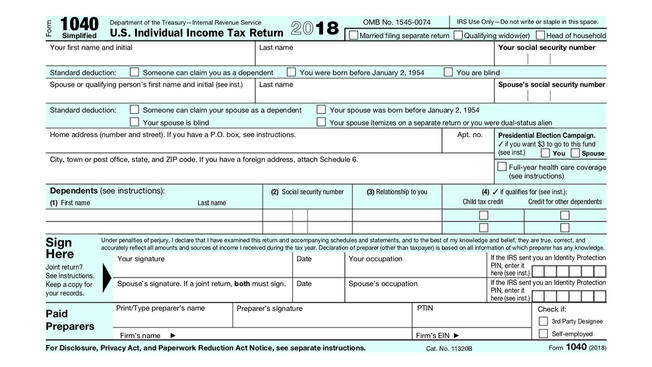

The Internal Revenue Service has released a prototype of the new Form 1040 that hundreds of millions of Americans use to file their annual taxes. The new “postcard sized” form will be used for the 2018 income tax year, which most Americans will file by April 15, 2019.

A full-size PDF draft version of the new 1040 form can be viewed from the IRS website.

Theoretically, the new approach will simplify the 1040 so that all 150 million individual taxpayers can use the same form. The new form consolidates the three versions of the 1040 (1040, 1040A, 1040EZ) into a single, simplified form, while giving the IRS the information it needs from each taxpayer needed to verify their tax liability or refund.

Although the form is postcard sized, taxpayers with common deductions things like mortgage and student loan interest, education credits, charitable deductions and business expenses will need to complete additional worksheets and schedules. Additionally, the form should not be mailed as a postcard, since the taxpayer’s Social Security Number would be visible.

“Tax simplification benefits everyone and is the right policy direction,” said Brad Smith, CEO of Intuit, the maker of TurboTax, the most-used consumer tax software brand in the U.S. “The fact is that the technology industry that invented income tax software can also greatly simplify and facilitate whatever tax system needs we may have in the future, for both consumers and small business, where the vast bulk of compliance burdens would otherwise lie. Having said this, it is also clear from our experience with millions of taxpayer customers that there is extensive complexity in the tax system that would plainly benefit from simplification and clarification in the best interest of the nation, our citizens, and the government itself.”

According to the IRS, the new Form 1040 uses a “building block” approach, in which the tax return is reduced to a simple form. That form can be supplemented with additional schedules if needed. Taxpayers with straightforward tax situations would only need to file this new 1040 with no additional schedules.

Since more than nine out of 10 taxpayers use software or a tax preparer, the IRS will be working with the tax community to prepare for the streamlined Form 1040. This will also help ensure a smooth transition for people familiar with software products and the interview process used to prepare tax returns.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, Taxes