May 8, 2014

IRS Releases 2014 Form W-2

The IRS recently released new tax forms for Tax Year 2014, for which individuals will file by April 15, 2015.

May 8, 2014

The IRS recently released new tax forms for Tax Year 2014, for which individuals will file by April 15, 2015.

April 17, 2014

After reducing its initial public offering price to $15 per share, Paycom Software Inc. made its trading debut on the New York Stock Exchange on Tuesday, opening at $17.90 per share and closing at $15.35.

February 27, 2014

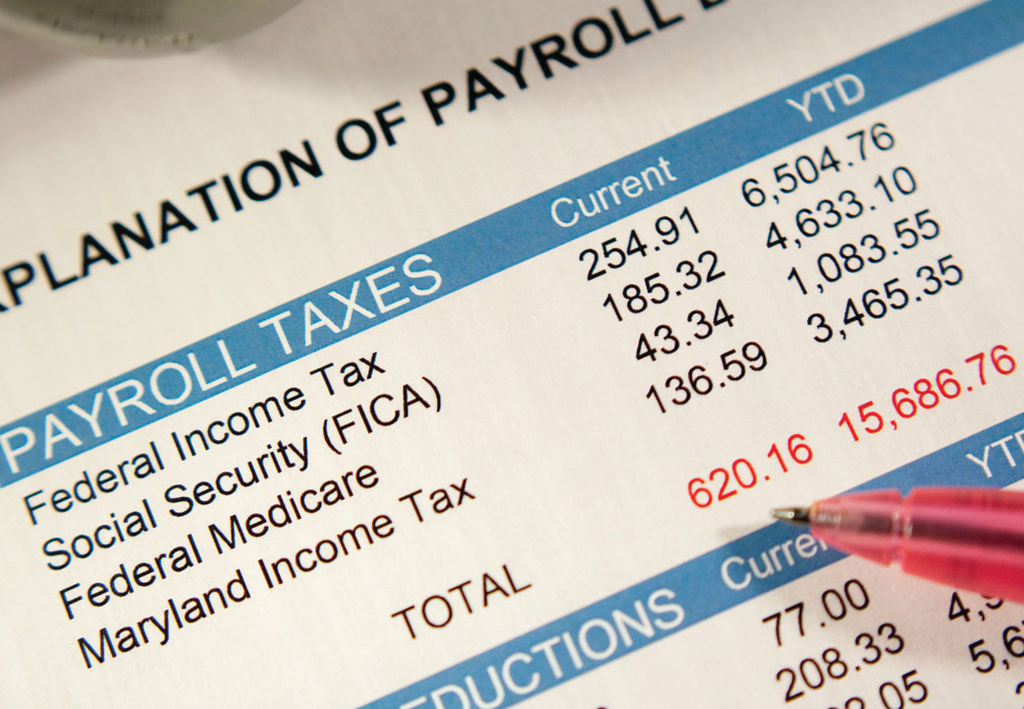

In January this year, the United States Supreme Court heard oral arguments in United States v. Quality Stores, Inc. The outcome of this case will clarify the taxable treatment of certain severance payments under the Federal Insurance Contribution Act (FICA).

February 27, 2014

Someone just asked TaxMama if there is a way to get her father’s earnings information from back in 1977-78. She needs it because his income in those years is not on his Social Security record.

February 6, 2014

The Supreme Court's rejection of the Defense of Marriage Act (DOMA) was big news in 2013. And in 2014, it has big payroll tax implications for employers who offer cafeteria benefits to same-sex spouses.

January 24, 2014

Thomson Reuters has released a special retrospective report focused on the key tax developments that occurred during 2013, which included a major federal tax law as well as many significant new cases, regulations, rulings, and revenue procedures.

December 24, 2013

The IRS surprised employers a few weeks back with a rule change that allows flexible spending account participants to roll over up to $500 of their unused account balances into the next year.

December 12, 2013

Having to run payroll for foreign nationals seems like a remote possibility for most payroll service providers. And it's true that only 14% of Thomson Reuters tax and accounting software users who process payroll reported paying foreign nationals in a recent survey.

November 17, 2013

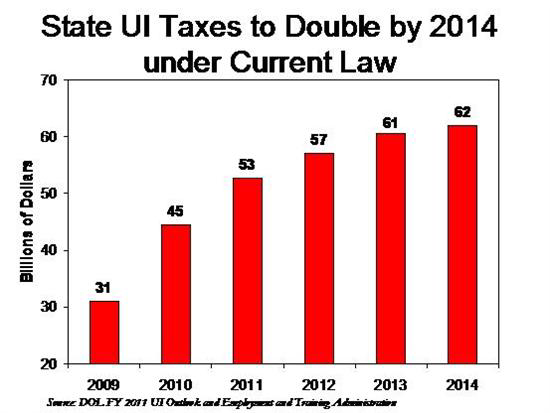

Your payroll clients are already paying FUTA, a federal tax levied on employers that are covered by their state's unemployment insurance program. Depending on where they're located, your clients may face an increase in FUTA when they file their 2013 taxes.

November 11, 2013

This month, we'll look at state unemployment tax, or SUTA. Unlike FUTA, SUTA offers employers in many states a way to reduce their tax rates in 2014. It's called a "voluntary contribution."

October 2, 2013

As we began 2013, taxpayers were shrouded in a cloud of uncertainty concerning taxes. That seemed to quickly be resolved for this year and into 2014, but we are now faced with a number of new tax and payroll issues.

July 25, 2013

Backed by business and labor groups, the state agency for injured workers has filed new legal documents in its fight to overturn a judge's ruling that some employers were overcharged $860 million in workers' compensation premiums from 2001 to 2009.