September 23, 2014

How Per Diem Rates Can Simplify Travel Expense Reporting

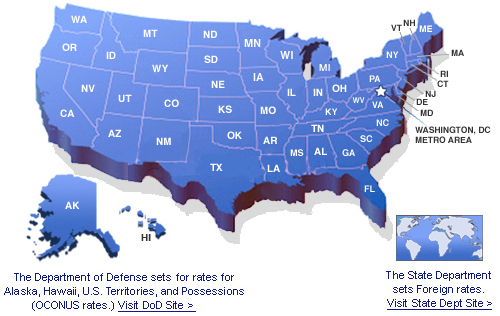

The IRS has just announced new federal per diem travel rates for Fiscal Year 2015 (FY 2015), which spans October 1, 2014 through September 30, 2015. Unlike many other previous years, when per diem rates were typically bumped up just a dollar or two or not