Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

February 12, 2026

Taxes April 24, 2024

An arm of Appeals, the Alternative Dispute Resolution Program Management Office will look to revitalize existing ADR programs.

Taxes April 24, 2024

The bill, introduced in both the House and the Senate, would require the IRS to spell out exactly what the error on the return is.

Taxes April 24, 2024

TIGTA investigators identified a scheme where individuals obtained Employer Identification Numbers, a unique nine-digit identifier required for tax purposes, and then used them to file business tax returns that improperly claimed...

IRS April 22, 2024

The list serves as a reminder to remain vigilant about tax scams not only during tax season, but all year long, the IRS said.

Payroll April 22, 2024

The analysis accounts for federal income taxes and withholdings for Social Security and benefits, as well as state and local taxes.

IRS April 19, 2024

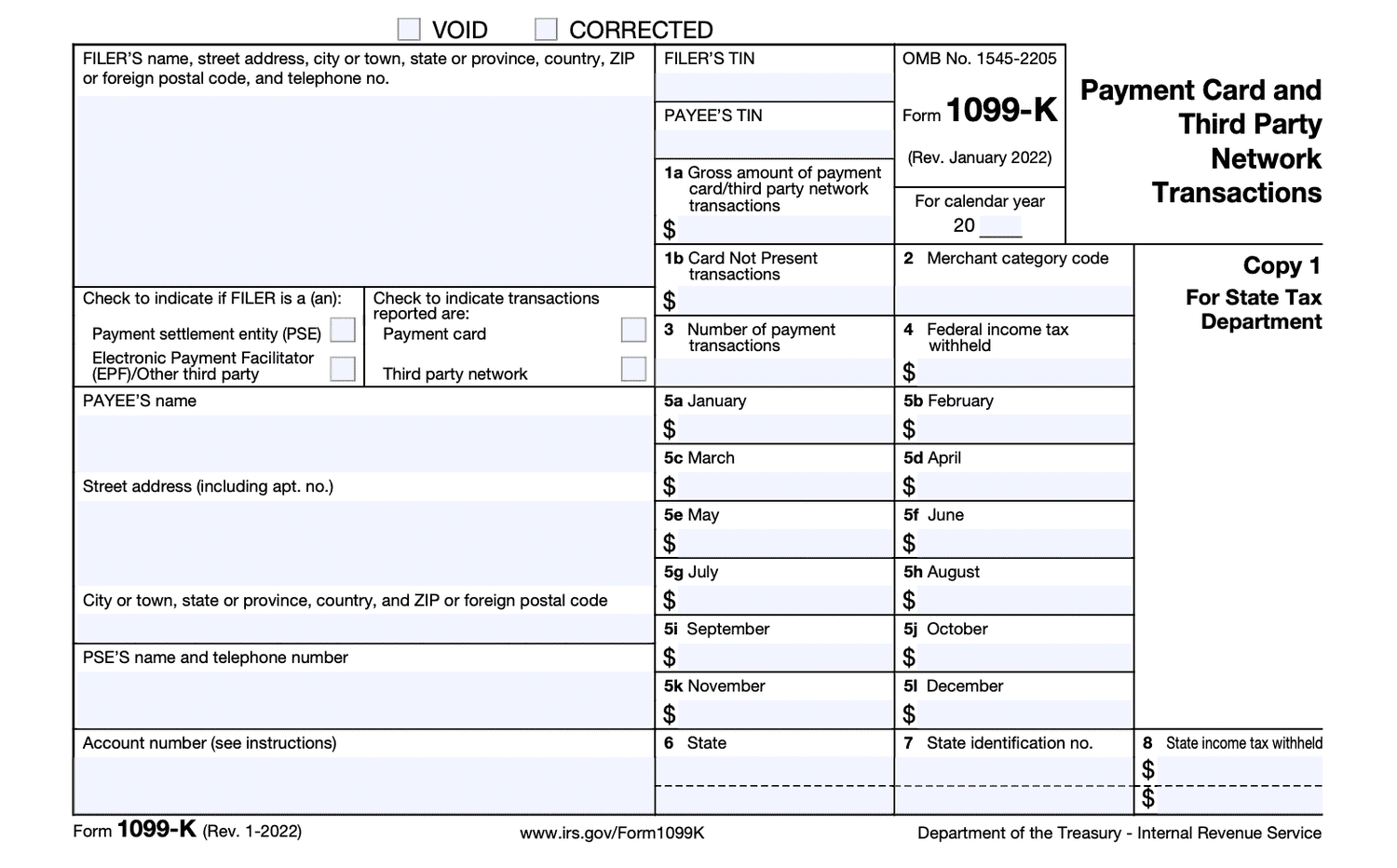

The IRS Friday posted on its website the highly anticipated draft Form 1099-DA, which brokers will use to report digital asset transactions.

Advisory April 19, 2024

There’s a high demand for 1099 services, according to the 2022 CPA.com and AICPA PCPS Client Advisory Services (CAS) Benchmark Survey.

Taxes April 19, 2024

Georgia’s 2019 abortion law allows expectant parents to claim an embryo or fetus as a dependent on their taxes.

![natural_disasters_list_1_.56117a5e5df03[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/12/natural_disasters_list_1_.56117a5e5df03_1_.61c1db14bf0ea.png)

Accounting April 18, 2024

Under current law, taxpayers affected by a major disaster often have less time to make a refund or credit claim than those who are not affected.

Taxes April 18, 2024

Ndeye Amy Thioub was indicted on three counts each of filing false tax returns and filing false tax returns as an employee of the U.S.

Taxes April 18, 2024

The rapper, whose legal name is Daniel Hernández, had his property seized for “nonpayment of internal revenue taxes.”

Taxes April 18, 2024

Some tax returns are being rejected because filers failed to provide information about ACA coverage they didn't know they had.