Apps, while a wonderful thing, can be a bit daunting, especially when there are dozens for every task of running a business. It can make it hard for small business owners to know the best apps for their business, and quite tedious for their accountants to get them set up. Insert the brand-new Apps tab within QuickBooks Online Accountant, which allows accounting professionals to easily connect apps to their clients’ QuickBooks Online, as well as their own firm. All of this can be done directly from QuickBooks Online Accountant – the one place where accountants can manage their practice and clients across all the services they offer.

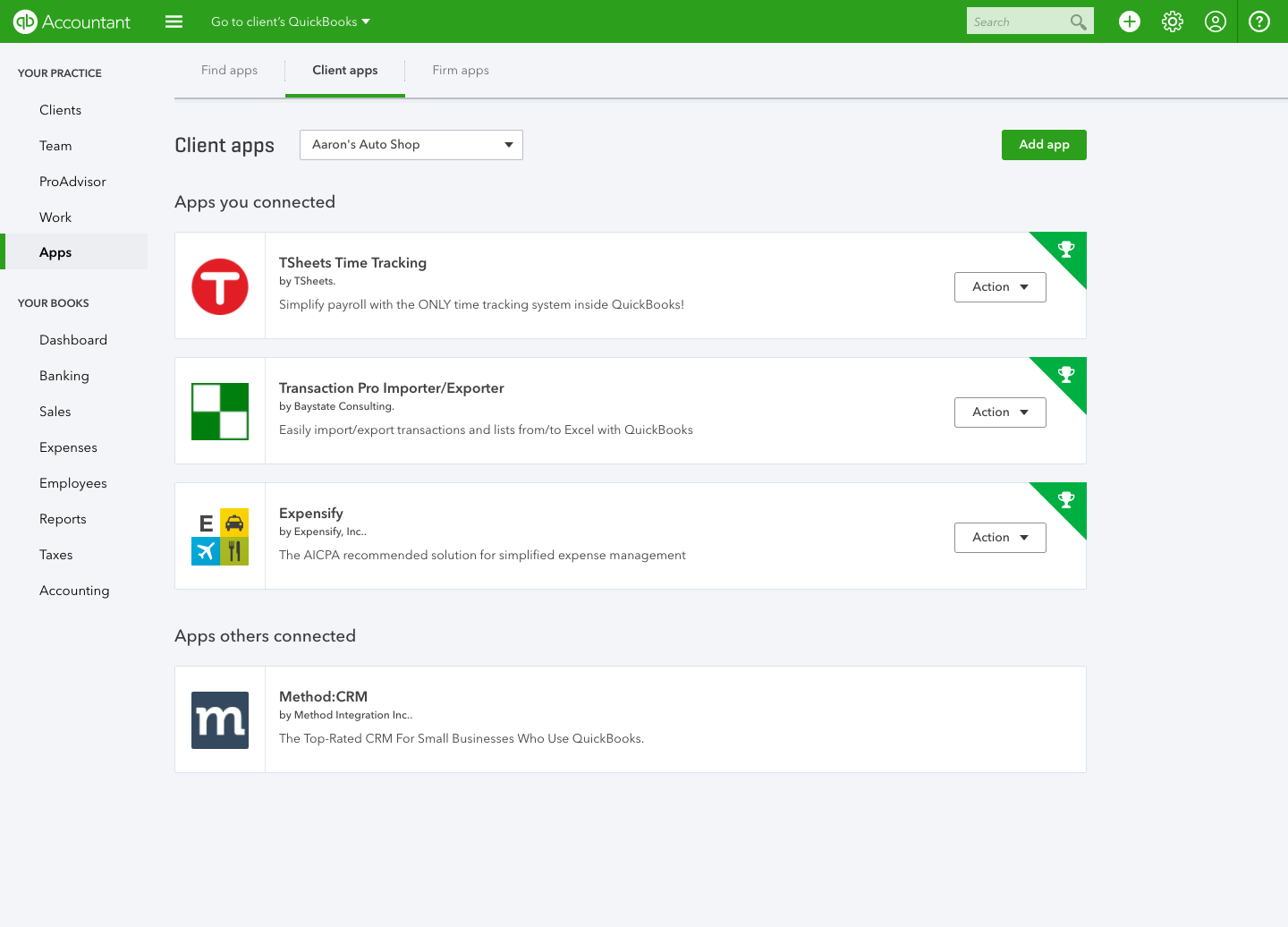

Connecting apps is easy and can be done right from the “Apps” tab on the left-hand side of the QuickBooks Online Accountant dashboard. From the Apps tab, users can also browse apps by categories without leaving QuickBooks Online Accountant. Once an app is selected, simply click “Get App Now” and choose to install the app for the firm or for the client. New users can even create an account from the same screen.

The Apps tab also shows which apps are used by clients and which are used by the firm. The app details include an overview of the app, reviews, pricing and support information. Whenever an accountant or their client connects an app, the clients’ books are synced to the app within a few minutes.

“Our goal is to get as much drudgery out of the way as possible for accountants so they can spend less time on day-to-day tasks and more time with their clients being a trusted advisor,” said Nitin Garg, product manager, QuickBooks, Intuit.

The introduction of the new Apps tab is very timely, considering the fact that app usage is on the rise among small businesses. According to Intuit’s research, 68 percent of small businesses use an average of four apps to help manage their business.

Previously, managing apps for clients took a lot of time. Accountants had to discover which third-party app they wanted to use with clients and find out if it would work with QuickBooks Online. They then had to sign up for the app and find a link, which was usually buried in the third-party app, before they were able to connect it to QuickBooks Online.

“The previous process created a gap for accountants – it wasn’t easy to know which apps were recommended by Intuit and it didn’t lend a lot of visibility to the apps connected to their clients. With the new Apps tab, accountants can see all the apps connected to a client in one view, enabling them to help clients find the right mix of apps for their particular needs and use the same apps across clients,” said Garg.

The new Apps tab will enable accountants to truly become trusted advisors to their clients, which is one of Intuit’s ongoing goals. Accounting pros no longer need to toggle back and forth between clients, going to an app’s website to sign up a client and then taking the steps to integrate the data between their client and the app. This is yet another example of QuickBooks Online Accountant being the one place for accountants to manage their clients and their businesses.

“With the new Apps tab, accountants will be able to see how they can help simplify some work processes for their clients by connecting the right apps. This new functionality also drives firm-level efficiencies by standardizing the way a firm’s clients’ businesses operate, which ultimately helps accountants better serve clients of the same niche,” said Garg.

The beauty of the new Apps tab is that while it presents no new experience for clients, it allows their accountants to better serve them by simply being able to add the best apps on their behalf.

The new Apps tab was rolled out to all QuickBooks Online Accountant users in the U.S., UK, Australia and Canada last month at no additional cost. Users can reference help articles within QuickBooks Online Accountant or visit http://intuit.me/NewAppsTab (case sensitive) for more information and resources.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs