Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 9, 2026

February 9, 2026

May 13, 2015

CCH Sales Tax Office is a comprehensive tax calculation system that combines industry-leading tax rate and taxability content with highly accurate jurisdiction boundary information and sophisticated logic. As a premier sales and use tax solution from Wolters Kluwer Tax & Accounting US Sales Tax Office provides: Effortless Setup and Maintenance — Configure the system to...…

May 12, 2015

So you think you’re a progressive firm, right? You’re committed to going digital and eliminating, or at least minimizing, paper. Your engagement letters are all electronic and are emailed to clients and prospects for signature.

May 12, 2015

Compared to front-line employees (those who are directly involved with the production of products or provision of services), more senior leaders viewed their organization's culture positively, reported having opportunities available to them and said ...

May 12, 2015

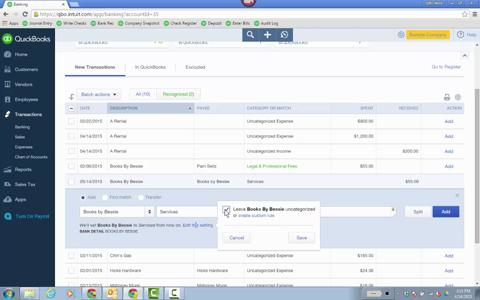

QBO Simple Start, Essentials and Plus all offer the critical ability to connect to bank and credit card accounts to download activity.

May 12, 2015

Imagine you are sitting in your office one day and a business client came in and dropped a six inch thick stack of paperwork and receipts on your desk and asked you to help make enough sense of it to submit a tax filing to the IRS. Your first reaction ...

May 12, 2015

I recently attended the New York Accounting Show put on by Flagg Management, generally acknowledged as the annual kickoff event for nationally recognized accounting conferences that provide continuing professional education and networking opportunities fo

May 11, 2015

A weekly roundup of professionals in the tax and accounting profession that have changed jobs and/or been promoted.

May 11, 2015

The American Institute of CPAs has launched a new membership section for practitioners and others who serve or work for the nation’s growing not-for-profit sector. The AICPA’s Not-for-Profit Section will provide support and resources in the areas of ...

May 11, 2015

Small businesses collectively make up 99.7 percent of all U.S. employer firms, employ nearly 49 percent of the private workforce, pay about 42 percent of the private payroll, and created 63 percent of all new jobs added during the past 20 years.

May 11, 2015

A subset of Americans is redefining the way families within their income bracket live, work and plan for the future, according to a survey released today by EverBank. The High Net Worker (HNW), named for the group’s earning power, dogged work ethic and av

May 11, 2015

The struggles endured in recent years by America’s young people pale in comparison to those suffered by their peers in Spain and Greece, where youth unemployment in excess of 50 percent has spawned great social unrest. Still, finding a job in the U.S. — l

May 11, 2015

The American Institute of Certified Public Accountants (AICPA) appreciates the opportunity to review and provide input into the February 2015 Request for Comment (Request) on the Financial Accounting Foundation’s Three-Year Review of the Private ...