By Gail Cole

One of the most effective ways for an accounting practice to increase revenue and promote client satisfaction is to offer additional services that are essential to client compliance and success. While tax automation tools have reduced the need for many manual accounting tasks, there’s growing demand for accounting professionals to offer client advisory services (CAS). The tax compliance landscape is incredibly complex; you can help your clients navigate it.

Businesses that field a lot of W-9 and 1099 forms are likely to be in particular need of advisory and perhaps outsourcing in the coming months and years — especially if they still manage these forms manually, as many do. There’s a high demand for 1099 services, according to the 2022 CPA.com and AICPA PCPS Client Advisory Services (CAS) Benchmark Survey. In fact, when asked “What services are the most in demand?”, 91% of respondents named “1099 creation and filing.”

Best practices for W-9 forms

A company must collect a W-9 form from every freelance worker, independent contractor, or gig worker they pay at least $600 in a calendar year, as you undoubtedly know. The W-9 form contains the payee’s Taxpayer Identification Number (TIN), which is used by businesses to report income paid to individuals who are not W-2 employees.

As their trusted advisor, you can help your clients develop best practices for W-9 form management, such as requesting a W-9 at the start of a vendor relationship. You can also counsel them on how to handle situations in which a W-9 contains incorrect information, or what to do when a vendor doesn’t supply a W-9.

Your clients may also want to consider establishing a system for payees to submit Forms W-2 and Forms W-9 electronically. Businesses that file 10 or more information return forms are now required to submit those forms to the IRS electronically. Per the IRS, the new electronic filing requirements for Forms W-2 apply to tax year 2023 Forms W-2 “because they are required to be filed by January 31, 2024.”

Where both paper and electronic filing is permitted, many of your clients will rely on you to explain the pros and cons of manual vs. electronic filing. Developing expertise in solutions that automate Form W-2 management will enable you to better advise your clients.

What your clients need to know about 1099s

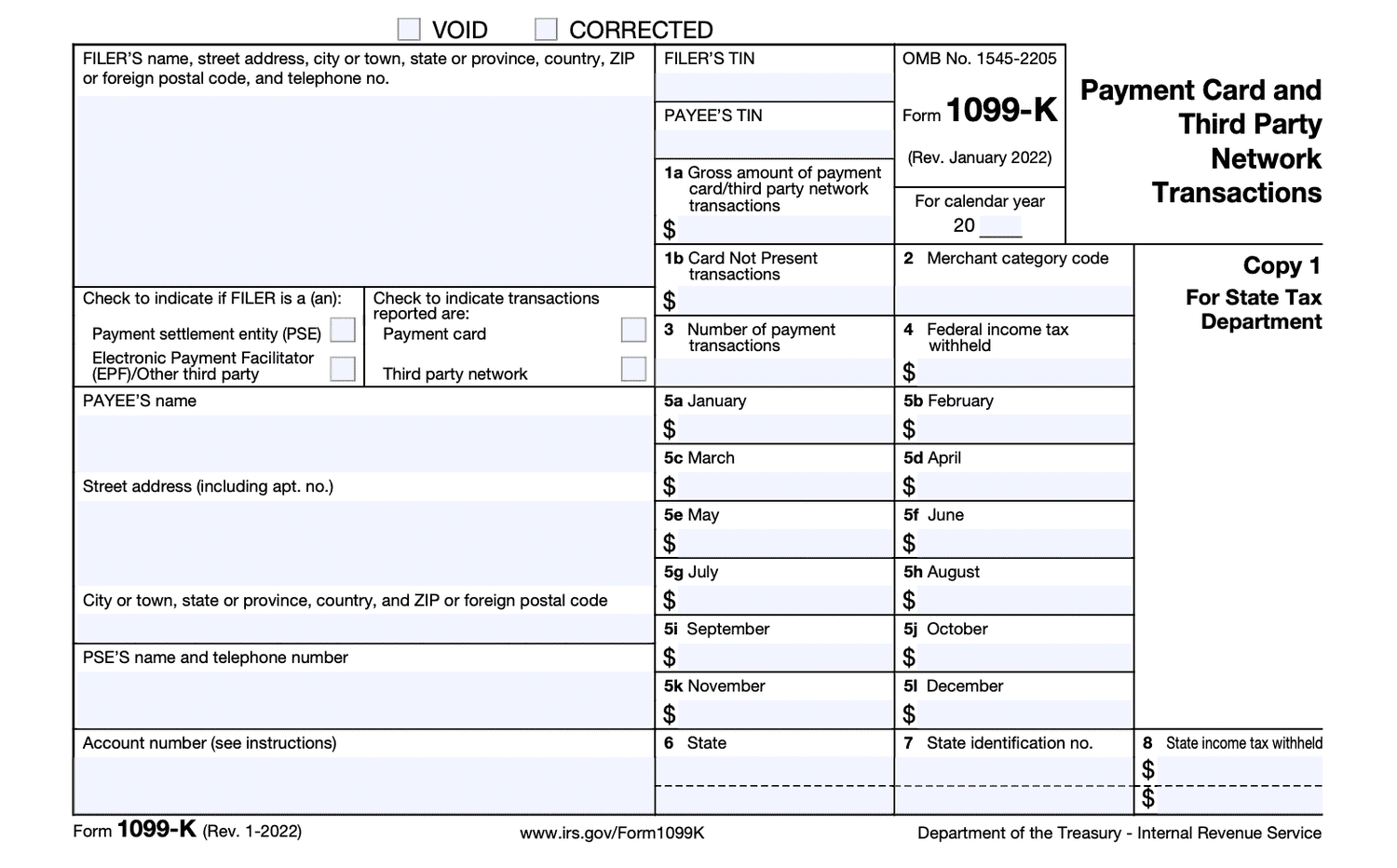

You’ve likely followed what’s been happening with the Form 1099 thresholds: how the American Rescue Plan of 2021 drastically lowered the 1099-K reporting threshold from $20,000 in aggregate payments and 200 transactions in a calendar year to $600, period — and how the new threshold was set to take effect for the 2022 tax year but was postponed to tax year 2023, then postponed again.

Concerned about the tsunami of 1099-K forms that will arise from the $600 threshold, and the fact that many people won’t know what to do when a 1099-K shows up in their mailbox, the IRS has proposed a $5,000 threshold for the 1099-K for tax year 2024. The decision isn’t yet final

— we’re still waiting for the IRS to make it official. If prior years are any indicator, we may not know until November or December.

Something else to consider: On January 31, 2024, the United States House of Representatives passed a bill that would increase the reporting threshold for the 1099-MISC and 1099-NEC forms from $600 to $1,000 for payments made on or after January 1, 2024. It would also decrease the reporting threshold for payments of direct sales from $5,000 to $1,000. Whether the Senate will approve these proposed changes remains to be seen.

A Census-wide survey of gig workers, marketplace sellers, and decision-makers at online marketplaces found that while a majority of marketplace sellers and gig workers were aware of the upcoming 1099-K changes, just 51% identified as “aware and prepared.” Meanwhile, 19% said they were “aware but not prepared,” and 12% answered “not aware or prepared.” Taxpayers will be even less prepared for new 1099-MISC and 1099-NEC reporting thresholds, should they take effect.

You can help your clients get ready for 1099 changes, whatever they turn out to be. Many may want a trusted accounting professional to advise them on the new 1099 rules and the most effective way to comply with them. Thus, for firms with CAS practices, automating the creation and filing of IRS forms is one way to extend services and potentially attract more clients.

How to streamline Form-1099 management

Businesses that send out a lot of 1099-K forms today will likely need to issue many more once the lower threshold takes effect, whether it ends up being $5,000 or $600 or something else. Handling 1099 forms manually may cease to be a viable option for many such businesses, but they may not realize that: About 47% of the online marketplaces surveyed by Censuswide plan to send out 1099-K forms “manually, using internal teams.”

Companies with robust internal teams may be able to handle the load, but some could find it overwhelming. The IRS expects an estimated 44 million Forms 1099-K to result from the $600 threshold. That’s an awful lot of forms.

You have the opportunity to advise your clients and help them identify the impact of a $5,000 or $600 Form 1099-K reporting threshold. Likewise, you can help them understand the potential benefits and downsides of outsourcing management of 1099 forms by developing expertise in solutions that automate the collection, storage, and filing of 1099 forms. Deepening your knowledge in this area and incorporating these services into your CAS practice will make you a valuable partner.

How to file 1099 forms

As with W-2 forms, businesses that only file a handful of 1099 forms can file paper returns. However, starting with tax year 2023, any entity that files 10 or more 1099 forms must file them electronically.

Businesses filing 1099 forms electronically for the first time must request a new IR-TCC code from the IRS. As it can take up to 45 days to receive the new code, the IRS recommends taxpayers submit the request for Filing Information Returns Electronically (FIRE) by November 1 of the year before the information returns are due. The IRS provides additional details.

How automating document management can enhance security for your clients

Going paperless improves security by eliminating or drastically reducing the collection, storage, and mailing of paper documents full of sensitive information. Vetted automated document management solutions generally adhere to strict security guidelines. For instance, the IRS-approved Avalara 1099 & W-9 uses the highest industry encryption standards and separately encrypts tax identification numbers.

The e-filing system used by the IRS also “meets strict guidelines and uses the best encryption technology.”

How automating IRS form management can improve compliance for your clients and help you grow your practice

Automating the management of IRS forms can reduce manual errors and greatly enhance and streamline compliance. It can also help taxpayers file forms electronically, as many must do as of tax year 2023.

Adding IRS document management to your CAS practice may also help you attract more clients and grow your business. If certain 1099 thresholds drop as expected, many businesses and even individuals could find themselves overwhelmed and in need of an effective method for achieving compliance.

Avalara 1099 & W-9 seamlessly integrates with many accounting solutions, providing a cost-effective, paper-free process to generate IRS-compliant forms. It will:

- Check for 1099 payee data errors

- Import data from various sources

- Deliver IRS forms directly to recipients electronically

- Verify TINs and address information against the IRS database in real time

- Manage multiple payers from one account

- Transfer data from year to year

- Store IRS forms in a secure location that’s accessible for an IRS audit

- Automatically flag filings that need to meet a state requirement

In short, automating the collection, storage, and submission of IRS forms is more reliable, efficient, and error-proof than handling them manually. So why not add document management to your client advisory services?

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs