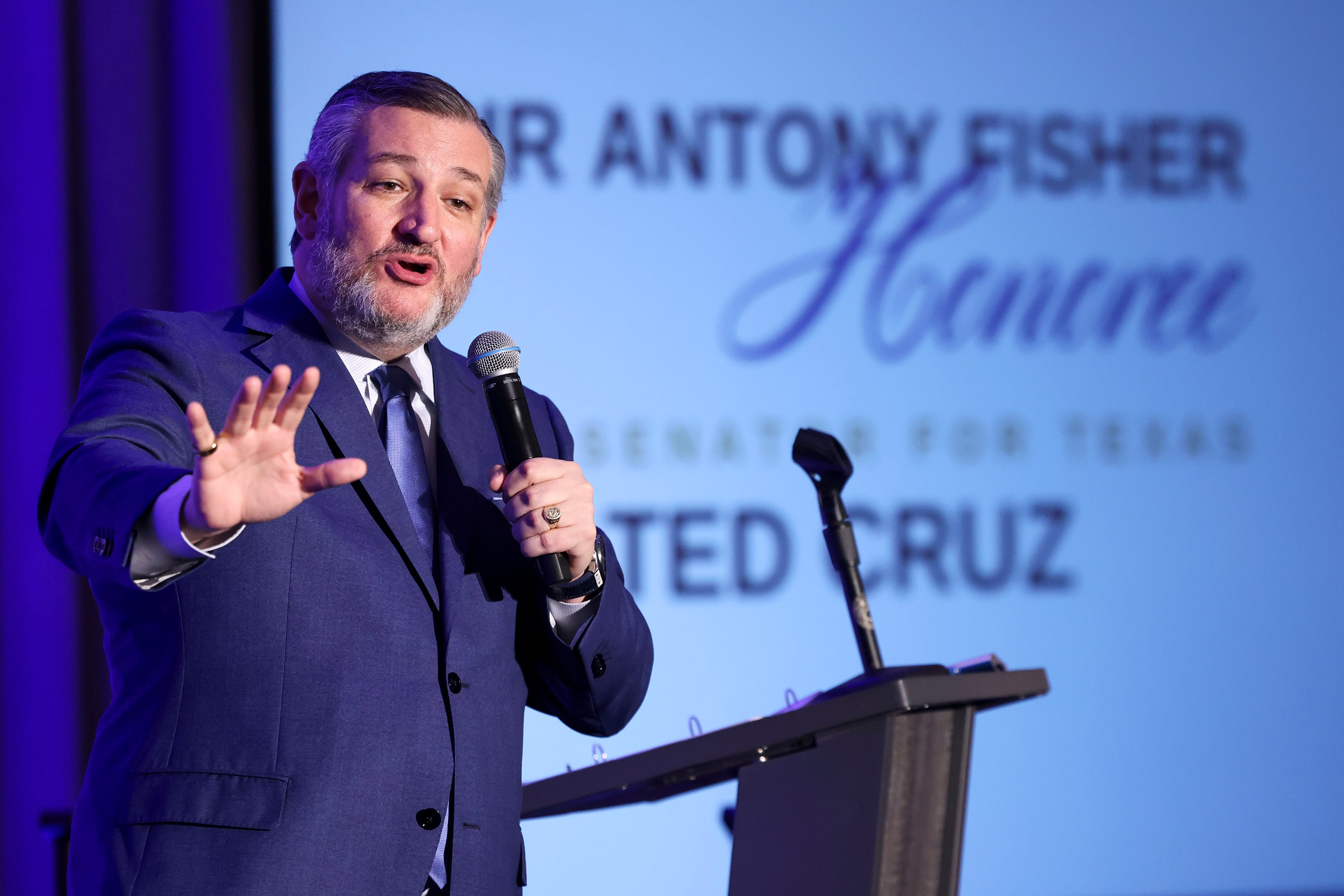

Taxes August 11, 2025

These States Have the Highest Share of Homeowners Who Would Benefit if Trump Scraps Capital Gains Tax

The biggest potential beneficiaries are those who have already built considerable wealth through their property, and they mainly come from states where home prices are high and have increased quickly, according to a Redfin report.