Payroll July 27, 2023

What Small Businesses Need to Know about the ADA and FMLA

Perhaps a supervisor’s most significant role is serving as the employer’s first line of defense against the incidence and continuation of regulatory non-compliance.

Payroll July 27, 2023

Perhaps a supervisor’s most significant role is serving as the employer’s first line of defense against the incidence and continuation of regulatory non-compliance.

Accounting July 27, 2023

U.S. economic growth unexpectedly picked up steam in the second quarter thanks to resilience among consumers and businesses in the face of high interest rates.

Payroll July 24, 2023

Overall, just 20% of U.S. adults say they do not have any financial regrets, while 6% say they don’t know what their biggest financial regret is.

Payroll July 24, 2023

The unemployment rates in 25 states are currently at or within 0.1 percentage point of a record low, Bureau of Labor Statistics data showed Friday. New Hampshire and South Dakota had the lowest jobless rates last month, at 1.8%.

Payroll July 23, 2023

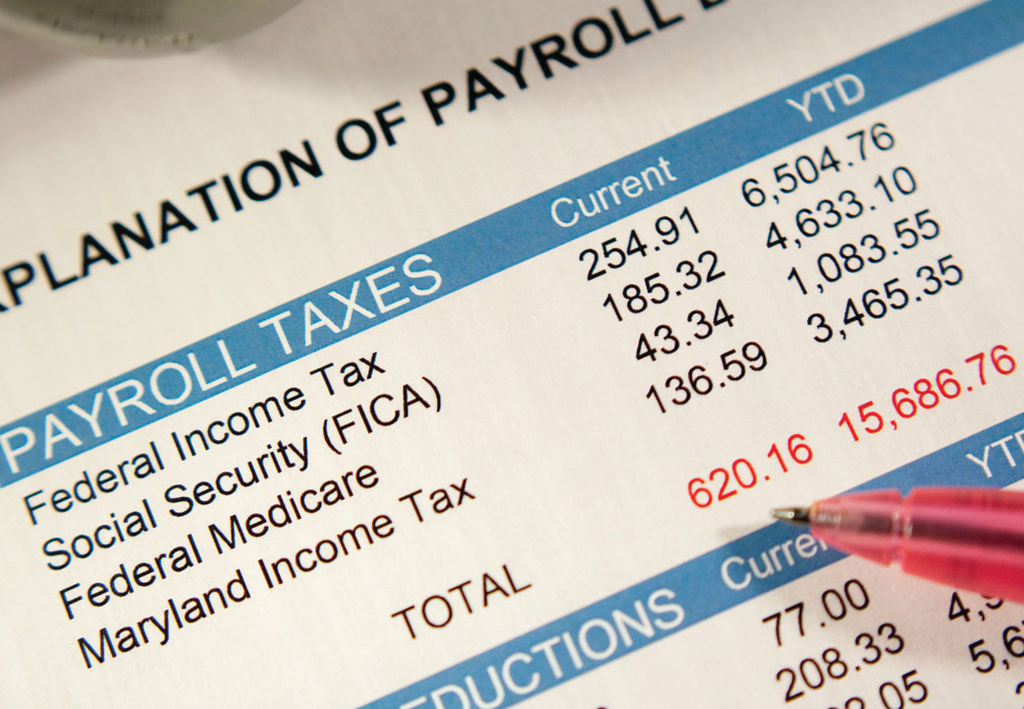

A Colorado man has been sentenced to 15 months in prison for evading the payment of more than $700,000 in employment taxes he owed to the IRS.

Payroll July 19, 2023

Previously, any money that grandparents gave a grandchild for college had to be reported as student untaxed income on the FAFSA, potentially lowering the student’s eligibility for financial aid.

Small Business July 19, 2023

Only 4 percent of high-paying jobs were remote before the pandemic. That rose to 9 percent by the end of 2020, and it’s more than 15 percent today. There are expected to be 36.2 million American employees working remotely by 2025.

Payroll July 18, 2023

Employees are exceedingly tempted to jump ship and seek out a more stable role when they sense financial distress, so clear dialogue regarding organizational health is crucial to retaining talent.

Payroll July 17, 2023

The new Workforce name reflects QuickBooks’ vision to provide businesses and their employees with a robust human capital management platform to manage their work, pay, and benefits in one place.

Payroll July 12, 2023

More than 3 in 4 travelers (77%) who have taken an overnight trip outside their local area this year experienced at least one travel-related issue, according to a new Bankrate report.

Accounting July 12, 2023

Professionals on the Move is a round-up of recent promotions and staffing announcements from around the accounting profession.

Payroll July 7, 2023

Fourteen people were charged in a $53 million fraud scheme involving the federal government’s pandemic relief program, including some executives from a Dallas metal recycling firm.