Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 9, 2026

February 9, 2026

February 20, 2018

Top Small Business Blogs & Social Media 6 Business Lessons to Take Your Brand from Startup to Growth. Xero blog.http://bit.ly/2quuKjp Online Brand Guidelines for Small Businesses. Barbara Weltman, via the CorpNet blog.http://bit.ly/2GY6Ctk 12 Key Levers of SaaS Success. David Skok, via For Entrepreneurs blog.http://bit.ly/2k98DWU Top Tips for Negotiating with Restaurant Vendors. Annie Pilon, via Small...…

February 20, 2018

Top Accounting Blogs & Social Media Are You Too Busy to be a Proactive, Future-Focused Advisor? Tom Hood, CPA, via LinkedIn.http://bit.ly/2EvnBoE New AICPA Chair Shares Vision of the Future. AICPA Insights blog.http://bit.ly/2nSflo8 Re-Engineer Your Audit Process. Wendy Cable from the Wolters Kluwer blog.http://bit.ly/2ET1cPW U.S. Treasury Official Says FDII Rules are BEPS Compliance. Robert Sledz from...…

February 20, 2018

Top Payroll Blogs & Social Media Payroll Rates for 2018. James Paille, via the Thomson Reuters blog. http://tmsnrt.rs/2EN8nsF Creating an Employer Brand that’s a Talent Magnet. Connect@ADP blog.http://bit.ly/2nqNknG What Your Accounting Resume Should Look Like This Year. Robert Half blog.http://bit.ly/2BfKQB7 Are Your Employees Passionate About Their Jobs. HR Payroll Systems blog.http://bit.ly/2smPRFg 10 Common Payroll Mistakes...…

February 20, 2018

Top Tax Blogs & Social Media IRS Warns about Private Debt Collectors. Rick Telberg, via CPATrendlines.http://bit.ly/2Ew67Z4 Sales Tax Holidays in 2018. Gail Cole, via Avalara blog.http://bit.ly/2BLvZ2c IRS Alerts Taxpayers about Corrected Forms 1095-A. From the Wolters Kluwer blog.http://bit.ly/2FYg5Ql State Corporate Income Tax Rates and Brackets for 2018. Morgan Scarboro, via the Tax Foundation.http://bit.ly/2GY6D0z Higher Sec....…

February 19, 2018

Enhancing employee engagement is a goal for many firms today. An employee who remains engaged throughout the year is better motivated, more productive and more dedicated to the firm than employees who are disengaged. One crucial way to improve employee...

February 19, 2018

It’s no secret that inadequate cash management is a major contributing factor to why businesses fail. Small businesses in particular need to implement proper cash management procedures into their everyday business, including timely reconciliation of ...

February 19, 2018

Freelancers have unique circumstances associated with filing their income taxes. They work on many jobs in a year which results in receiving many 1099-Misc forms. If they have jobs that pay less than $600 each, then they may not receive 1099s for those...

February 19, 2018

Each January, over 170,000 technology and electronics enthusiasts descend upon Las Vegas to attend the world’s largest Consumer Electronics Show (CES) to see the latest consumer technologies. While a significant amount of the media attention ...

February 15, 2018

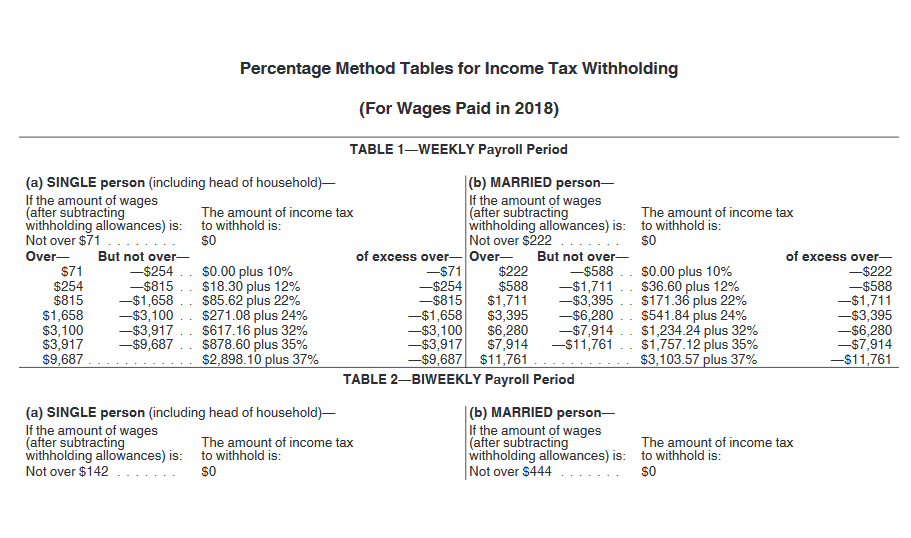

The Internal Revenue Service has released Notice 1036, which updates the income-tax withholding tables for 2018 reflecting changes made by the tax reform legislation enacted last month. This is the first in a series of steps that IRS will take to help ...

February 15, 2018

Hiring recent graduates has long been a vital part of accounting firms’ recruitment strategies. But it’s also one that’s consistently challenging. Talented college students frequently find they have their pick of employers when they enter the job market.

February 14, 2018

With a Section 751 Transfer, we are usually talking about a commercial building or an appreciable asset. For this article, we are going to stick with a commercial building, because it is easier to explain. Let’s say you have a partner that has a ...

February 14, 2018

A Section 1031 Exchange is a like-kind exchange. Before the new tax law, if you had anything classified as property, you could exchange that property for property that was like-kind, and avoid the capital gains tax on the transactions.