Taxes February 8, 2023

AICPA Sends Tax Proposals to Lawmakers

The 61 recommendations in the compendium include proposals related to employee benefits, individual income tax, international tax and tax administration, among others.

Taxes February 8, 2023

The 61 recommendations in the compendium include proposals related to employee benefits, individual income tax, international tax and tax administration, among others.

Accounting February 7, 2023

State CPA Society News & Updates is a round-up of recent announcements and initiatives by CPA associations in the United States and its territories.

Accounting February 2, 2023

CalCPA proactively drives evolution within the accounting profession by promoting business growth and integrity, protecting public interests, and positively impacting the community to deliver a better future for all.

Accounting January 19, 2023

The IFRS Sustainability Symposium, which will be held at the Palais des congrès de Montréal, is designed for global business leaders, investors and policymakers.

Accounting January 18, 2023

ICPAS serves an extraordinary community of more than 22,600 accounting and finance professionals in a variety of CPA and non-CPA roles.

Accounting January 17, 2023

State CPA Society News is a round-up of recent announcements and initiatives by CPA associations in the United States and its territories.

January 17, 2023

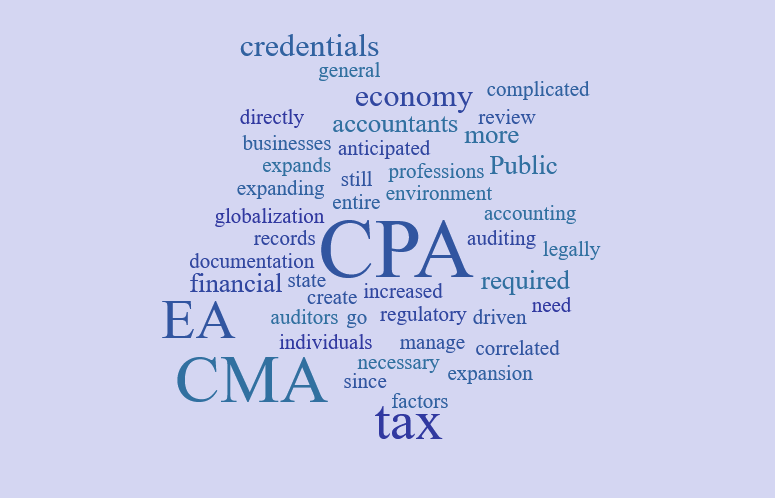

Rather than being constrained towards a single country, accounting credentials such as Certified Public Accountant (CPA), Enrolled Agent (EA) and Certified Management Accounting (CMA) are quickly turning into global designations.

Accounting January 12, 2023

Cybernews reported that threat actors bragged on a hacking forum that they compromised AICPA database.

Accounting January 4, 2023

The Blueprints are based on the knowledge and skills required of a newly licensed CPA in today’s world.

December 14, 2023

The standards provide a framework for the development, presentation, measurement, and reporting of CPE programs.

Accounting November 21, 2022

During the past two weeks, 67 TXCPA volunteer members provided more than 50 career presentations and reached more than 1,335 Texas students.

Accounting November 10, 2022

Educators and accounting professionals developed the Framework to define the skills-based competencies students need as they enter the profession.