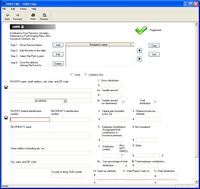

Distributions from Pensions, Annuities, Retirement Plans, IRAs, or Insurance Contracts

A Form 1099-R is generally used to report designated distributions of $10 or more from pensions, annuities, profit-sharing and retirement plans, IRAs, and insurance contracts.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs