Firm Management February 6, 2026

Wipfli Partners with The Caddie Network

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

Firm Management February 6, 2026

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

February 6, 2026

February 6, 2026

February 6, 2026

February 6, 2026

September 21, 2017

Most business owners want the same thing; they want to pass on their business to their kids. Others may want to sell the business, and some just want to give it away. However, all these options have unique tax concerns that must be considered.

September 21, 2017

The relentless advance of technology. You are aware of it. Whether you are boomer, a millennial, or even Gen Z (some call them the “iGeneration”). We can’t deny it. We live in a time of technological marvels. And the velocity of development related to ...

September 21, 2017

The office network that tax professionals and accountants use is at risk by hackers looking to do more than just peek at client information: The hackers are trying to take those networks over, says the IRS and state tax agencies. If that happens, the ...

September 20, 2017

As the U.S. Senate and U.S. House of Representatives return to session, a new survey from The Workforce Institute at Kronos Incorporated and Future Workplace reveals it can cost organizations as much as $100,000 each time a federal, state, or even local labor-related regulation is created or changed. “The $100,000 Bill” report is based on...…

September 20, 2017

Looking to enhance your payroll offering? There’s no better way than placing time clocks in your clients’ businesses. Time clocks are simple to implement; in many cases they integrate with your current payroll software. They also provide an ...

September 20, 2017

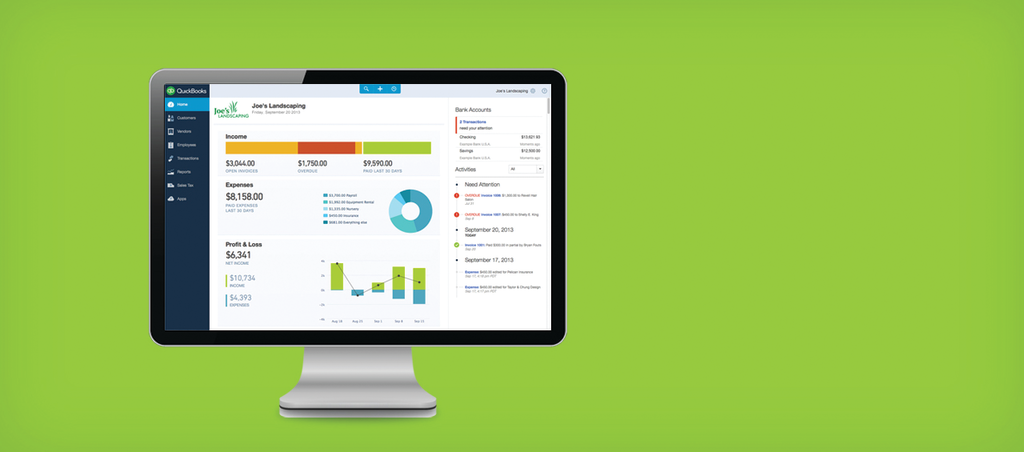

Continuous enhancements and integrations allow accounting professionals who use QuickBooks Online Accountant to streamline their workflow to get more done in one place.

September 20, 2017

There may be nothing more certain than death and taxes, but Americans like to push thoughts of that first topic away. Perhaps that's why almost three-fourths of U.S. small businesses don't have a succession plan and most small business owners don't ...

September 20, 2017

In 2017, female accounting professionals still lack the support they need in the workplace in order to advance their careers. Last year, I wrote a column on the topic of females only being represented in 19% of accounting firm leadership positions, ...

September 20, 2017

Few topics are as poorly understood as business valuation. Despite common misperceptions, it is a complex topic that cannot be boiled down to simplistic formulas or rules of thumbs.

September 19, 2017

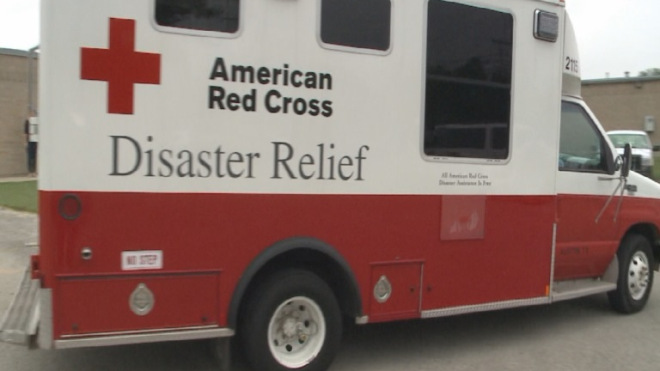

When natural disasters strike, Americans naturally want to help. And that feeling of compassion is doubled when those catastrophes happen to our neighbors, our fellow citizens.

September 19, 2017

Like accountants, landscapers have a busy season and a not-so-busy season, which happens to be nearly opposite of yours. How can you focus your marketing and lead generation efforts during your busiest time of the year to gain new clients?

September 19, 2017

This is a tantalizing brave new world for younger accountants who like the idea of turning their penchant for number-crunching into a sexier profession, but what about those who are, ahem, reaching their golden age? It kind of sounds like rather than ...