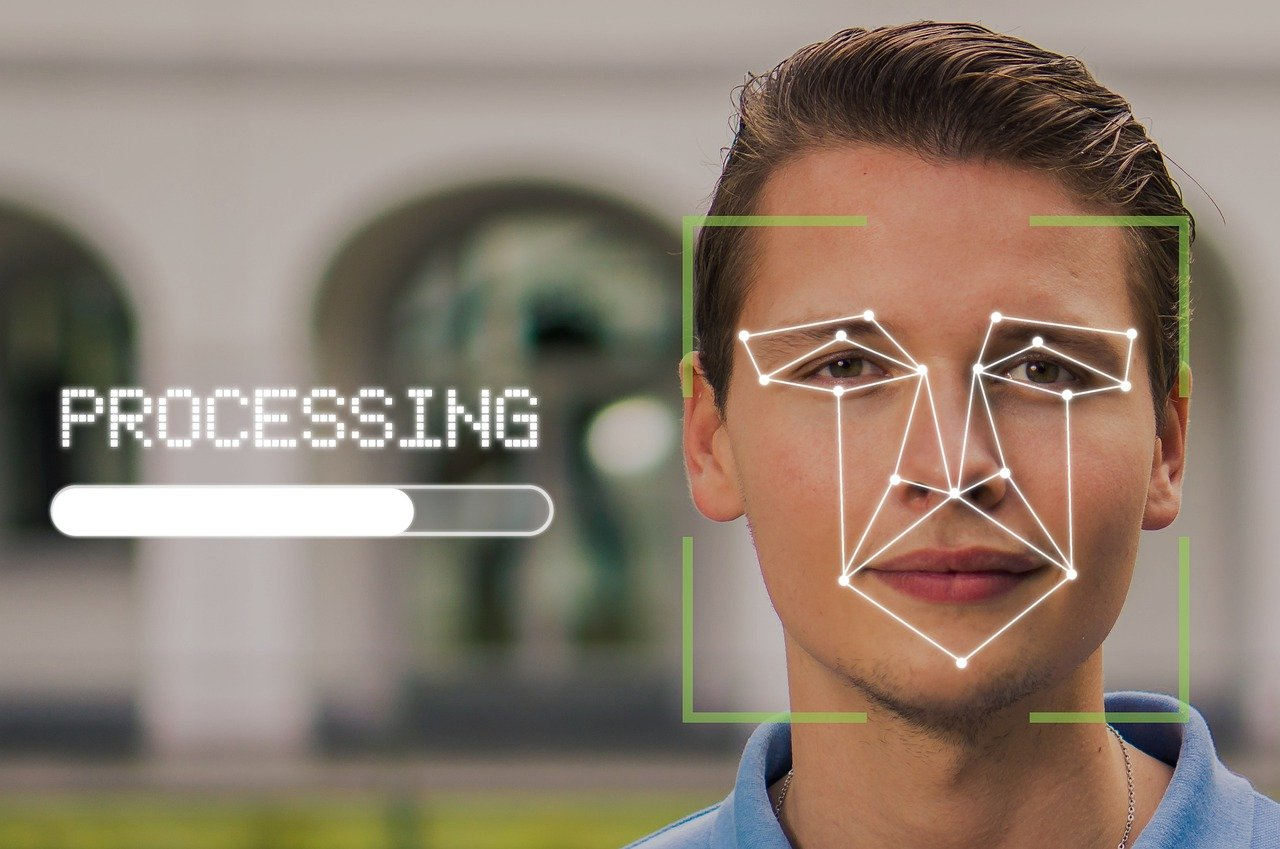

The IRS says it will transition away from using a third-party service for facial recognition to help authenticate people creating new online accounts. The transition will occur over the coming weeks in order to prevent larger disruptions to taxpayers during filing season.

This action by the IRS to move away from facial recognition comes after some discomfort by taxpayers at having a third-party technology provider managing the service. https://www.cpapracticeadvisor.com/tax-compliance/news/21254817/irs-to-start-requiring-facial-recognition-for-tax-transcripts-and-payments

During the transition, the IRS will quickly develop and bring online an additional authentication process that does not involve facial recognition. The IRS will also continue to work with its cross-government partners to develop authentication methods that protect taxpayer data and ensure broad access to online tools.

“The IRS takes taxpayer privacy and security seriously, and we understand the concerns that have been raised,” said IRS Commissioner Chuck Rettig. “Everyone should feel comfortable with how their personal information is secured, and we are quickly pursuing short-term options that do not involve facial recognition.”

The transition announced today does not interfere with the taxpayer’s ability to file their return or pay taxes owed. During this period, the IRS will continue to accept tax filings, and it has no other impact on the current tax season. People should continue to file their taxes as they normally would.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs