January 21, 2020

Grant Thornton Launches Indirect Tax Platform

The platform bridges the various indirect tax management functions into one simplified workflow, easing the compliance burden in addition to providing insight for strategic management.

January 21, 2020

The platform bridges the various indirect tax management functions into one simplified workflow, easing the compliance burden in addition to providing insight for strategic management.

January 6, 2020

More businesses are required to electronically file and remit Arizona transaction privilege tax (TPT) and Hawaii General Excise Tax (GET) in 2020 than in previous years.

December 19, 2019

Some of the wackiest sales tax tales in 2019 centered on remote sales tax. States won the right to tax remote sales only recently, with the United States Supreme Court decision on South Dakota v. Wayfair, Inc. (June 21, 2018) — and implementation ...

December 11, 2019

Avalara’s 2020 sales tax changes report reveals major changes in legislation and consumer preference that are poised to disrupt ecommerce in 2020.

December 10, 2019

The two-day Institute is intended for attorneys, accountants, state tax officials, tax directors, tax managers, and individuals who seek expert discussion on the latest technical, legislative, and planning developments. Attendees will learn practical ...

December 9, 2019

The January 2019 notice provided an exception for small remote sellers. Businesses with no physical presence in New York need to collect New York sales tax only if, in the immediately preceding four sales tax quarters ...

October 2, 2019

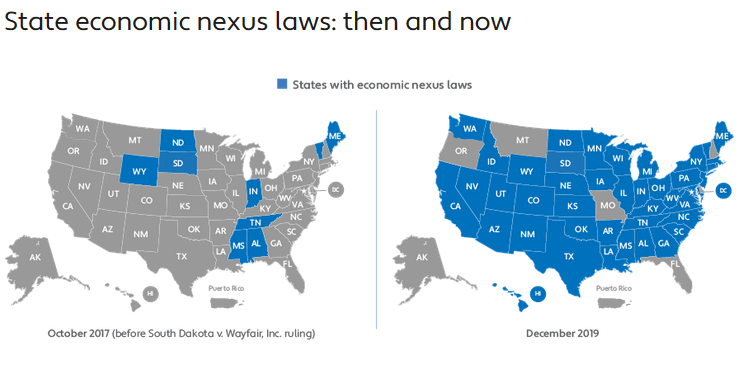

In the wake of Wayfair, you need to monitor your sales into all states with economic nexus — and that’s almost all states. Of the 45 states* (plus the District of Columbia) that have a general sales tax, 43 have an economic nexus law or rule.

September 23, 2019

A business must have nexus — a connection with a state — for the state to require the business to collect and remit sales tax. Before the Wayfair ruling, sales tax nexus was based solely on physical presence: States couldn’t require an out-of-state ...

September 23, 2019

Sales tax never takes a break. Although only a handful of state legislatures are in session in August, there were still plenty of sales tax changes. Congress looks to regulate state remote sales tax laws. A small group of federal lawmakers from non-sales-tax states are still pushing to regulate the way states tax remote sales. Learn...…

![web-bnr-ficpa-accounting-show-next-era-2019[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/07/34831/accounting_show_next_era_2019_1_.5d6e71e222689.png)

September 3, 2019

Technology, transition and transformation highlight the Florida Institute of CPAs’ (FICPA) 2019 Accounting Show Next Era - the association’s largest and longest-running educational conference for CPAs in the state.

September 3, 2019

As of October 1, 2019, ALL out-of-state sellers making sales for delivery into Kansas are required to register with the Department of Revenue and collect and remit Kansas sales or use tax.

August 12, 2019

Megg Dillon, 36, has been wanting to redecorate her Santa Monica, Calif., apartment, so she appreciated physically seeing the items she usually browsed online. “I do like that pineapple,” she said to her friend, referring to the fruit-shape cutting board inside home furnishings retailer Wayfair’s pop-up shop at the King of Prussia Mall. “How cute...…