Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 8, 2026

June 8, 2022

Ledgible, a professional crypto tax and accounting platform, has received $20 million in funding for its Series A Round led by EJF Capital LLC ("EJF") through its affiliate, the EJF Silvergate Ventures Fund.

June 8, 2022

While the resurgence signals impressive resilience, companies are finding that the cost and liabilities of leases are on the rise amid an inflationary environment and lessors looking to recoup losses.

June 8, 2022

The findings showed that 82% of executives say their company lost revenue due to miscommunication in the invoice-to-cash cycle, leaving money on the table and damaging customer relationships.

![IRS_logo.5f4d027a0e5d3[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/06/IRS_logo.5f4d027a0e5d3_1_.62a093ad9a2a1.png)

June 8, 2022

Difficulties in working with a resource-challenged Internal Revenue Service have become a more pressing concern for CPA firms over the past year, even as they grapple with lingering impacts from the pandemic, a new survey by the AICPA & CIMA shows.

June 8, 2022

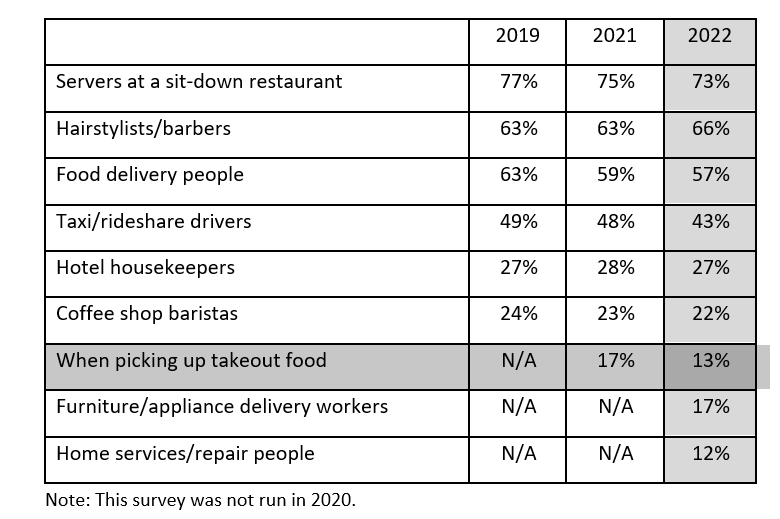

The number of U.S. adults who say they always tip for services (servers at a sit-down restaurant, hairstylists/barbers, food delivery people, taxi/rideshare drivers, hotel housekeepers, coffee shop baristas and when picking up takeout food) has ...

June 7, 2022

In a cost segregation analysis, your client’s property elements are divided into two categories: real property, which includes permanent and immobile objects, like their building’s foundation, and personal property, which includes objects like kitchen ...

June 7, 2022

The estate tax exemption is scheduled to revert to $5 million in 2026, with inflation indexing. Fortunately for married couples, the exemption is “portable” by law. In other words, the estate of the second spouse to die can benefit from any unused ...

June 6, 2022

The Illinois CPA Society (ICPAS) is honored to present its Outstanding Educator Award to three Illinois college and university accounting faculty as part of its 2022 awards program.

June 6, 2022

The American Institute of CPAs’ Auditing Standards Board and Accounting and Review Services Committee have collectively released four new quality management standards designed to improve a CPA firm's risk assessment and audit quality.

June 3, 2022

Consumers accustomed to inflation continued to spend in April as retail sales overcame higher prices to show both monthly and year-over-year increases, according to the National Retail Federation.

June 3, 2022

AICPA News is a round-up of recent announcements from the association.

June 3, 2022

Each year, these awards are presented to an Outstanding Leader and an Emerging Leader in recognition of their commitment to advancing diversity in the accounting profession.