When California’s Fair Pay Act took effect on Jan. 1, it represented one of the toughest equal pay laws in the nation. The law, which strengthened the state’s Equal Pay Act, represents the latest legislative change causing issues and concerns for employers throughout the United States.

“Sixty-six years after passage of the California Equal Pay Act, many women still earn less money than men doing the same or similar work,” said Gov. Edmund G. Brown Jr., when he signed the legislation into law. “This bill is another step toward closing the persistent wage gap between men and women.”

Although federal anti-discrimination laws have long required that women and men are paid equally for the same work, the new law in California not only expands what may constitute a similar job, but also places the burden of demonstrating that any differences in pay for similar jobs are based on legitimate factors other than gender, such as education or experience, on the employer.

California now has one of the strictest laws in the country, and other states have recently passed equal pay laws or are considering them. These new laws could leave more employers open to lawsuits and claims of discrimination. In order to stay compliant, employers should take some time to understand the different laws that could impact them, review their pay scales, and make sure any pay differences can be justified by legitimate business reasons.

State and Federal Laws

The new California law puts a greater burden on employers to prove that they have not discriminated against employees with their pay practices. Previously, California employees had to prove that they were not being paid at the same rate as someone of the opposite gender at the “same establishment” for “equal work.” Now, the phrase “same establishment” has been eliminated from the law, and “equal work” has been changed to “substantially similar work.”

In order to avoid discrimination claims, California employers now have to prove that any pay differences are based on any or all of four factors:

- A seniority system;

- A merit system;

- A system that measures earnings by quality or quantity of production; or

- A bona fide factor other than sex, such as education, training, or experience.

The California law also prohibits companies from banning employees from disclosing their own wages, asking colleagues about their wages, or talking about how much others are paid.

Along with California, other states have been strengthening their equal pay laws as well. Last year, New York passed the “Achieve Pay Equity” law, which is similar to California’s. In 2015, Connecticut passed a law that makes it illegal for employers to ban employees from revealing their own compensation or asking colleagues about their salary. Under Delaware law, state contractors must pay female employees equally. Other states that have recently considered equal pay legislation include Washington and Massachusetts.

Employers can also face pay discrimination claims under federal laws such as the Equal Pay Act of 1963, Title VII of the Civil Rights Act of 1964, the Age Discrimination in Employment Act of 1967 (“ADEA”), the Lilly Ledbetter Fair Pay Act of 2009, and Title I of the Americans with Disabilities Act of 1990 (“ADA”). “The law against compensation discrimination includes all payments made to or on behalf of employees as remuneration for employment,” according to the U.S. Equal Employment Opportunity Commission. “All forms of compensation are covered, including salary, overtime pay, bonuses, stock options, profit sharing and bonus plans, life insurance, vacation and holiday pay, cleaning or gasoline allowances, hotel accommodations, reimbursement for travel expenses, and benefits.”

- Equal Pay Act

According to the EEOC, The Equal Pay Act (“EPA”) requires that men and women be paid equally for equal work in the same establishment. While the jobs do not need to be identical, they must be substantially equal. “It is job content, not job titles, that determines whether jobs are substantially equal,” according to the EEOC. “Specifically, the EPA provides that employers may not pay unequal wages to men and women who perform jobs that require substantially equal skill, effort and responsibility, and that are performed under similar working conditions within the same establishment.”

- Title VII, ADEA, and ADA

Title VII, the ADEA, and the ADA prohibit compensation discrimination on the basis of race, color, religion, sex, sexual orientation, national origin, age, or disability. These laws differ from the EPA because there is no requirement that anyone claiming pay discrimination have a job that is “substantially equal” to a higher-paid person outside the protected class. According to the EEOC, it is also unlawful to retaliate against an individual for opposing employment practices that discriminate based on compensation or for filing a discrimination charge, testifying or participating in any way in an investigation, proceeding, or litigation under these laws.

- Lilly Ledbetter Fair Pay Act

The first piece of legislation that Pres. Barack Obama signed was the Lilly Ledbetter Fair Pay Act. The act overturned the U.S. Supreme Court’s ruling in Ledbetter v. Goodyear Tire & Rubber Co., Inc., which limited the time period for filing complaints of compensation discrimination. According to the EEOC, “The Act states the EEOC’s longstanding position that each paycheck that contains discriminatory compensation is a separate violation regardless of when the discrimination began.”

Next Steps

As more states pass equal pay laws, companies need to be sure that they comply with all required legislation. In order to remain in compliance and avoid potential discrimination claims, employers should take several steps.

- Talk to the experts

Legal counsel, including in-house attorneys and outside lawyers, can help companies stay up to date with any changes in laws and react to those changes. Employers should work proactively with their attorneys, so they are not caught by surprise. The Human Resources department can also be a valuable source of information on equal pay best practices.

- Be prepared to justify pay differences

In California, employees must be paid the same for substantially similar work. At this early stage, it remains unclear what will constitute “substantially similar work.” Some jobs may be easy to compare and contrast, but others may be far more challenging to differentiate. Furthermore, California’s new law opens the door for comparisons between employees in different locations and different markets. All of this means that employers need to review jobs that have pay differences and evaluate whether those differences can be justified.

- Conduct a wage audit

In order to be prepared to justify pay differences, employers should conduct a wage audit across their company, including across departments and even locations. As part of the audit, employers should review all pay and compensation-related policies and procedures, job descriptions, employee handbooks, and review and evaluation protocols. The audit should also consider and explain the skill required, the responsibility given, or the level of experience necessary for certain positions. If potential trouble spots arise, proactively addressing them now is always the best approach.

- Consider adopting mandatory arbitration agreements

Many employers have already adopted mandatory arbitration agreements with class action waivers for all employees. Such agreements help limit exposure to costly litigation, especially class actions. However, these agreements are not one-size-fits-all or appropriate for all employers, and many states have unique requirements that must be considered. Employers should consult with their in-house and outside attorneys to determine whether such agreements make sense for them.

Pay and compensation are often very sensitive subjects, and companies already need to navigate extensive laws around pay discrimination. With new changes in state laws, employers need to be even more careful about pay practices and policies, along with job descriptions. Otherwise, they could be facing even more litigation by employees who claim they have been discriminated against.

————-

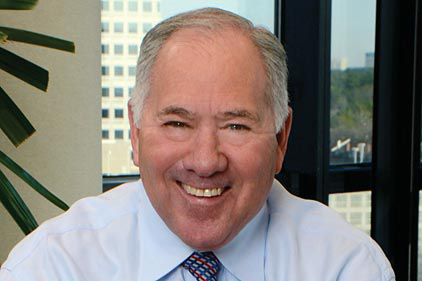

Richard D. Alaniz is senior partner at Alaniz Schraeder Linker Farris Mayes, L.L.P., a national labor and employment firm based in Houston. He has been at the forefront of labor and employment law for over thirty years, including stints with the U.S. Department of Labor and the National Labor Relations Board. Rick is a prolific writer on labor and employment law and conducts frequent seminars to client companies and trade associations across the country. Questions about this article, or requests to subscribe to receive Rick’s monthly articles, can be addressed to Rick at (281) 833-2200 or ralaniz@alaniz-schraeder.com.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Firm Management, Payroll