From the October 2013 issue.

As we began 2013, taxpayers were shrouded in a cloud of uncertainty concerning taxes. That seemed to quickly be resolved for this year and into 2014, but we are now faced with a number of new tax and payroll issues.

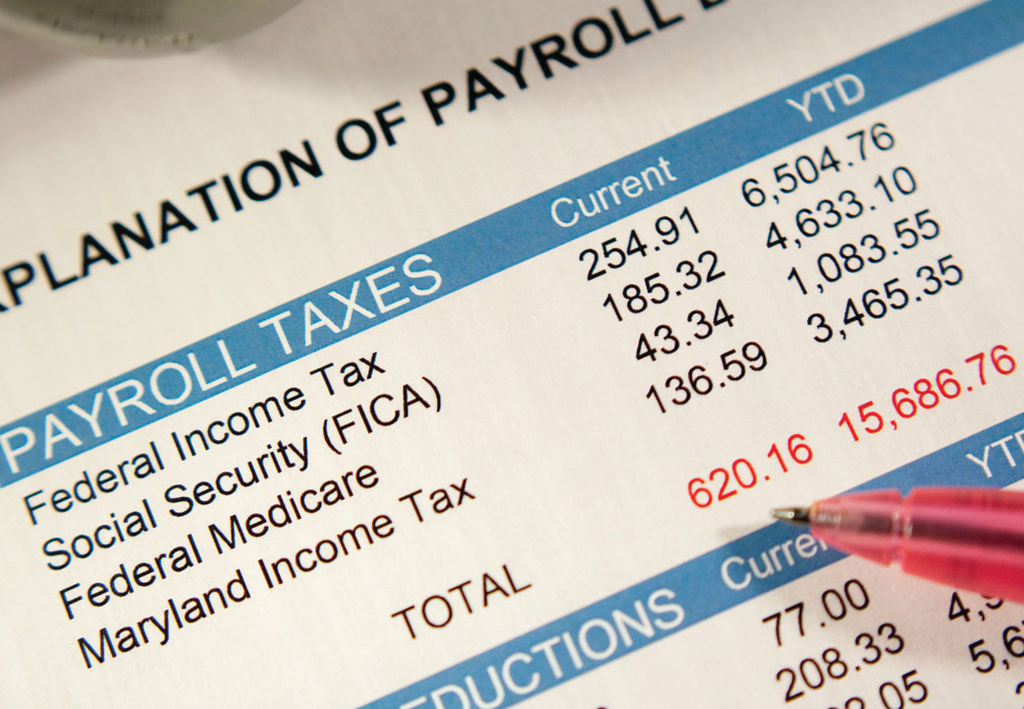

At the forefront were increases in federal withholding tax and the expiration of the 2% Social Security tax holiday. Add to that a new tier of Social Security and Medicare calculations for high wage earners and many businesses and taxpayers may feel the cloud of uncertainty has not thinned out.

With all of the changes, accounting professionals may find it hard to keep up and many are becoming reliant on payroll tax vendors to track these changes. Thankfully, payroll vendors have diligently updated their tax tables and programs to incorporate all of these changes. As in last year’s reviews, the products included this year are from vendors with a notable presence in the tax and accounting professional space.

Today, accounting professionals have a vast array of payroll processing vendors and platforms to choose from. From full in-house software to fully outsourced solutions, and traditional PC software or cloud based solutions, accounting professionals can find a solution to meet their needs as well as for their clients. This also allows custom tailored solutions to meet the needs of organizations of any type and size. Many of the software vendors even offer distinct levels of collaboration with clients allowing clients to participate as much or little as desired, while still relying on the accounting professional for oversight.

With more accounting professionals starting or expanding their payroll service offerings, the options available also lend well to revenue streams. Most of the vendors have systems that allow accounting firms to set up fixed-fee or other pricing models, which allow professionals to establish a revenue stream from existing or potential clients.

All of the products reviewed this year offer core processing features that are strong enough to handle payroll needs for most business situations. Payroll vendors are working persistently to ensure quick and easy data entry and are starting to build in error checking functions. These error checking functions can easily detect unusual withholding and time data amounts or improperly entered Social Security Numbers. By including these functions, each payroll run is processed with a high level of accuracy.

With all of the changes to payroll and the vendor interfaces, help and support options have increased. Each product reviewed incorporates a help and support system that generally offers strong assistance features and most are US-based. Payroll vendors are also utilizing web-based support models to allow users to easily find common errors and questions and not spend time waiting for telephone or email based support.

Web-based portals are a polarizing issue for many accounting professionals, but payroll seems to allude this stigma. Nearly all payroll products reviewed offer some level of client and employee self-service portal. Many vendors license the use of this function separately, but the features provided are similar across all products. At a minimum, employees have access to current and previous paystub information. Many vendors further enhance their systems to allow timekeeping functions and time off requests.

In addition to web-based portals, a handful of payroll vendors are releasing mobile apps to accompany service offerings. This provides employees direct access to similar information as on the web, but does not require a computer to access. Accounting professionals and clients may also use these apps to perform quick payroll processing or to run basic reports. Those that offer mobile apps typically limit their offerings to iOS and Android mobile devices.

As the landscape of payroll continues to change, payroll vendors will continue to update their solutions. In the meantime, accounting professionals have the opportunity to be well positioned in the payroll service area by creating new revenue streams and profitability.

—–

Note for RC:

Here are the categories for this review:

| Basic System Functions | ||||||||||||||||||||||

| · General Navigation/Ease-of-Use | ||||||||||||||||||||||

| · Designed for Accounting Professionals | ||||||||||||||||||||||

| · Concurrent Users | ||||||||||||||||||||||

| · Scalability (number of payrolls handled) | ||||||||||||||||||||||

| · Multiple Pricing Options | ||||||||||||||||||||||

| · Multi-Client Management | ||||||||||||||||||||||

| · Payroll Tax Tables (for all states, jurisdictions, municipalities) | ||||||||||||||||||||||

| · After-the-Fact Payroll | ||||||||||||||||||||||

| · Multi-State Taxes | ||||||||||||||||||||||

| · Direct Deposit | ||||||||||||||||||||||

| · Common Paymaster Calculations | ||||||||||||||||||||||

| Reporting & Monitoring | ||||||||||||||||||||||

| · Compliance Due Date Tracking/Monitoring | ||||||||||||||||||||||

| · Quarterly & Annual Forms for all States | ||||||||||||||||||||||

| · E-filing & Payment | ||||||||||||||||||||||

| · Customizable Reports | ||||||||||||||||||||||

| · Dashboards for Employee Management | ||||||||||||||||||||||

| · Worker's Comp Tracking | ||||||||||||||||||||||

| Integration/Import/Export | ||||||||||||||||||||||

| · Integration w/programs | ||||||||||||||||||||||

| · Integration w/external programs (GL export, etc.) | ||||||||||||||||||||||

| · Built-in Timesheet Management | ||||||||||||||||||||||

| · Time Clock Import | ||||||||||||||||||||||

| · Web timesheet/phone time reporting support | ||||||||||||||||||||||

|

· Data import/export formats supported

|

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, Payroll, Payroll Software, Payroll Taxes