Payment Fraud Hit Record Number of Businesses in 2016

Nearly three quarters of corporate treasury and finance professionals said their companies were victims of payments fraud last year, according to the 2017 AFP Payments Fraud Survey, underwritten by J.P. Morgan.

This is the highest percentage since the survey debuted in 2005 and comes after a dramatic increase in 2015. Check fraud and business email compromise are both on the uptick.

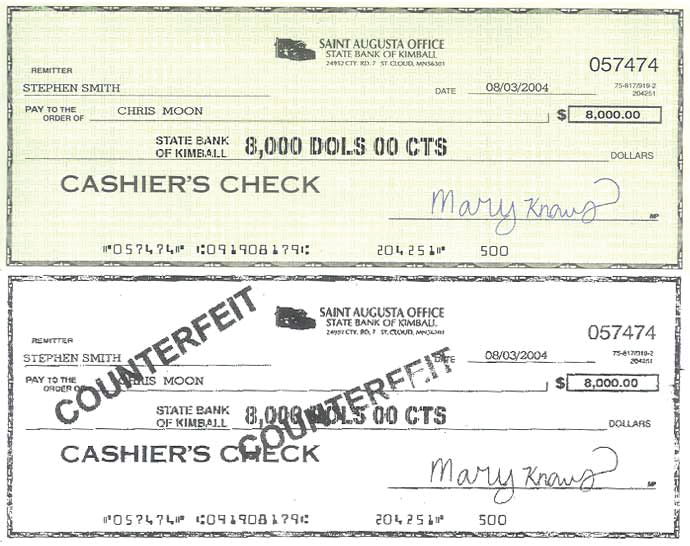

Checks continue to be the most popular method for committing payments fraud. Fully 75 percent of organizations that were victims of payments fraud in 2016 experienced check fraud—an increase from 71 percent in 2015. This is a reversal of the declining trend observed in check fraud since 2010.

Key findings:

- 74 percent of survey respondents said their organizations were victims of business email compromise in 2016—a 10 percentage point increase from 2015.

- 70 percent of organizations are being proactive and have implemented controls to prevent business email compromise.

- 63 percent of payments fraud attempts were made by outside individuals.

“With the advancement of technology, organizations are more vulnerable to fraud attacks now than before, and business leaders need to equip their people and systems with the tools and resources needed to prevent fraud and alleviate the impact of an attack,” said Jim Kaitz, president and chief executive of AFP. “Companies that offer mandatory training for all employees, particularly around cybersecurity, and that have a plan to respond to payments fraud, will fare better than those that do not.”

Over 70 percent of corporate treasury and finance professionals are hesitant about adopting mobile payments at their organizations as they question the security of this payment method.

“The fraud survey serves as an important resource in understanding the potential risks within the payments industry and should not be underestimated,” said Nancy McDonnell, Managing Director and Treasury Sales Executive at J.P. Morgan. “With three-quarters of companies experiencing fraud in 2016, it is important that businesses take preventive measures by educating their employees and implementing the products and processes they need to prepare and protect their assets and data from cyberfraud.”

Latest News:

- 60% of CFOs Optimistic on Economy and Their Businesses. CFOs in the U.S. and Canada have increased optimism on macroeconomic conditions and their own companies’ prospects, according to Deloitte’s CFO Signals survey for the first quarter (1Q 2017). www.cpapracticeadvisor.com/12320475/

- How Money Savvy are Millennials? Millennials have become the largest segment of the adult population, and a Deloitte study reports they are expected to grow their wealth significantly in the next several years, at least in part because they are heading into their prime-earning years. www.cpapracticeadvisor.com/12321408

- Financial Audits Help Improve Business Performance. Financial statement audits, essential to helping the capital markets function effectively and with confidence, are helping today’s business leaders improve the performance and operational processes of their companies, according to a new Deloitte survey. www.cpapracticeadvisor.com/12320476

- Internal Audit Functions Need Disrupting, says PwC Study. Internal audit functions are losing ground in trying to keep pace with stakeholder expectations, according to the 13th annual PwC State of the Internal Audit Profession study. www.cpapracticeadvisor.com/12320590

- 4 Questions to Ask New Business Valuation Clients. Attracting new clients is a common challenge for valuation professionals. Unlike traditional accounting services (such as tax preparation and audits) that some clients need each year, valuations are often performed to meet a one-time need triggered by situations such as a shareholder dispute, a divorce settlement or a bankruptcy. www.cpapracticeadvisor.com/12320252

Top A&A Social Media Posts

- 8 Questions Your Financial Statements Won’t Answer – Geni Whitehouse LinkedIn post: http://bit.ly/2o775lA

- The Promise of Blockchain Technology – Doug Sleeter in the Accountex Blog: http://bit.ly/2o7alxx

- The 2017 Top IT Security Risks: Everything is Connected – Chris Ellingwood in BerryDunn’s Firm Footing blog: http://bit.ly/2nIov4B

- Supreme Court Nominee’s Record Provides Insight into Views on Internet and Social Media Law: Michael Lambert in Specialty Technical Publishers Audit, Compliance and Risk blog: http://bit.ly/2nhisbU

- Can What You Are Doing Be Done By Artificial Intelligence? – Rita Keller’s Solutionsn for CPA Firm Leaders blog: http://bit.ly/2o1WaYT

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs