Taxes February 12, 2026

Senate Votes to Overturn D.C. Tax Decoupling, as Locals Push Back

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

Taxes February 12, 2026

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

February 10, 2026

February 10, 2026

February 10, 2026

February 10, 2026

Taxes December 12, 2025

Of the $10.59 billion, $4.5 billion resulted from tax fraud, marking an increase of 111.8% from FY24, the agency said this week.

Taxes December 12, 2025

The casino executives—Derek Stevens of Circa, Tom Reeg of Caesars Entertainment, and Craig Billings of Wynn Resorts—are pressing lawmakers for the restoration of the 100% deduction for gambling losses, which was reduced to 90% under the One Big Beautiful Bill Act.

Taxes December 11, 2025

Scott Bessent targeted New York Gov. Kathy Hochul, Colorado Gov. Jared Polis, and Illinois Gov. JB Pritzker over their state's taxes amid the ongoing holiday season.

Taxes December 11, 2025

The Treasury Department and the IRS provided guidance in Notice 2026-05 on Dec. 9 on new tax benefits for health savings account participants under this summer's One Big Beautiful Bill Act.

Taxes December 11, 2025

Boston Mayor Michelle Wu has said the new tax rates will result in a 13%, or $780 increase, in property taxes for the average single-family homeowner next year.

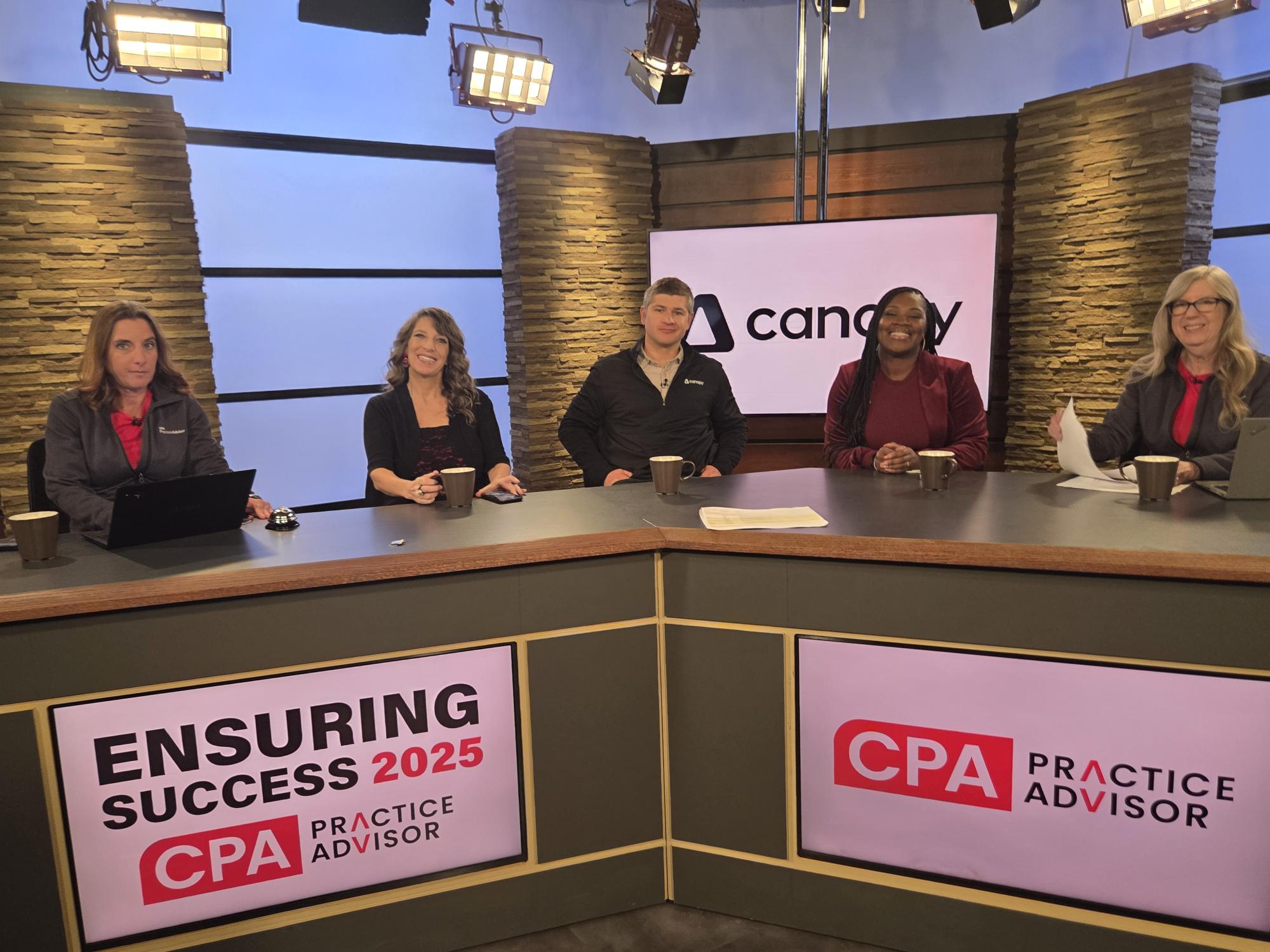

Accounting December 10, 2025

The event is ongoing on Dec. 10-11, 2025, with 7 hours of NASBA-certified CPE credit on each day (14 hours total). A total of five sessions also qualify for IRS-certified CE credit.

Taxes December 9, 2025

A Michigan judge ruled against marijuana businesses in the state Dec. 8, rejecting their arguments that a new 24% wholesale tax on their products, imposed by the Legislature as part of a road-funding deal, should be immediately blocked.

Taxes December 8, 2025

Even if you never claim a tax deduction, the federal government may still know which charities you support.

Legislation December 8, 2025

For CPAs, accountants, and tax professionals, the OBBB delivers sweeping reforms, some long-awaited from the Tax Cuts and Jobs Act (TCJA) of 2017 and some unexpected.

Taxes December 1, 2025

The measure, which was filed with the attorney general’s office in October and opposed by Gov. Gavin Newsom, would impose a one-time 5% tax on Californians with assets worth $1 billion or more.

Taxes December 1, 2025

The latest numbers from the Tax Foundation show that Wyoming is the most taxpayer-friendly state, Montana is 6th, and Idaho is 9th. But Washington coming in near last at 45th is a cause for concern.

Taxes November 26, 2025

The Republican senator from West Virginia and his wife owed the $5.2 million going back to at least 2009. The Justice Department sued Nov. 24 to collect the money, and the Justice family agreed hours later to pay up.