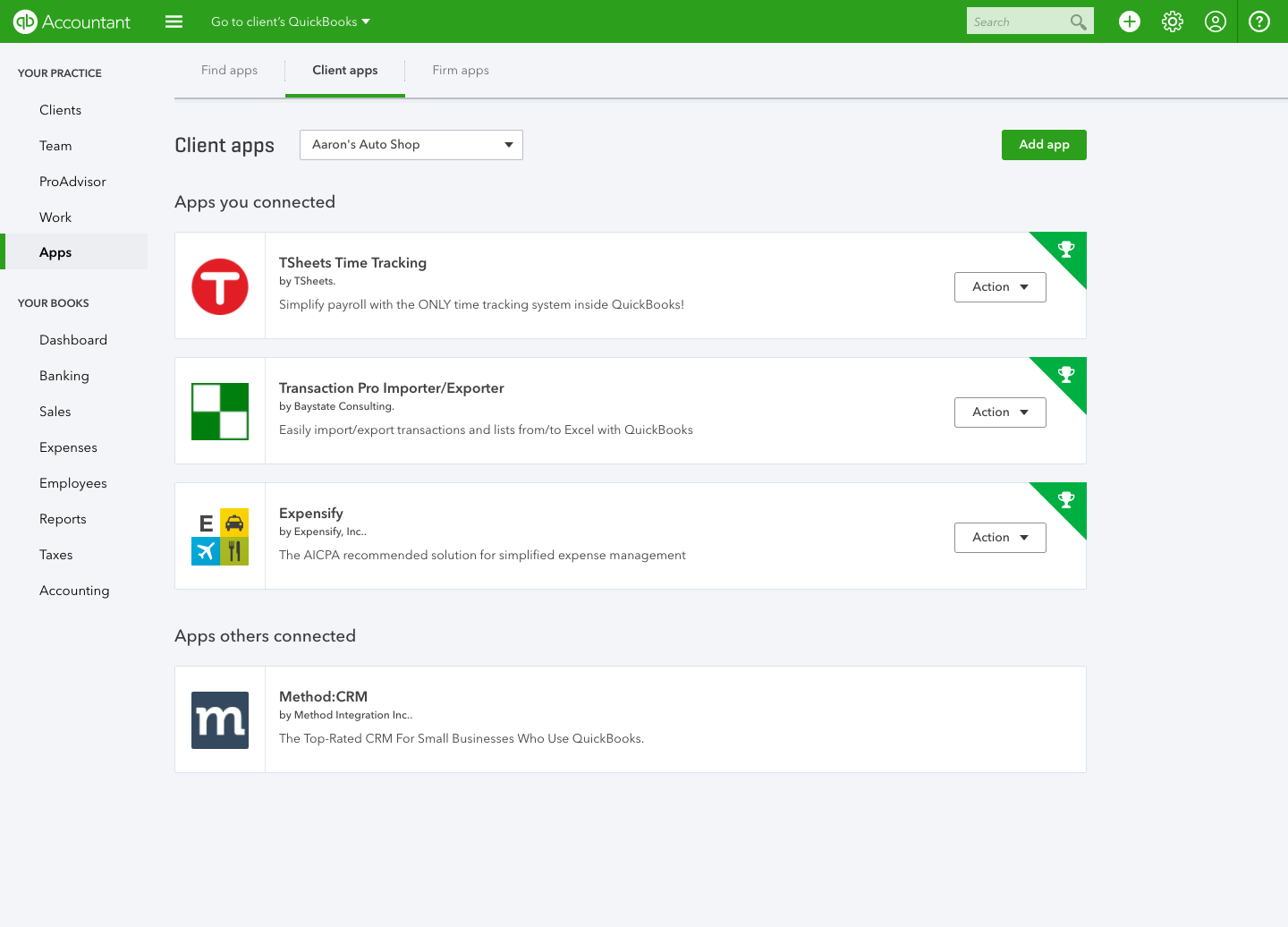

New Apps tab within QuickBooks Online Accountant helps accounting pros expand their role as trusted advisors and add apps directly to their clients’ QuickBooks Online accounts

October 18, 2017

A new study shows significant trends in enterprise use of external contractors; growing enterprise demand for on-demand support, influx of highly skilled contractors into the workforce, business challenges, and increased individual interest in ...

October 18, 2017

It’s ironic that a profession dedicated to minimizing financial risks is so fraught with risk. While many business owners worry about liability and property risk — especially in the immediate wake of Hurricanes Harvey and Irma — insurance for ...

October 18, 2017

Steve's practice uses AccountantsWorld's Accounting Power system, which makes it easy to collaborate with clients to share data, includes strong financial reporting and write-up functions, has trial balance, and includes a full bookkeeping system for ...