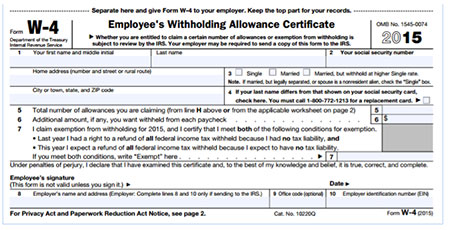

When you hire employees, you should have them complete Form W-4 when they start work. The form lets you know how much federal income tax to withhold from employees’ wages.

Form W-4 is a short form, but it can still be confusing. If your employees have questions while filling it out, would you be able to answer them?

This article will give you the information you need to have a basic understanding of the form and to give your employees Form W-4 help.

When to fill out Form W-4?

There are three main times when employees might need to fill out a Form W-4.

1. Upon hire

Employees should fill out Form W-4 when they first begin work for your business. You will then use each employee’s claimed allowances to calculate how much federal income tax withholding to deduct from wages, beginning with the next payroll you run.

2. Withholding adjustments

Your employees need to give you a new Form W-4 whenever they need to adjust their withholding. Employees should give you a new form within 10 days of experiencing a life event that changes the number of allowances they can claim on the personal allowances worksheet. For example, an employee should give you a new Form W-4 when their marital status changes.

Employees can also give you a new form anytime during the year if they find too much or too little tax is being withheld. You are required to implement the new form as soon as possible. The longest you can wait to change withholding is the start of the first payroll period that ends 30 days after an employee turns in the form.

3. Exemption from withholding expiration

If any employees fill out an exemption from withholding, they will need to fill out a new Form W-4 every year before the Form W-4 deadline for exemptions on February 16 to keep the exemption.

What are allowances?

Employees can claim allowances on Form W-4. For each claimed allowance, the employee’s federal income tax withholding decreases. Employees can claim allowances for a few things, including dependents and spouses.

Page 2 of Form W-4 has worksheets that employees can use if they plan to itemize their deductions, claim certain credits, or make income adjustments. If employees use the worksheets for W-4 form help, they will still record their allowances on line 5 of page 1.

You will use the allowances that employees claim to calculate their federal income tax withholding. You can use the withholding charts in Publication 15 or payroll software to calculate income tax withholding.

What is an exemption?

What does exempt mean on W-4? Some employees might be able to claim an exemption from withholding, meaning they do not have to pay federal income tax. Employees can claim an exemption from withholding if they meet these two conditions:

- The employee had a right to a refund of all federal income tax withheld last year because they had no tax liability.

- The employee expects a refund of all federal income tax withheld this year because they will have no tax liability.

If an employee wants to claim an exemption from withholding, they only need to fill out lines 1, 2, 3, 4, and 7 on Form W-4.

Do nonresident aliens fill out Form W-4?

If you hire a nonresident alien (NRA), that employee must fill out a Form W-4 if they are subject to income tax withholding. NRA employees should follow these instructions when filling out Form W-4:

- Select “Single” on line 3, regardless of marital status.

- Claim only 1 allowance on line 5, unless the employee is from Canada, Mexico, South Korea, a U.S. national, or is a student or apprentice from India.

- Do not claim exempt status on line 7.

- Write “Nonresident Alien” or “NRA” above the dotted line on line 6.

For more information on Form W-4 or about withholding federal income tax from NRA employees, see IRS Notice 1392.

What do you do with completed forms?

Once employees complete their forms, you do not send them to the IRS. You will only send Form W-4 to the IRS if it requests you to do so.

You need to keep a Form W-4 on file for every employee. You should keep every Form W-4 on file for at least four years, even for employees who quit or were fired.

Giving employees much needed Form W-4 help

You are a small business owner. You shouldn’t be expected to be a Form W-4 expert. But if employees ask questions, this article should give you some of the information you need to give employees W-4 form help.

If you need more information on Form W-4, search the IRS website. It has many resources, including withholding information for employees and a withholding calculator to help employees determine their allowances.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs