Firm Management February 6, 2026

Wipfli Partners with The Caddie Network

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

Firm Management February 6, 2026

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

February 6, 2026

February 6, 2026

February 6, 2026

February 6, 2026

August 13, 2019

If you were to draw a picture of today’s accounting landscape, you’d find technology front and center, hogging up all the attention. It’s not hard to see why it’s gained such a place of prominence.

August 12, 2019

As accountants, we often take great comfort in what we know. We are typically viewed as reactive experts in taxation, auditing, and financial accounting. These three core areas are places we connect with: we feel comfort in the debits and ...

August 12, 2019 Sponsored

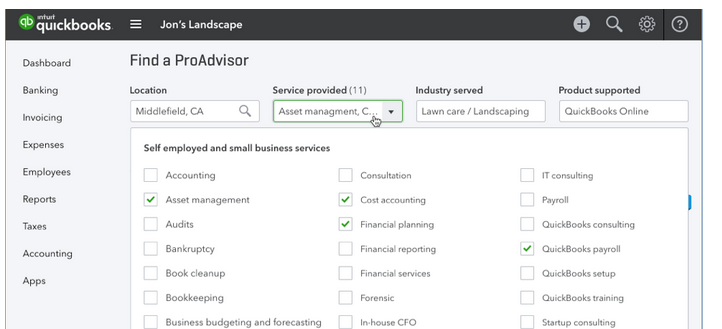

QuickBooks Online Accountant allows accountants and bookkeepers to access all your clients, resources, and tools under one login. It’s cloud-based, which means there are no annual releases or upgrades; instead, Intuit is constantly introducing ...

August 8, 2019

We’re living in an era where every part of our daily lives is impacted by technology in one way or another. We have numerous new methods of electronic communication and seemly endless options for home entertainment and improved technology that ...

August 8, 2019

Now that we’ve passed the mid-year point, it’s a good time for a quick refresher course on what your business clients need to know about choosing their legal structure. Your clients’ business entity type has legal, financial and administrative ...

August 7, 2019

Technology continues to be the accelerator in the transformation of the accounting profession. To implement new technology and leverage existing technology, your processes need to be optimized and improved.

August 7, 2019

Clients of small firms are traditionally very partner-loyal, not firm-loyal. For this reason, it takes additional time to transition clients to the successor firm. If you are one-to-five years away from retiring, a Two Stage Deal may be for you.

August 6, 2019

Practicing in the government and municipality industry sector requires a high level of technical expertise and an acumen for a host of accounting and auditing standards that stretch beyond the Financial Accounting Standards Board (FASB) and U.S.

August 1, 2019

Job opportunities for accountants are generally expected to grow 10 percent by 2026, and that extends to payroll accountants too. With unemployment low and businesses bringing on new hires at a faster rate, the need for payroll ...

July 26, 2019

As tax professionals, we are always seeking ways to add value (and maybe even a little more revenue) to our practices. Few taxpayers realize the importance of making an informed decision on how to title their real property.

July 24, 2019

The Tax & Accounting Technology Innovation Awards honor new technologies that help accounting firms and their small business clients operate more efficiently and profitably through improved workflow, increased accessibility, or enhanced collaboration.