Accounting February 28, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 28, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

December 2, 2011

800-739-9998 www.cchgroup.com/portal 2012 Overall Rating 4.75 Best Fit Firms wanting secure client file sharing functions with integration into other CCH programs, along with file versioning and automated retention and expiration capabilities. Strengths Can be used on all major browsers and platforms Strong security customization File versioning for online edits to shared documents Customizable...…

December 2, 2011

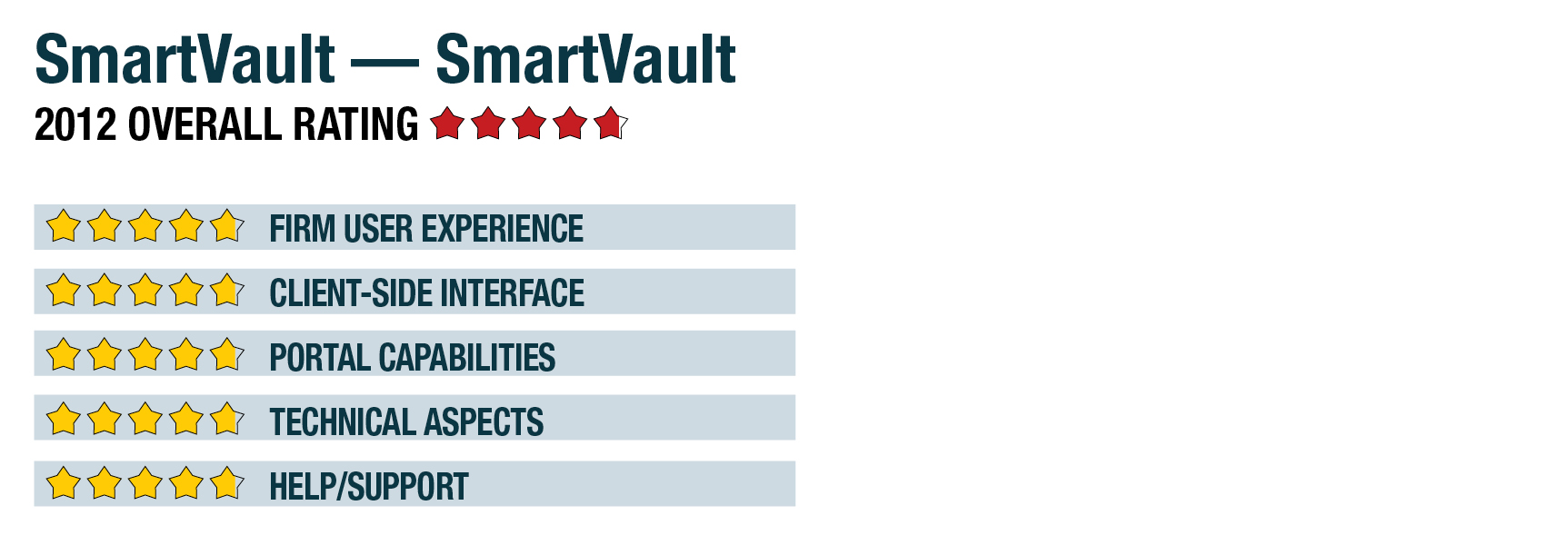

866-674-6785 www.SmartVault.com 2012 Overall Rating 4.75 Best Fit Professional firms and also businesses wanting a web-based document management system that includes client portals and integrations with common small business applications. Strengths Integrated Toolbar for QuickBooks Customizable firm and client-side branding Familiar expandable folder structure User-by-user access right customization Automated synching to desktop or...…

December 2, 2011

800-968-8900 www.cs.thomson.com 2012 Overall Rating 5 Best Fit Firms using other programs in the Thomson Reuters CS Professional Suite, particularly those using the document management and tax programs. Strengths Customizable firm branding and integration of login on firm website Two-way firm/client sharing and collaboration Broad integration with programs in CS Professional Suite Ability to...…

December 2, 2011

781-356-5152 www.XCMsolutions.com 2012 Overall Rating 4.25 Best Fit Firms using or considering the broader XCM Workflow Management system to provide structured digital management of their engagements, including the ability to securely share files with clients. Strengths Simple client interface No storage or bandwidth/transfer limits Customizable firm branding Two-way firm/client sharing and collaboration Dependable hosting,...…

December 2, 2011

888-667-8440 www.OfficeToolsPro.com 2012 Overall Rating 4.75 Best Fit Firms using or considering the Office Tools Professional Practice Management 2011 system, who want to provide user-friendly portals to clients. Strengths Tight integration with Practice Management 2011 system Project management and file sharing Built-in client communication tools Customizable firm branding Good integration with outside programs Potential...…

December 2, 2011

800-441-3453 www.ShareFileCPA.com 2012 Overall Rating 4.5 Best Fit Accounting practices wanting a simple, yet secure method of sharing files with clients and allowing them to upload files to the firm. Strengths Firm branding and the ability to place a login field on firm website Sharing of files two ways between client and firm Multiple...…

December 1, 2011

800-716-2558 ext. 100 www.cPaperless.com 2012 Overall Rating 4.25 Best Fit Professional firms seeking a stand-alone system that will make it easy for their clients to send files to them, as well as securely share returns and other documents with their clients. Strengths Simple for clients and firms to use Strong security customization options Customizable...…

December 1, 2011

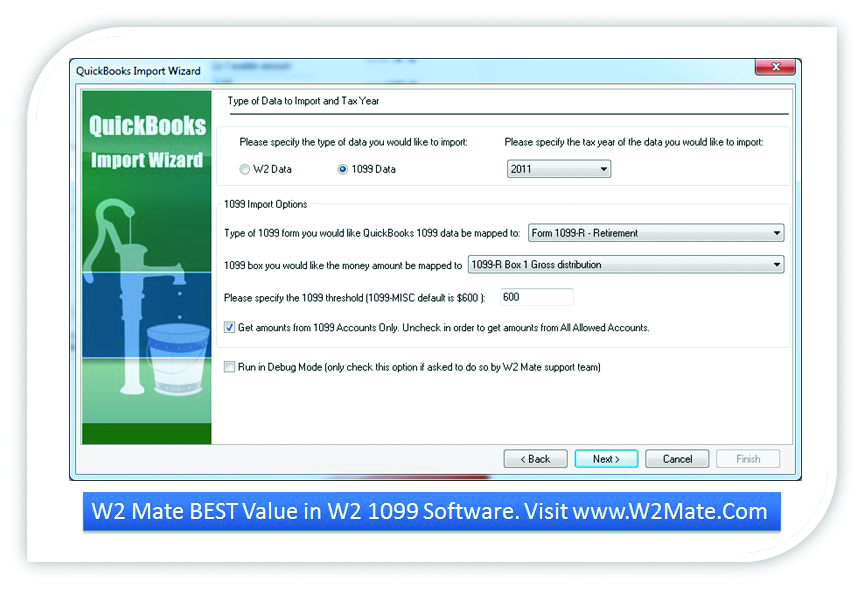

Dividends and Distributions Prints on 1099 Dividend laser forms and on blank paper.E-Files 1099 DIV & eFile 1099 Forms (Electronic Filing).Imports 1099 DIV forms Intuit QuickBooks, Sage Peachtree, Sage DacEasy , Microsoft Dynamics and Microsoft Excel FormatSupports 1099-DIV, MISC, INT, R, S, 1098-T, 1098, 1099 A, 1099 B, 1099 C, 1099 PATR and 1099 OID...…

December 1, 2011

IRS 1099-R Software IRS Form 1099 R : Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Prints on 1099-R laser forms and on blank paper. Imports 1099R forms Intuit QuickBooks, Sage Peachtree, Sage DacEasy , Microsoft Dynamics and Microsoft Excel Format Supports 1099 R, MISC, INT, DIV, S, 1098-T, 1098,...…

December 1, 2011

IRS 1099-MISC Software IRS Form 1099 MISC : Miscellaneous Income Prints on preprinted 1099-MISC forms and W2 forms. Prints 1099 MISC Copies & W2 Copies to blank paper. Meets Internal Revenue Service & SSA regulations. Creates secure PDF 1099 MISC form & PDF W2 form. E-File 1099 MISC & eFile W2 Forms (Electronic Filing)....…

December 1, 2011

Interest Income Software Prints on preprinted 1099-INT & other 1099 forms. Prints 1099 INT, 1099-MISC, 1099-DIV, 1099-R & W2 Forms Copies to blank paper. Imports 1099-INT forms Intuit QuickBooks, Sage Peachtree, Sage DacEasy , Microsoft Dynamics and Microsoft Excel Format Meets IRS & SSA regulations. eFile 1099 INT & eFile 1099 Forms (Electronic Filing)....…