Firm Management February 6, 2026

Wipfli Partners with The Caddie Network

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

Firm Management February 6, 2026

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

February 6, 2026

February 6, 2026

February 6, 2026

February 6, 2026

October 10, 2011

800-811-0961 www.sagefundaccounting.com 2011 Overall Rating 5 Best Fit Sage Fund Accounting (formerly Sage MIP Fund Accounting) is optimally designed for mid-sized nonprofit organizations and government entities that require flexibility as well as detailed budgeting and grants management capabilities. Strengths Extensive list of modules Contains fundraising & grant management add-on options Excellent budgeting capability Available...…

October 10, 2011

877-872-2228 www.accufund.com 2011 Overall Rating 4.75 Best Fit AccuFund is an ideal fit for mid-sized nonprofits and government entities that desire a modular design and consistency throughout the program. Strengths Two versions available Excellent budgeting & grant management capability Easy system navigation User-defined dashboards Solid, customizable reporting options Available as a desktop or SaaS...…

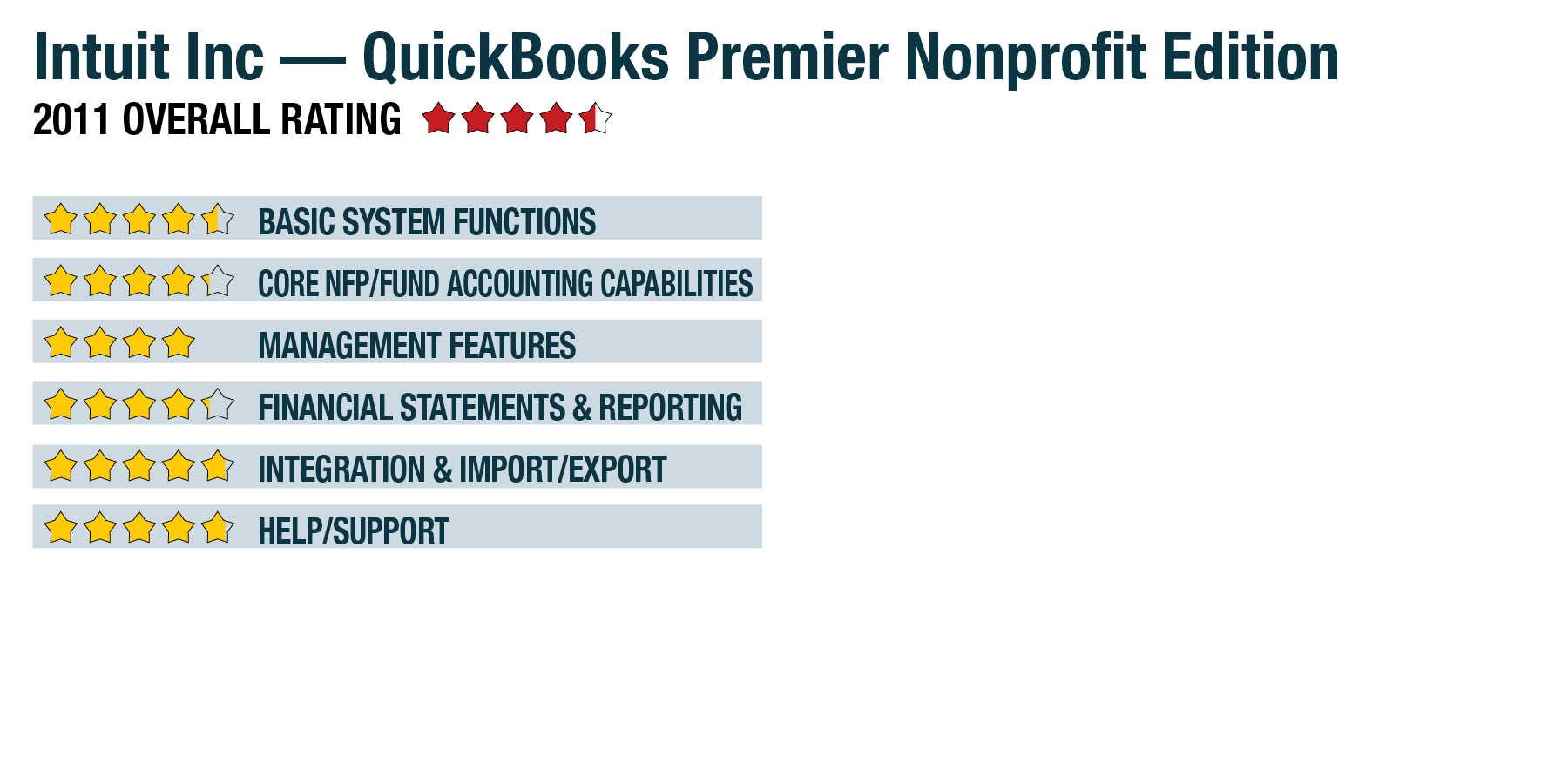

October 10, 2011

866-379-6636 www.quickbooks.com 2011 Overall Rating 4.5 Best Fit QuickBooks Premier Nonprofit 2011 is best suited for smaller nonprofits that are looking to get organized quickly and inexpensively. Strengths Easy installation & system navigation Numerous tutorials & training videos available Good reporting Affordability Solid budget tracking At-a-glance snapshot of customer activity Potential Limitations Easy to...…

October 10, 2011

877-696-0900 www.fundez.com 2011 Overall Rating 4.5 Best Fit FUND E-Z is an excellent fit for small to mid-sized nonprofit organizations that need an easily navigated fund accounting product that is available in Basic and Pro editions. Strengths Scalable, with two editions available Outstanding Fundraising module Easy system navigation Solid reporting capability Excellent budget functionality...…

October 7, 2011

877-737-3642 www.serenic.com 2011 Overall Rating 5 Best Fit Serenic Navigator is a powerful system optimally designed for larger nonprofit organizations that need a fully integrated financial solution that provides solid performance and system reliability. Smaller users may wish to utilize the SaaS version, Navigator Online, which was designed for small to mid-sized users. Strengths...…

October 7, 2011

800-388-3038 www.cougarmtn.com 2011 Overall Rating 4.75 Best Fit DENALI is flexible and easily accessible, making it a perfect choice for small to mid-sized nonprofit organizations that desire a scalable and user-friendly product. Strengths Modular design ensures system flexibility Intuitive user interface make system navigation easy Financial & Sales Dashboards Excellent reporting customization options Integration...…

October 7, 2011

800-888-6894 www.etek.net 2011 Overall Rating 4.5 Best Fit eTEK Fundamentals is a brand new product optimally designed for small to mid-sized nonprofit organizations, offering a high level of security with its SaaS version. Strengths Built on Microsoft Office platform for easy system navigation Excellent fund raising module available Easy report customization Solid import/export capability...…

October 7, 2011

800-350-4720 www.aqubanc.com Cheque 21 System, from Aqubanc LLC is a donation processing software product designed for larger nonprofit organizations, and is designed to speed up donation/gift acceptance for more immediate donor acknowledgement. Cheque 21 works with many popular nonprofit software products including Blackbaud Raiser’s Edge and eCRM, Amergent, Talisma, PledgeMaker, Donor Perfect and Sage. Ideal...…

October 7, 2011

800-292-296 www.cyma.com 2011 Overall Rating 4.75 Best Fit CYMA would fit well in small to mid-sized nonprofit organizations that require flexibility, scalability, and customization capabilities not often found in basic, off-the-shelf products. Strengths Excellent report customization Solid grant tracking Easy system navigation Solid import/export capability 3 separate data-entry modes Potential Limitations No fundraising module...…

October 7, 2011

The Sage Accountants Network has a wide range of products, which gives it more breadth than almost any other competing program. While some competing programs have strong solutions for a small business, and others cater to large, global organizations, the Sage Accountants Network allows accounting professionals to access discounted software for small, midsized and...…

October 7, 2011

Vote for the Best… we want your input Each year, the Readers’ Choice Awards give our readers the opportunity to help shine a spotlight on the technologies, services and vendors they use and trust — the ones that help them succeed in their profession, and those that they find valuable for their clients. While voting...…