Earlier this month, the IRS started requiring identity verification through the third-party contractor ID.me in order to use the IRS website to verify taxpayer identity before viewing taxpayers’ child tax credit and advance credit payments. https://www.irs.gov/credits-deductions/2021-child-tax-credit-and-advance-child-tax-credit-payments-topic-k-verifying-your-identity-to-view-your-payments.

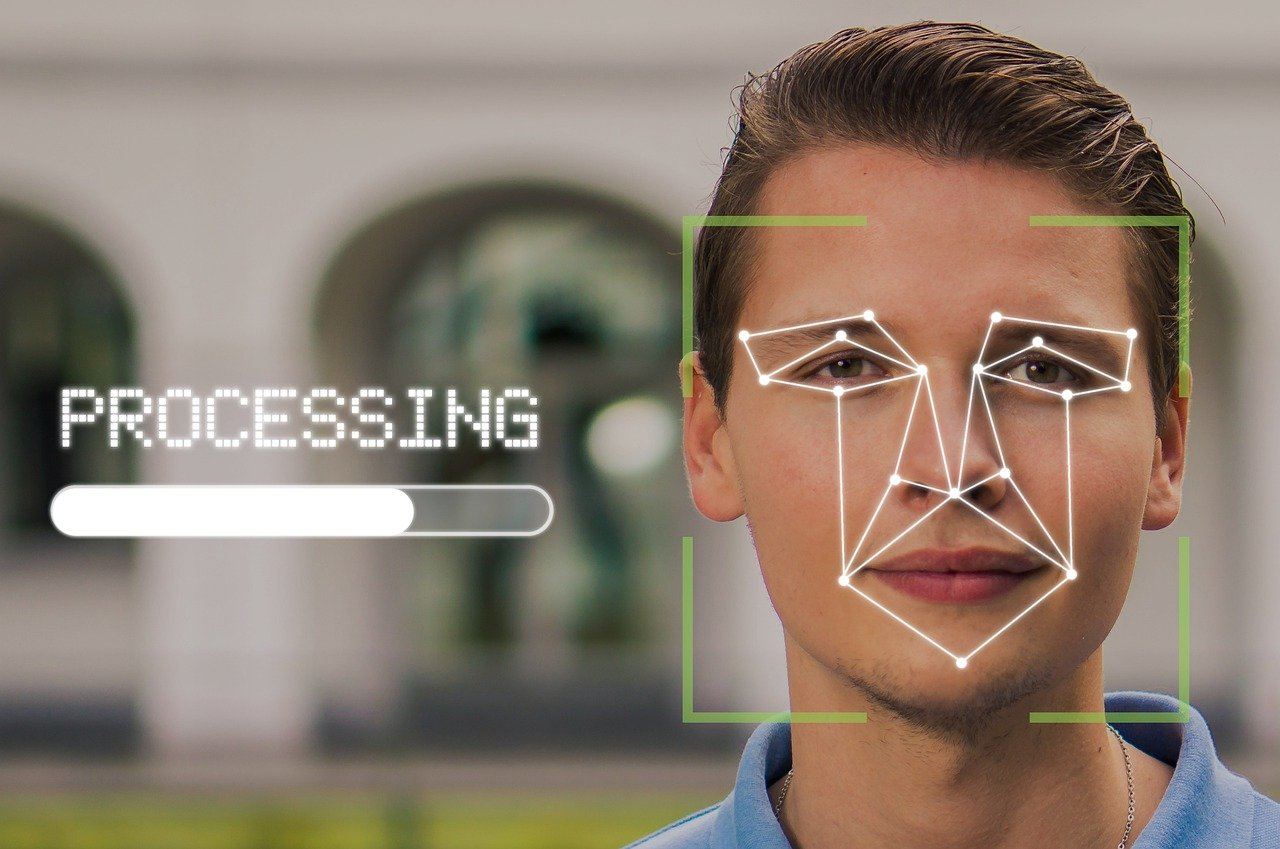

That verification requirement will soon be required for all taxpayers to view other personal tax documents on the IRS website. Although ID.me is widely-used, including by other government entities, and is generally considered secure, the thought of facial recognition being implemented by the agency many Americans already love to hate will be at least somewhat disturbing to some.

“Facial recognition technology … has been proven time and time again to have biases and privacy implications that must be carefully considered for both functional and ethical perspectives,” said Paul Laudanski, Head of Threat Intelligence at the security technology firm Tessian. “In addition, not all people have equal access to biometric authentication capabilities whether due to lack of access to reliable internet services, devices with compatible cameras and sensors, or simply because they don’t have compatible physical characteristics. This also presents issues with addressing identity theft.

According to The Washington Post, “Taxpayers will still be able to file their returns the old-fashioned way. But by this summer, anyone wanting to access their records – including details about child tax credits, payment plans or tax transcripts – on the IRS website will be required to record a video of their face with their computer or smartphone and send it to the private contractor ID.me to confirm their identity.” (Via Yahoo! News: https://www.yahoo.com/news/irs-wants-scan-face-171738919.html)

ID.me is a Virginia-based company with contracts with multiple states and almost a dozen federal agencies, including the Veterans Administration and Department of Labor.

The company’s two-year contract with the Treasury Department and the IRS is reported to be worth $86 million, which by federal standards is somewhat low, but the current implementation is still limited.

One of the biggest concerns for many Americans is security, aside from conjuring up thoughts of a sci-fi futuristic authoritarian government. The top legal representative for the Electronic Privacy Information Center, Jeramie Scott, told the Post, “You go from a government agency, that at least has some obligation under the Privacy Act and other laws, to a third party, where [there’s a] lack of transparency and understanding, and the potential risks go up.”

Publicly, the IRS has stated that it takes security and “inequities in service seriously.”

The ID.me system is available on computers or mobile devices, and it guides users through a process that includes taking a picture of their face, official identification (drivers license or passport, for example), and occasionally other documents. On the back end, if the automated system is unsure if the images match, it may require additional supporting information or get a human involved in the verification process.

ID.me says it allows users to select a setting to delete their images and data after use, but IRS rules suggest the company may have to retain that data for up to seven years.

Tax preparers who request transcripts on behalf of their clients may ask how this change will impact them. According to Jordan Ray, chief revenue officer at Canopy Tax, “Our users are already accustomed to the IRS verification process required to establish an online account. While including facial recognition as part of the one-time setup process may lead to some initial friction from users, we are confident that challenges will be minimal. To minimize disruptions, we encourage our users to transition to the new process well ahead of the summer 2022 deadline.” Canopy Tax users have access to a secure login with the IRS whereby they can pull down transcripts of client returns.

“Because security is a top priority for both CPAs and individuals, we support the IRS’s initiatives to create a more secure process to accessing important tax documents, like transcripts, said Larry Furr, Canopy’s chief product officer. “At Canopy, we go to great lengths to incorporate the latest security measures and ensure our software functions well with the enhanced security measures made by other third-party partners.”

[Note: The author of this article has used ID.me for VA purposes.]

======

More on IRS facial recognition:

– Washington Post (via Yahoo! News): https://www.yahoo.com/news/irs-wants-scan-face-171738919.html

– IRS Website: https://www.irs.gov/credits-deductions/2021-child-tax-credit-and-advance-child-tax-credit-payments-topic-k-verifying-your-identity-to-view-your-payments

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs