Small business owners are more optimistic, according to a new survey, but at least one group isn’t impressed.

“ It appears that the small business sector has finally attained a normal level of activity, which will hopefully keep the economy moving forward, even at a sub-par pace. That being said, improved profit trends accounted for over half the Index gain, a rather unusual but welcomed development. This was supported by positive sales trends and continued, although rising, fuel prices.

“The NFIB May survey results confirm that the economy is moving ahead, but at an uninspiring pace” said Bill Dunkelberg, NFIB Chief Economist. “Owners do what is necessary, like hiring workers when needed, to keep up with growth mostly powered by an increasing population.”

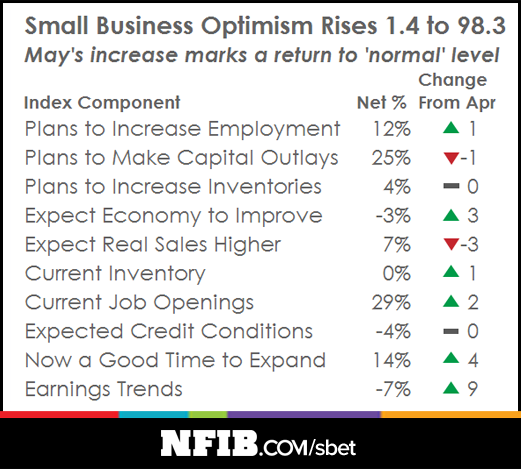

The Index of Small Business Optimism increased 1.4 points to 98.3 in spite of 5 months of lousy growth. May is the best reading since the 100.4 December reading but nothing to write home about. The 42 year average is 98.0, a bit lower than the 99.5 average through 2007. Eight of the 10 Index components posted improvements. Overall, the Index remained in a holding pattern, a few points below the pre-recession average, although at the 42 year average, and showing no tendency to “break out” into a stronger pattern of economic growth.

Small businesses posted another decent month of job creation in May, a string of 5 solid months of job creation. On balance, owners added a net 0.13 workers per firm over the past few months. Fourteen percent reported raising employment an average of 2.7 workers per firm while 12 percent reported reducing employment an average of 3 workers per firm. Fifty-five percent reported hiring or trying to hire (up 2 points), but 47 percent, reported few or no qualified applicants for the positions they were trying to fill. Thirteen percent reported using temporary workers. Twenty-nine percent of all owners reported job openings they could not fill in the current period, up 2 points, revisiting the February reading, and the highest reading since April 2006.

The seasonally adjusted net percent of all owners reporting higher nominal sales in the past 3 months compared to the prior 3 months rose a stunning 11 points to a net 7 percent. Eleven percent cited weak sales as their top business problem (unchanged). Expected real sales volumes posted a 3 point decline, falling to a net 7 percent of owners expecting gains, after a 5 point decline in January and February, a 2 point decline in March and a 3 point decline in April. Overall, expectations are not showing a lot of strength.

The net percent of owners reporting inventory increases fell 4 points to a net negative 5 percent (seasonally adjusted). The net percent of owners viewing current inventory stocks as “too low” improved 1 point to a net 0 percent. The reductions were apparently a result of unexpectedly strong improvement in sales trends, and left balance in the assessment of current stocks. The net percent of owners planning to add to inventory was unchanged at a net 4 percent, in sympathy with the more widespread reduction in stocks. Inventory investment might have been even stronger in light of the liquidation had expectations for real sales gains improved rather than softened.

Fifty-four percent reported outlays, down a surprising 6 points. Of those making expenditures, 39 percent reported spending on new equipment (up 4 points), 21 percent acquired vehicles (down 4 points), and 13 percent improved or expanded facilities (unchanged). Six percent acquired new buildings or land for expansion and 12 percent spent money for new fixtures and furniture, both figures up 1 point. These numbers suggest, overall, a back-tracking of investment spending. The percent of owners planning capital outlays in the next 3 to 6 months fell 1 points to 25 percent, not a strong reading historically but among the best in expansion.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Staffing