Accountants are a vital part of any business, especially small businesses. Many times, they do more than just “accounting.” They are accountants, bookkeepers, advisors, business partners, tax preparers, data entry personnel and so much more – all for many clients. This means they’re often working in numerous programs. Something as simple as a change in contact information could easily become very tedious when they have to spend time changing the same information in multiple solutions.

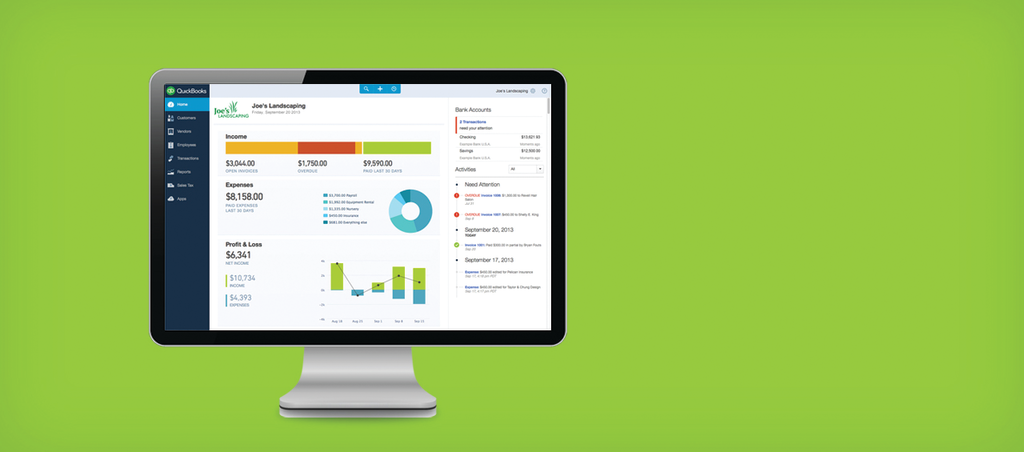

In an effort to streamline simple tasks like this and other processes, Intuit has worked hard to transform QuickBooks Online Accountant into the “one place” accounting professionals can go to complete all their work. It has added a number of enhancements and functionalities, all free of charge, so that accounting professionals can spend more time being trusted advisors to their clients, and less time toggling between solutions.

“Accounting professionals are oftentimes juggling multiple solutions to manage their clients. On top of that, they have many deadlines that they have to keep track of because missing a deadline often means incurring fines or losing a client. There is a constant fear of something falling through the cracks,” said Patti Newcomer, vice president of marketing and analytics, ProConnect Group, Intuit. “QuickBooks Online Accountant allows accountants to manage their work and their clients in one place with one login, increasing productivity and reducing complexity.”

The most important features that allow accountants to get more done in one place are Practice Management and the ProConnect Tax Online integration within QuickBooks Online Accountant. Accounting professionals usually work from multiple apps, which all have separate logins, and this can increase the risk for error and the chances that a task is missed. Now, with just one login, accounting professionals can access Practice Management capabilities, manage their workflow, communicate with clients and even create a tax return, all within QuickBooks Online Accountant.

Most compliance work, including tax, consists of managing due dates and multiple recurring engagements efficiently. For example, during tax season, accounting professionals spend approximately five hours per client analyzing and “cleaning up” their books to prepare them for a tax return. The Practice Management capabilities within QuickBooks Online Accountant are designed to help multi-service firms manage all of their services and workflows in a way that saves them time and automates many of the processes that they previously tracked separately in multiple applications. The automation of processes is designed to simplify the workflow and significantly save accountants time by creating one place that provides a seamless, end-to-end experience. A great example of this process automation is the integration between QuickBooks Online Accountant and ProConnect Tax Online, which allows accountants to translate a client’s QuickBooks Online books into a tax return and then e-file that return without leaving QuickBooks Online Accountant.

Intuit also realized that accountant-client communication within solutions was disconnected as there was no efficient or easy way for accounting professionals to communicate with clients or collect documents right from their tax software. Intuit worked with their developers to create Intuit Link, a way for professionals to collect documents digitally from within QuickBooks Online Accountant, helping to truly make it “one place to do it all.”

In addition, Intuit has also integrated QuickBooks Self-Employed into QuickBooks Online Accountant to help accounting professionals with their scheduled fee clients. Research shows that one in five employees are becoming self-employed each year. Integrating QuickBooks Self-Employed into QuickBooks Online Accountant helps bring new opportunities to accountants to grow their practice and their clientele. Through QuickBooks Online Accountant, accountants can also leverage the wholesale billing option for QuickBooks Self-Employed, saving up to 50 percent on the retail price of the product for the lifetime of the subscription.

“Self-employed individuals that use QuickBooks Self-Employed report getting more than $4,300 in potential tax savings and more than $18,000 in potential deductions annually. These tools help accountants give better tax advice to help clients make better decisions and see monetary benefits,” said Newcomer.

Moving forward, accountants and small businesses can expect Intuit to continue to add functionality to the Practice Management capabilities within QuickBooks Online Accountant, including the ability to manage and create client tasks across an entire firm and receiving and managing documents.

Customers can visit https://quickbooks.intuit.com/accountants/quickbooks-accountant/ for more information on how to use QuickBooks Online Accountant to do more in one place.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs