Income Tax February 10, 2025

IRS Income Tax Refund Schedule for 2025

This chart can help you estimate when you should get your 2025 income tax return, based on when you file and a few other easy factors.

Income Tax February 10, 2025

This chart can help you estimate when you should get your 2025 income tax return, based on when you file and a few other easy factors.

Small Business February 7, 2025

The fee would apply once per transaction even if the items are delivered in multiple shipments, so long as the purchase contains one item of tangible personal property subject to Maryland sales tax.

Small Business February 7, 2025

If you’re a self-employed individual, you can deduct your “ordinary and necessary” business expenses, just like the corporate giants do. However, you’re also held to the same strict substantiation rules.

Small Business February 7, 2025

If you plan to do business outside of the United States, you’ll need to understand value-added tax (VAT). It’s the most common consumption tax in the world.

Taxes February 7, 2025

Ippei Mizuhara, who stole nearly $17 million from the Los Angeles Dodgers superstar to cover debts, was ordered to pay nearly that sum in restitution to Ohtani and a little more than $1 million to the IRS.

Taxes February 7, 2025

If you found this article, you're probably expecting a refund and are starting to think about doing your taxes or going to a tax pro, or perhaps you just filed, and are curious how long you need to wait for that $$$.

Small Business February 6, 2025

The report covers sales tax changes specifically affecting the manufacturing, retail, and software industries. It also addresses beverage alcohol, communications, excise, lodging, and VAT changes.

IRS February 6, 2025

The IRS has notified workers essential to tax season that they must work until May even if they accepted the Trump administration's federal employee buyout offer, the deadline of which was put on hold temporarily by a federal judge on Feb. 6.

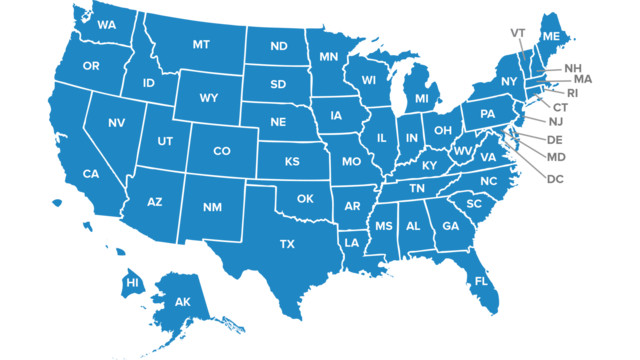

State and Local Taxes February 6, 2025

President Donald Trump outlined his tax priorities in a meeting with Republican lawmakers, including a call to end the carried interest tax break used by private equity fund managers and expand the state and local tax deduction.

![natural_disasters_list_1_.56117a5e5df03[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/12/natural_disasters_list_1_.56117a5e5df03_1_.61c1db14bf0ea.png)

Taxes February 6, 2025

The American Institute of CPAs requested that the IRS incorporate a checkbox and Federal Emergency Management Agency (FEMA) disaster number space into various tax returns.

Taxes February 6, 2025

The survey was created to gauge the impact of the $10,000 cap on SALT deductions imposed by the Tax Cuts and Jobs Act (TCJA) in 2017. The cap is due to expire this year.

Small Business February 5, 2025

Respondents reported 13-quarter highs in their confidence in meeting growth projections (65%), increased demand (64%), cost control goals (62%) and labor needs (60%).