The IRS and the U.S. Department of the Treasury have issued proposed regulations updating the federal income tax withholding rules to reflect changes made by the Tax Cuts and Jobs Act (TCJA) and other legislation.

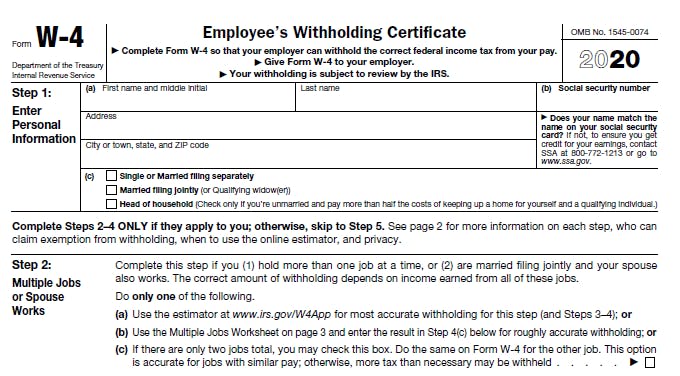

In general, the proposed regulations, available now in the Federal Register, are designed to accommodate the redesigned Form W-4, Employee’s Withholding Certificate, to be used starting in 2020, and the related tables and computational procedures in Publication 15-T, Federal Income Tax Withholding Methods. The proposed regulations and related guidance do not require employees to furnish a new Form W-4 solely because of the redesign of the Form W-4.

Employees who have a Form W-4 on file with their employer from years prior to 2020 generally will continue to have their withholding determined based on that form.

To assist with computation of income tax withholding, the redesigned Form W-4 no longer uses an employee’s marital status and withholding allowances, which were tied to the value of the personal exemption. Due to TCJA changes, employees can no longer claim personal exemptions. Instead, income tax withholding using the redesigned Form W-4 will generally be based on the employee’s expected filing status and standard deduction for the year.

The Form W-4 is also redesigned to make it easier for employees with more than one job at the same time or married employees who file jointly with their working spouses to withhold the proper amount of tax.

In addition, employees can choose to have itemized deductions, the child tax credit, and other tax benefits reflected in their withholding for the year. As in the past, employees can choose to have an employer withhold a flat-dollar extra amount each pay period to cover, for example, income they receive from other sources that is not subject to withholding. Under the proposed regulations, employees now also have the option to request that employers withhold additional tax by reporting income from other sources not subject to withholding on the Form W-4.

The proposed regulations permit employees to use the new IRS Tax Withholding Estimator to help them accurately fill out Form W-4. As in the past, taxpayers may use the worksheets in the instructions to Form W-4 and in Publication 505, Tax Withholding and Estimated Tax, to assist them in filling out this form correctly.

The proposed regulations also address a variety of other income tax withholding issues. For example, the proposed regulations provide flexibility in how employees who fail to furnish Forms W-4 should be treated. Starting in 2020, employers must treat new employees who fail to furnish a properly completed Form W-4 as single and withhold using the standard deduction and no other adjustments. Before 2020, employers in this situation were required to withhold as if the employee was single and claiming zero allowances.

In addition, the proposed regulations provide rules on when employees must furnish a new Form W-4 for changed circumstances, update the regulations for the lock-in letter program, and eliminate the combined income tax and FICA (Social Security and Medicare) tax withholding tables.

Treasury and IRS welcome public comment on these proposed regulations. See the proposed regulations for details.

Updates on TCJA implementation can be found on the Tax Reform page of IRS.gov.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs