Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 9, 2026

![ADP_1[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/01/ADP_1_1_.61d61ba0d5b43.png)

January 5, 2022

Private sector small business employment increased by 204,000 jobs from November to December according to the December ADP Small Business Report.

January 5, 2022

AICPA News is a round-up of recent announcements from the association.

January 5, 2022

According to the 2020 AFP Payments and Fraud Control Survey Report, for the first time, in 2019, BEC schemes were the most common type of fraud attack experienced, with 75 percent of organizations experiencing an attack and 54 percent of those ...

January 5, 2022

People who owed tax when they filed their 2020 tax return may find themselves in the same situation again when they file for 2021. This will likely be true, especially if they failed to take action to avoid another shortfall by increasing their ...

January 4, 2022

Aaron Clayton, CPA, CGMA, CHFP – 2021 40 Under 40 Honoree Partner, Eide Baillyhttps://www.eidebailly.com/ Career highlights: AICPA Young Member Leadership Committee – Member (2020 – Current) AICPA Leadership Academy Graduate (2016) South Dakota CPA Society – Board of Directors (2018 – Current) South Dakota CPA Society Committee Member (Various roles since 2013 – including the...…

January 4, 2022

The commemoration was a collaboration of the AICPA, Diverse Organization of Firms, Illinois CPA Society, National Association of Black Accountants, and National Society of Black CPAs, who collectively supported the creation and release of two ...

January 3, 2022

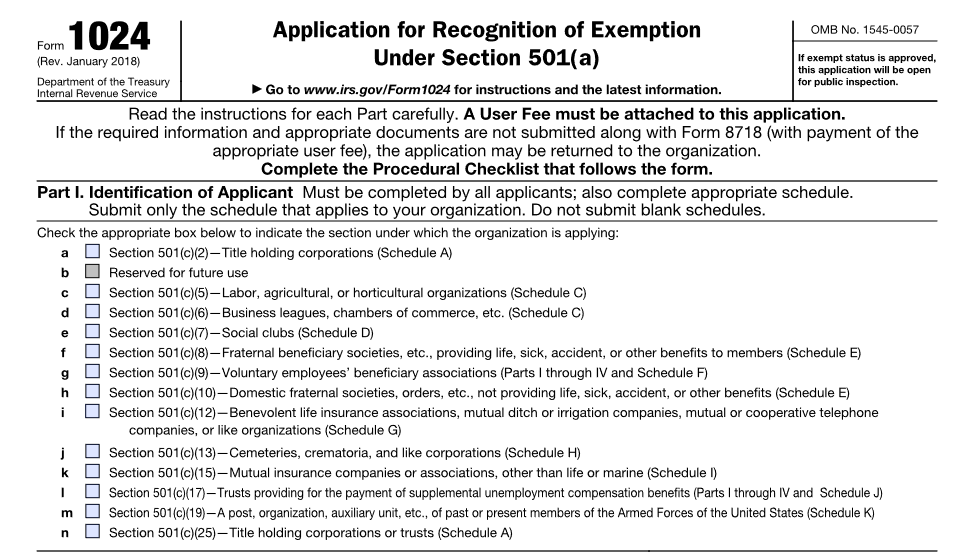

Beginning Jan. 3, 2022, applications for recognition of exemption on Form 1024 must be submitted electronically online at Pay.gov. The IRS will provide a 90-day grace period during which it will continue to accept paper versions of Form 1024 ...

January 3, 2022

Let the beginning of the year be a time of self-reflection, both personally and professionally, so that your new year can be a time for new journeys and endeavors. When you look back at your past year, you can see how your work paid off and how ...

January 3, 2022

Making changes to your clients’ operating model may require more cash flow, funding or loans. It can be overwhelming to assess those changes — and their impact on your long-term business strategy. Be your clients’ trusted advisor and work with them ...

January 2, 2022

The tax law contains strict rules against certain types of “prohibited transactions.” If you’re not careful and comply with all the rules, you could trigger adverse tax consequences.

January 2, 2022

The tax law provides a unique tax-saver for some people on their 2021 tax returns: They can save for retirement by contributing to an IRA and reduce their tax liability at the same time. Depending on their situation, IRA contributions may be wholly or ...

January 2, 2022

Employees across the country have been empowered by the transformations in the world of work. The priorities of employees have evolved post pandemic. FlexJobs, a job site for flexible employment, reported 16 percent of 7,300 workers surveyed said they ...