Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

October 13, 2014

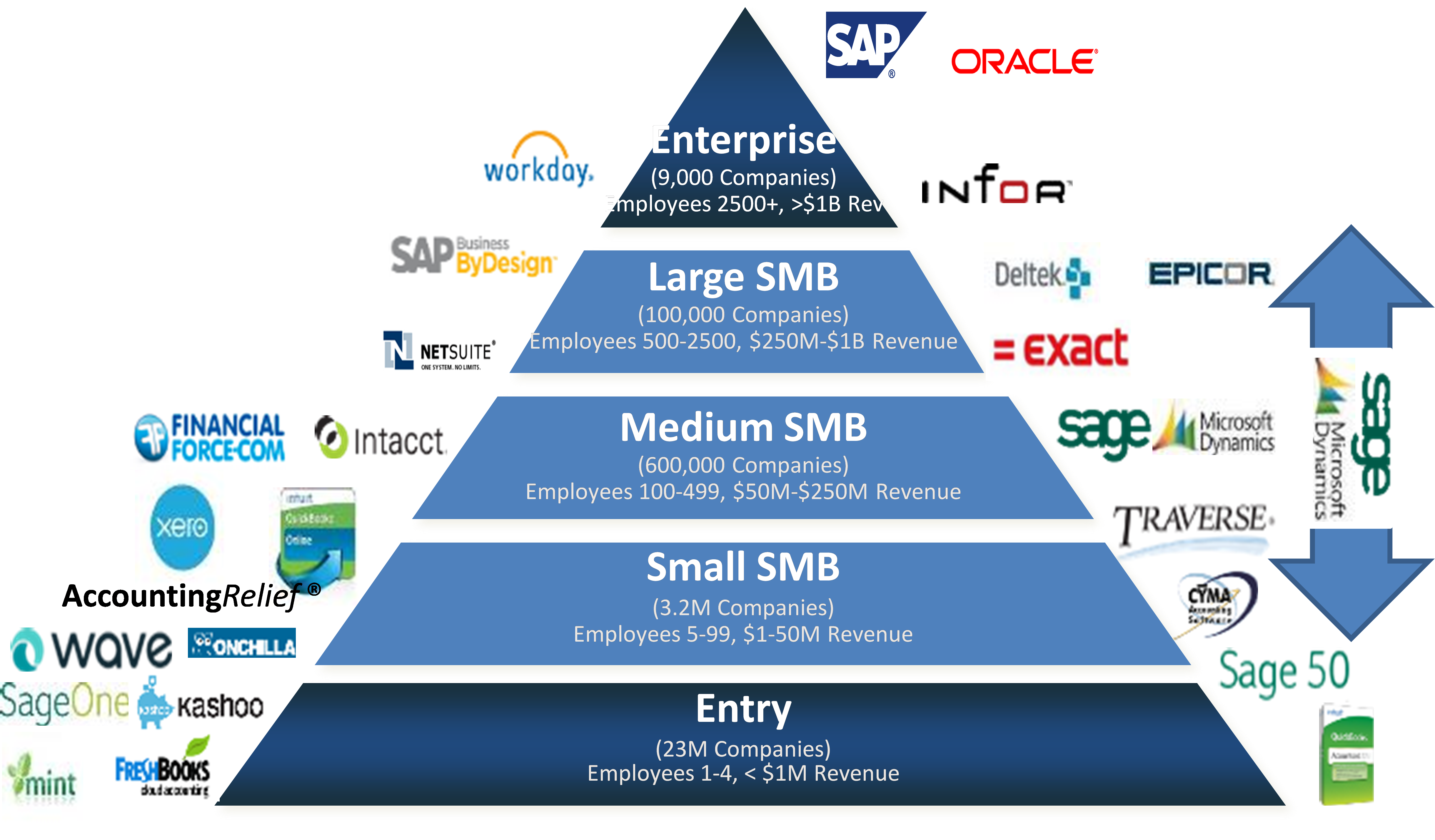

Expectations from business owners and clients have changed. This is particularly true with accounting software and the impact on traditional write-up services.

October 10, 2014

I believe it was 2007 when I met Randy Johnston and Doug Sleeter, two of CPA Practice Advisor's thought leaders, both of whom are contributors to our magazine and also members of the magazine's Advisory Board.

October 10, 2014

Magtax is a year-end form compliance solution provided by American Riviera Software. Magtax is offered in two editions: Standard and Professional. Both offer similar functions, but this review will focus on the Professional edition. Basic System Functions – 4.75 Stars Magtax Professional comes with a five user license and provides for an unlimited number of...…

October 10, 2014

Laser Link is an easy to use year-end compliance reporting solution. Built around forms data entry screens, the system is easy to navigate and use. New for the current release is compatibility with Windows 8/8.1. Basic System Functions – 4.5 Stars Laser Link is a locally installed solution but is also capable for use in...…

October 10, 2014

MAG-FILER is a year-end tax compliance solution used to process W-2 and 1099 forms through paper and electronic filing. The software solution is an all-inclusive design without multiple modules to purchase or consider. Basic System Functions – 4.5 Stars MAG-FILER installs as a local machine program or on a network with multiple users. During the...…

October 10, 2014

W-2/1099 Filer is a year-end form compliance software solution. New for the current release is an enhancement to the on-screen, prior year data view and additions to state electronic filing compliance. Basic System Functions – 4.75 Stars W-2/1099 Filer is installed on local machines, but can also be used in a multi-user, network environment for...…

October 10, 2014

1099-Etc is a payroll software solution designed to prepare a variety of period-end, year-end and related state payroll forms. With available add-on modules, 1099-Etc supports after-the-fact and live payroll, electronic filing and other payroll related functions. Basic System Functions – 4.75 Stars 1099-Etc is a modular system that can be installed locally on machines, through...…

October 10, 2014

After-the-Fact Payroll is part of a suite of products offered by AccountantsWorld. Each product in the product lineup is wholly cloud-based to assist public practitioners in achieving a constant connection to client data. After-the-Fact Payroll is intended as a payroll system, but has a number of features specific to assist in year-end tax reporting. Basic...…

October 10, 2014

Tax-Mate 1099 is a year-end compliance solution that comes in four editions, Print, Print Plus, Transmittal, and Advisor with each edition providing more features, respectfully. This article will focus on Tax Mate 1099 Advisor due to the focused effort on accountant centric features. Basic System Functions – 5 Stars Tax-Mate 1099 Advisor installs on local...…

October 10, 2014

Cloud-based payroll service provider Payroll Vault ended its second annual conference by honoring several of its franchisees. The conference was held at the Inverness Hotel in Englewood, Colorado.

October 9, 2014

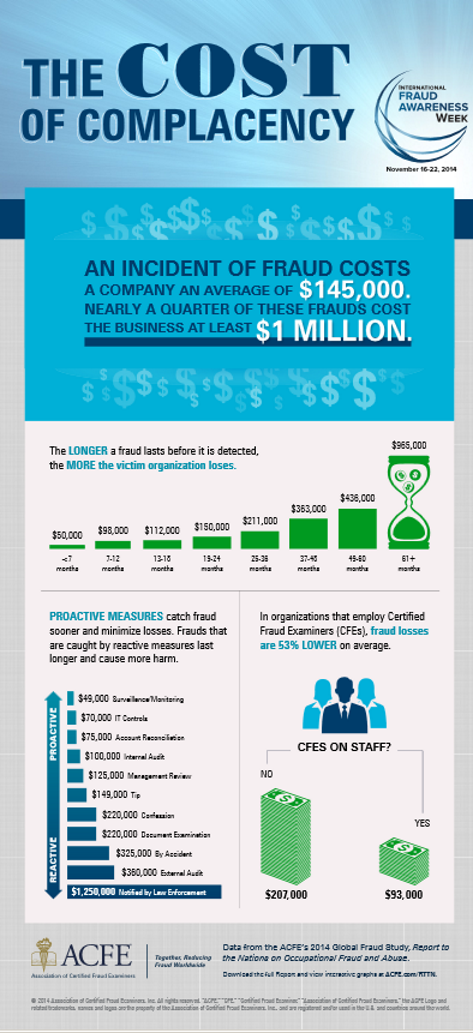

Fraud costs businesses billions directly, but what is the cost of complacency? Research conducted by the Association of Certified Fraud Examiners (ACFE), the world’s largest anti-fraud organization, indicates that the longer a fraud lasts before it is ...

October 9, 2014

One of the most nerve wracking aspects about tax season for millions each year is the possibility of being audited. For small business owners and those who are self-employed, the chance of being audited is even greater.