September 12, 2014

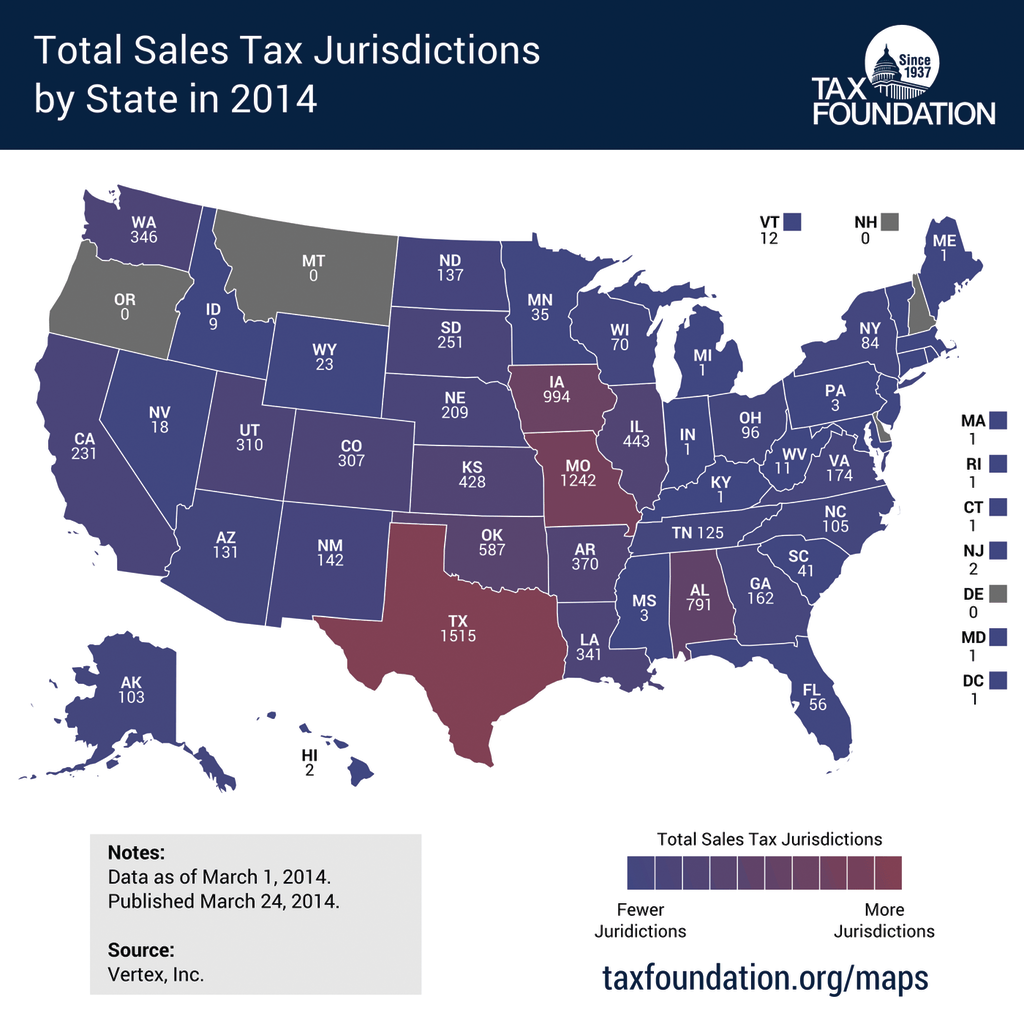

Are Your Clients Likely to Face a SALT Audit?

Historically, a business' gross revenues follow seasonal patterns and even a small change in gross revenue should result in a small change in the associated accounts. In an attempt to discover why one established contractor was selected for audit, I reviewed their sales tax filings and created the below table.