By Scott H. Cytron

Filing taxes for your clients doesn’t have to be a drain on your firm’s time, energy, and resources. For today’s firms, continuing with “business as usual” might mean:

- Collecting paper documents and using multiple software programs, leading to data entry errors, complex workflows, and wasted time.

- Struggling to recruit and retain high-quality employees.

- Wrestling with sky-high tax season burnout and subpar work-life balance.

During the Intuit Accountants “Better Together” event in New York City, the Intuit ProTax Group brought together tax professionals and industry thought leaders. The panel of industry tax experts discussed technology, and modernizing tax and advisory firms to address their challenges and inefficiencies they face throughout the year.

“Business as usual” doesn’t cut it for modern firms

Paperwork and storage. Data entry and manual processes. Redundant and draining tasks that eat away at a tax professional’s time and energy. For many, this is “business as usual” at their firm. If this sounds like your firm, you’re not alone.

Tax and advisory firms often have complex workflows that involve using multiple software programs to get the day’s work done. For tax professionals and their firms, the high stress and workloads are unsustainable to stay in the field. Chris Picciurro, founder of Teaching Tax Flow, articulated the high cost of demanding accounting jobs.

“Honestly, I missed the first five years of my older kids’ lives,” Picciurro told an audience of accounting professionals during Intuit’s Better Together NYC event. “At that point, I said, ‘It’s them or me.’ I was driving home—it was probably 2 am—from our office, and I thought, ‘What the heck is going on? It’s a very lucrative job, but it’s not a job I want anymore.’ And I felt like this business is built based on me running it—not processes and not systems. So something has to change.”

It was a pivotal moment that led to the right-sizing of Picciurro’s firm. With streamlined software solutions that facilitated efficient processes and logical systems, change is exactly what he did.

Why Intuit ProConnect Tax is different

Piccurrio completely overhauled his firm’s structure, services, and systems to make it work for his personal and professional life. The pivot was life changing. Today, he has a successful, satisfying work life that’s balanced with his family life. He sees the opportunity for new generations of accounting professionals to have well-balanced, gratifying careers.

Among the technological solutions Piccurrio implemented to keep his work life in check was ProConnect Tax.

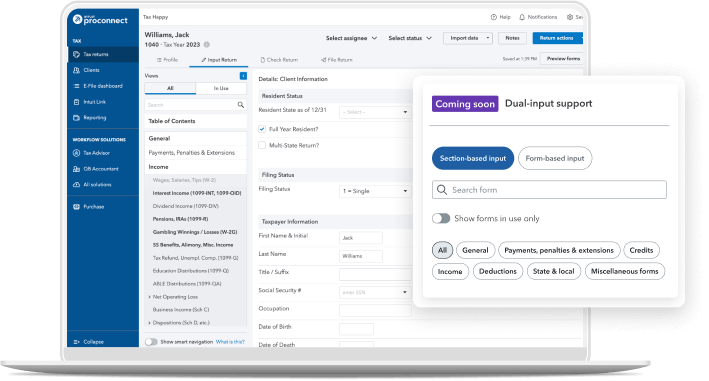

This cloud-based professional tax software allows you to create tax returns in minutes, from anywhere. As an Intuit product, it seamlessly integrates with QuickBooks Online Accountant—the go-to software when working with a business owner’s books. Add on Intuit Tax Advisor, an integrated advisory tool that automatically generates strategies for client tax savings, and you come full circle from tax prep to tax planning.

“This is just the natural flow of data,” said ASE Group Founder Al-Nesha Jones, CPA, MBA, MOM, whose practice has used Intuit products since she opened her firm. “We don’t do tax returns if we don’t do the bookkeeping, because everybody knows without bookkeeping, it’s probably a mess. It’s a natural progression to go from QuickBooks to ProConnect Tax.”

The integrated flow among these bookkeeping and tax software solutions reduces the number of applications tax professionals need to use during busy season and, of course, throughout the year.

“When I’m using an integrated tool, I’m just streamlining things,” Jones said. “I’m reducing the chance for error, reducing data entry, and reducing my time.”

Notable features in ProConnect Tax

Intuitive features embedded in ProConnect—such as flags, imports, automations, and cloud storage—plus Intuit Link, eSignature, and Protection Plus, are among the integrations that save Intuit ProConnect Tax users money, mental energy, and time.

“It’s the way that I’m able to take what I would have needed with four to five other subscriptions to do what I do—and it’s just all included in one place,” Jones said. “It just saves so much time per tax return.”

One of the newest, in-demand features allows you to pull all of your client’s transcripts straight from the IRS into ProConnect Tax. With this feature, you can:

- Catch and fix errors proactively before your client gets an IRS notice.

- Get a single source of truth to double check before you file, so you don’t miss a thing.

- Complete tax returns faster and more accurately with less client back-and-forth conversations.

- Access the latest client IRS financials; this is helpful for onboarding new clients, resolution work, and completing extensions.

An Integrated System

Synergies across the Intuit suite of software aren’t the only integrations that save time and money for firms.

- ProConnect Tax includes Intuit Link, a cloud-hosted portal that gathers and manages clients’ tax documents and data.

- When it’s time to have clients sign contracts and tax documents, Intuit eSignature provides a quick and convenient way to request signatures.

- ProConnect Tax securely stores all the client documents, data, tax forms, and signatures.

- Protection Plus is a low-cost option to add on to any ProConnect Tax returns your firm files. Protection Plus expands your team to include CPAs and EAs who work with your team to handle any notices, issues with IRS forms, and audits. They take care of the long phone calls with state or federal agencies to fully resolve any flagged issues.

Technology enables talent recruitment and retention

These kinds of smart automations, technological innovations, and delegation of rote manual tasks to technology also pave the way for a more rewarding career in tax and accounting.

Technology solutions such as ProConnect Plus open up the hiring field and provide a built-in competitive advantage when recruiting new talent. Using cloud-based software rather than device-specific desktop solutions widens the talent pool from a small group of qualified individuals who can commute to your office to anyone in your state, time zone, or across the country.

Check out ProConnect Tax for more information and find out how it can benefit your firm.

Scott H. Cytron is president of Cytron and Company, known for helping companies and organizations improve their bottom line through strategic public relations, communications, marketing programs and top-notch client service. An accredited consultant, Scott works with companies, organizations, and individuals in professional services (medical, legal, accounting, engineering), high-tech and B2B/B2C product/service sales.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs