For the calculation of the Average Monthly Payroll cost under the Paycheck Protection Program (PPP), the Gross Payroll approach should be used for the application, according to the recommendation from the AICPA-led small business funding coalition. This recommendation was developed in conjunction with the National Payroll Reporting Consortium (NPRC). It comes after the additional guidelines Treasury and the Small Business Administration (SBA) issued on Thursday.

For the calculation of the Average Monthly Payroll cost, we recommend that payroll providers and CPAs use Gross Payroll based on 2019 data versus Net Payroll (defined as Gross Payroll less federal withholding and employee FICA). Neither the CARES Act nor the recent guidance instructs the PPP applicant to exclude federal withholding and employee FICA for the 2019 period. The Average Monthly Payroll cost includes Gross Payroll and the other defined PPP payroll cost elements such as health care, etc.

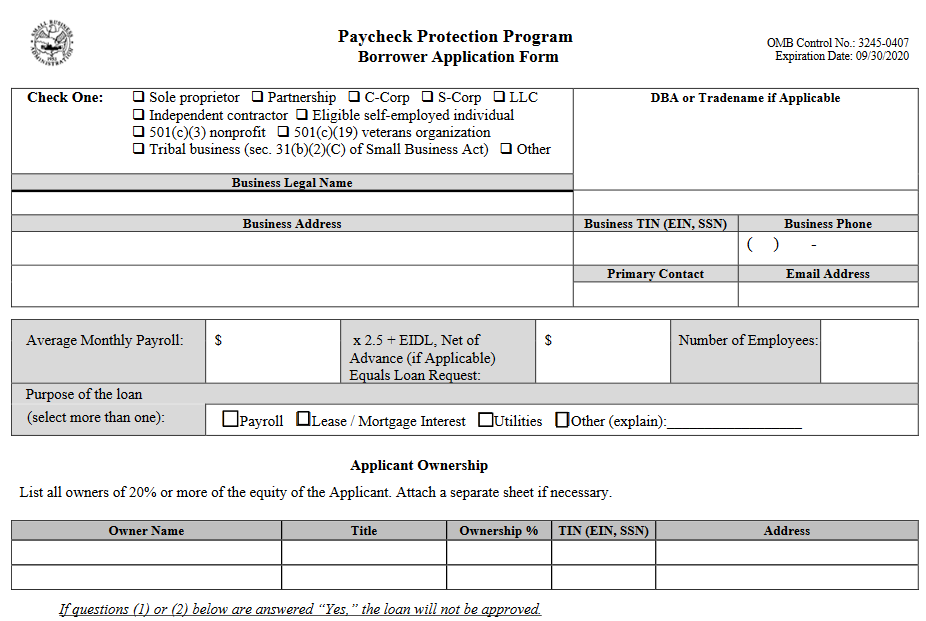

Downloadable Paycheck Protection Program (PPP) Borrower Application Form.

“Treasury and the SBA have acted quickly to generate this small business stimulus. As key stakeholders in the implementation of the PPP relief, we are collectively working to drive consistency in the interpretation of the administration’s guidance. Our goal is to help produce an efficient application process to quickly get the funds in the hands of small businesses and their employees,” said Erik Asgeirsson, president and CEO of CPA.com.

Mark Koziel, CPA, CGMA, the AICPA’s executive vice president of firm services, added, “Based upon statements from members of Congress, it appears that the intent of the PPP was to base the salary calculation on gross wages with no adjustment for federal taxes. This ensures that payroll tax expenses are not passed on to the small businesses in need. In a program of this magnitude, it’s expected that guidance will evolve and terms will be clarified.”

The AICPA also said that its discussions with Treasury, SBA, banks and payroll processors to address these and other issues are ongoing and that it will keep its members, coalition partners and small businesses updated on the efforts to protect Main Street America.

The American Institute of CPAs (AICPA) is the world’s largest member association representing the CPA profession, with more than 429,000 members in the United States and worldwide, and a history of serving the public interest since 1887. AICPA members represent many areas of practice, including business and industry, public practice, government, education and consulting. The AICPA sets ethical standards for its members and U.S. auditing standards for private companies, nonprofit organizations, federal, state and local governments. It develops and grades the Uniform CPA Examination, offers specialized credentials, builds the pipeline of future talent and drives professional competency development to advance the vitality, relevance and quality of the profession.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Income Taxes, Small Business, Taxes