Taxes February 12, 2026

Senate Votes to Overturn D.C. Tax Decoupling, as Locals Push Back

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

Taxes February 12, 2026

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

February 12, 2026

February 10, 2026

February 10, 2026

October 26, 2014

Should retirees take money out of their qualified retirement plans like 401(k)s and IRAs to help pay for their living expenses? Most retirement-savers in their 70s or older have little choice: Under the federal tax law, they are mandated to make ...

October 23, 2014

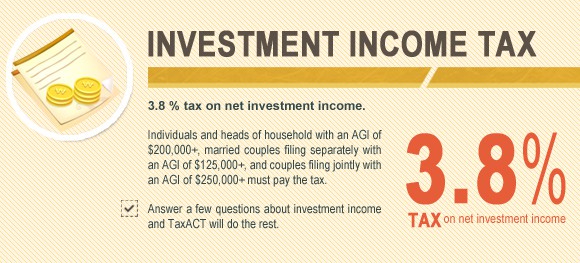

If there is one thing that all CPAs can agree upon, it is that the 2014 tax return filing season was one of the most strenuous that any practitioner has seen in their career. Between rate increases, the imposition of new taxes, and the reinstatement of th

October 21, 2014

To handle new business, public accounting firms are looking to add to their workforce. Many still need to fill positions left vacant during the downturn and take some of the burden off their current teams.

October 21, 2014

Taxpayers who adopt a child do more than open their hearts – they also open their opportunities to take advantage of tax credits.

October 20, 2014

Thomson Reuters has released a new special report on year-end tax planning for 2014 for individuals and businesses. The report highlights the unique opportunities and challenges faced by taxpayers in today’s uncertain legislative environment. It describes the moves to make by year-end to achieve maximum overall tax savings for 2014 and later tax years. It...…

October 20, 2014

Year-end Tax Guide for 2014 highlights the most important tax planning considerations for individuals and small businesses.

October 20, 2014

The American Institute of CPAs (AICPA) sent a letter to the Internal Revenue Service (IRS) explaining that an ambiguity exists under current rules for determining adjustments to the accumulated adjustment account (AAA) of an S corporation when both ...

October 16, 2014

[This is part of a special series about year-end tax planning and preparation.] In the usual case, the tried-and-true tax strategy at the end of the year is to pull deductions into the current year and push income into the following year. And, for the most part, it still makes sense. But now there’s a few...…

October 15, 2014

While most Americans are thinking about football season, the MLB baseball playoffs, the coming NBA season, hockey or the upcoming holidays, savvy financial professionals are advising taxpayers to think about their taxes.

October 14, 2014

[This is part of a special series of articles designed to maximize tax benefits and minimize tax pitfalls at the end of the year.] The alternative minimum tax (AMT) is often referred to as a “stealth tax” because it sneaks up on unsuspecting taxpayers. But you’re not doing your job well if your clients are caught...…

October 12, 2014

The Internal Revenue Service has announced that a planned power outage will cause some services to be unavailable this weekend (Oct. 11-14), which may affect some of the million-plus tax filers, and their tax professionals, who file extended personal inco

October 10, 2014

Keeping up-to-date on changes and proposed changes can be overwhelming, especially if you have a business to run that doesn’t involve payroll. That’s why, as a payroll practitioner, it’s important that you help your clients understand any new changes and what they mean for their business. In 2015, there will be several changes that can...…