Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

Taxes May 1, 2024

The recommendations would simplify filing for taxpayers and practitioners and will reduce the administrative burden on the IRS.

Taxes May 1, 2024

Roger Ver was charged with mail fraud, tax evasion, and filing false returns in order to avoid paying at least $48 million in U.S. taxes.

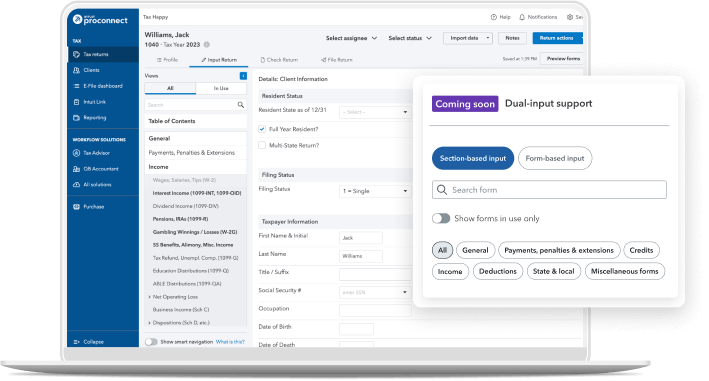

Advisory April 29, 2024 Sponsored

During the Intuit Accountants “Better Together” event in New York City, the Intuit ProTax Group brought together tax professionals and industry thought leaders.

Small Business April 28, 2024

The Internal Revenue Service is offering tax-related information to entrepreneurs in anticipation of the upcoming kick-off of National Small Business Week.

Taxes April 26, 2024

About 140,800 taxpayers in 12 states filed their federal tax returns through the new service, but its future is up in the air.

Taxes April 25, 2024

The final regulations also describe special rules related to excessive credit transfers and recapture events.

Taxes April 25, 2024

Voters in seven swing states support billionaires tax and trimming benefits for the wealthy more than raising payroll taxes.

Taxes April 24, 2024

An arm of Appeals, the Alternative Dispute Resolution Program Management Office will look to revitalize existing ADR programs.

Taxes April 24, 2024

The bill, introduced in both the House and the Senate, would require the IRS to spell out exactly what the error on the return is.

Taxes April 24, 2024

TIGTA investigators identified a scheme where individuals obtained Employer Identification Numbers, a unique nine-digit identifier required for tax purposes, and then used them to file business tax returns that improperly claimed...

Taxes April 19, 2024

Georgia’s 2019 abortion law allows expectant parents to claim an embryo or fetus as a dependent on their taxes.

Taxes April 18, 2024

The rapper, whose legal name is Daniel Hernández, had his property seized for “nonpayment of internal revenue taxes.”