Taxes May 27, 2025

Pending Tax Legislation Will Result in Cancellation of IRS Direct File

The tax bill that passed the House and is headed to the Senate includes a provision to end the IRS Direct File program.

Taxes May 27, 2025

The tax bill that passed the House and is headed to the Senate includes a provision to end the IRS Direct File program.

Taxes May 23, 2025

For U.S. citizens and resident aliens now living or working abroad, including those with dual citizenship, the deadline for filing returns and paying any taxes owed is June 16, 2025.

Taxes May 21, 2025

Instantly access a unified, organized summary of every section in the legislative bill, highlighting what matters most for tax planning and compliance.

Technology May 21, 2025

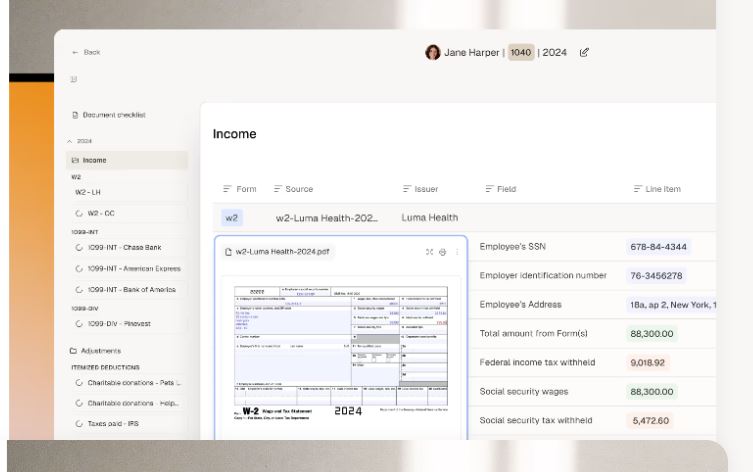

Filed automates the complete lifecycle of a tax return–from structuring diverse client documents to validating returns and proactively flagging anomalies based on firm-defined rules.

Accounting May 21, 2025

James J. Sirleaf, 65, of Darby, PA, pleaded guilty to 15 counts of aiding and assisting in the preparation of false income tax returns and three counts of filing false personal income tax returns for himself.

Technology May 20, 2025

The company is now rapidly expanding its reach, actively securing authorization across all U.S. states and major U.S. cities to offer truly nationwide filing.

May 19, 2025

The conference will deliver the latest information on the newest and proposed policy changes, latest rulings and regulations, and emerging trends impacting real estate and partnership taxation.

Taxes May 16, 2025

In a new case, an office mix-up authorizing the wrong FedEx service resulted in a missed tax deadline. The Tax Court addressed whether the “equitable tolling” doctrine grants the taxpayer a reprieve.

Taxes May 15, 2025

The Tax Counseling for the Elderly and Volunteer Income Tax Assistance grants allow eligible organizations to apply for annual funding to provide free federal tax return preparation assistance for up to three years.

Taxes May 14, 2025

Although damages paid due to physical injuries are tax-exempt, other payments for non-physical injuries are generally subject to tax. In this case, a man who claimed he was injured while he was incarcerated walked away with a split decision.

Taxes May 12, 2025

For individuals, the rate for overpayments and underpayments will be 7% per year, compounded daily, the IRS said on May 12.

Taxes May 12, 2025

The House Ways and Means Committee release of the tax measures, ahead of planned debate on the panel Tuesday, is a sign the Republican-controlled chamber is moving toward a floor vote this month on the legislation.