December 6, 2019

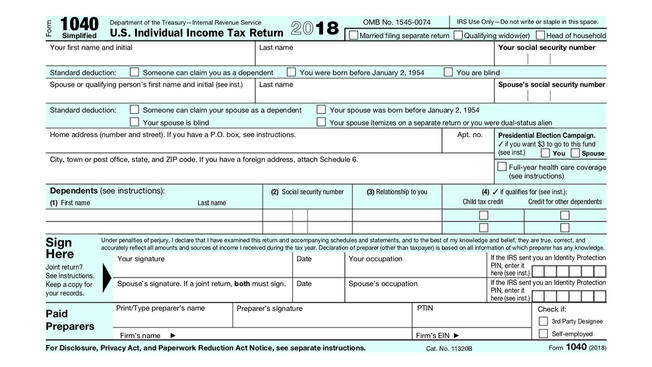

Forms W-2, W-3 Due by Jan. 31, 2020

Certain Forms 1099-MISC, Miscellaneous Income, filed with the IRS to report non-employee compensation to independent contractors are also due at this time. Such payments are reported in box 7 of this form.