Taxes February 12, 2026

Senate Votes to Overturn D.C. Tax Decoupling, as Locals Push Back

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

Taxes February 12, 2026

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

February 10, 2026

February 10, 2026

February 10, 2026

February 10, 2026

Taxes May 9, 2024

77% of tax professionals believe AI technology can be applied to their work, and 56% of in-house corporate tax teams think their external tax advisers’ firms should be using AI.

Taxes May 7, 2024

Higher taxes are "quite likely," the Berkshire Hathaway chairman and CEO said, as Washington prepares for major tax discussions next year.

IRS May 7, 2024

During a House Appropriations subcommittee hearing May 7, Danny Werfel gave lawmakers an update on the tax credit's status.

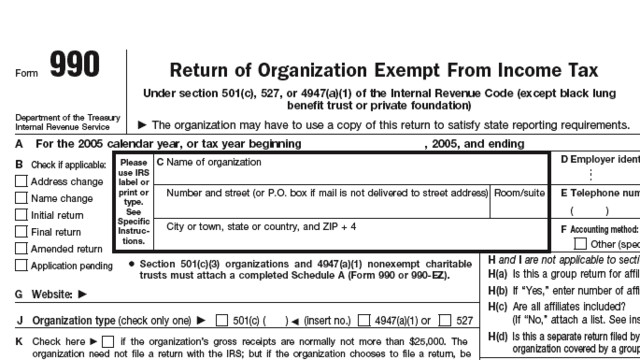

Income Tax May 7, 2024

While the April 15 tax deadline for most Americans to file their individual annual tax returns has passed, there are several deadlines each year, some for individuals, businesses, nonprofits and even organizations that are tax-exempt.

Taxes May 3, 2024

But the IRS chief emphasized once again that audit rates won't increase for small businesses and taxpayers making under $400,000.

Taxes May 3, 2024

The Biden administration on May 3 gave carmakers a partial reprieve in finalizing electric vehicle tax credit rules.

Small Business May 3, 2024

There were about 45 sales tax holidays in 24 states in 2023 and could be even more than that in 2024.

Taxes May 1, 2024

The recommendations would simplify filing for taxpayers and practitioners and will reduce the administrative burden on the IRS.

Taxes May 1, 2024

New guidance touches on the role farmers will play in the production of clean jet fuels and reducing emissions in the aviation industry.

Taxes May 1, 2024

Roger Ver was charged with mail fraud, tax evasion, and filing false returns in order to avoid paying at least $48 million in U.S. taxes.

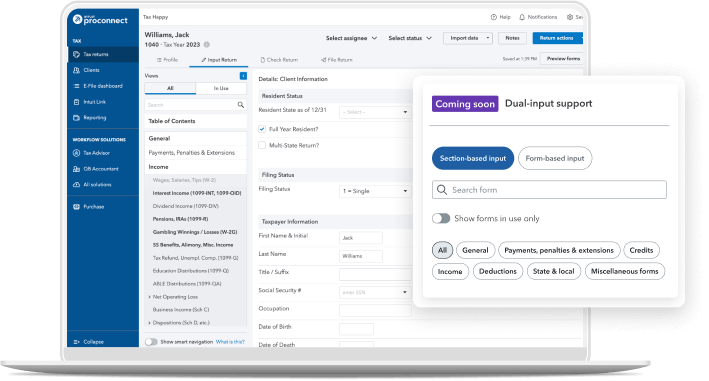

Advisory April 29, 2024 Sponsored

During the Intuit Accountants “Better Together” event in New York City, the Intuit ProTax Group brought together tax professionals and industry thought leaders.

Small Business April 28, 2024

The Internal Revenue Service is offering tax-related information to entrepreneurs in anticipation of the upcoming kick-off of National Small Business Week.