Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

Sales Tax May 14, 2024

The term “communications tax” often refers to a multitude of federal government charges, state and local taxes, fees, and regulatory contribution charges.

Taxes May 14, 2024

This year’s speaker line-up features nationally recognized experts who will guide participants through in-depth sessions and discussions...

Taxes May 9, 2024

Starting on July 1, the rate for overpayments and underpayments for individuals will be 8% per year, compounded daily.

IRS May 9, 2024

Beginning in January, you'll be able to contribute more to your health savings account, based on the IRS's latest inflation adjustments.

Taxes May 9, 2024

That puts a massive price tag on what is likely to be a top issue in Washington next year as lawmakers grapple with the future of Trump’s tax cuts, which are slated to expire at the end of 2025.

Taxes May 9, 2024

77% of tax professionals believe AI technology can be applied to their work, and 56% of in-house corporate tax teams think their external tax advisers’ firms should be using AI.

Taxes May 7, 2024

Higher taxes are "quite likely," the Berkshire Hathaway chairman and CEO said, as Washington prepares for major tax discussions next year.

IRS May 7, 2024

During a House Appropriations subcommittee hearing May 7, Danny Werfel gave lawmakers an update on the tax credit's status.

Income Tax May 7, 2024

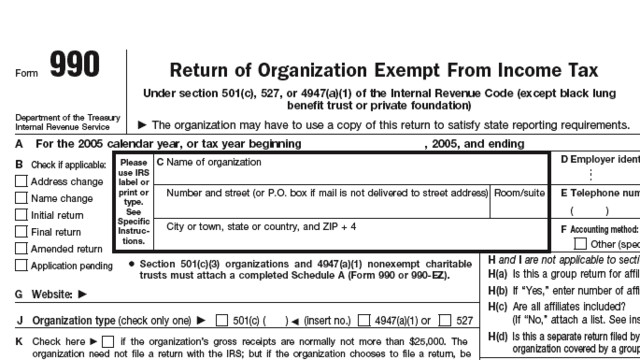

While the April 15 tax deadline for most Americans to file their individual annual tax returns has passed, there are several deadlines each year, some for individuals, businesses, nonprofits and even organizations that are tax-exempt.

Taxes May 3, 2024

But the IRS chief emphasized once again that audit rates won't increase for small businesses and taxpayers making under $400,000.

Small Business May 3, 2024

There were about 45 sales tax holidays in 24 states in 2023 and could be even more than that in 2024.

![natural_disasters_list_1_.56117a5e5df03[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/12/natural_disasters_list_1_.56117a5e5df03_1_.61c1db14bf0ea.png)

Taxes May 2, 2024

Original documents such as tax returns, Social Security cards, marriage certificates, birth certificates and land ownership documents need to be secured in a waterproof container in a safe space.