Taxes February 12, 2026

Senate Votes to Overturn D.C. Tax Decoupling, as Locals Push Back

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

Taxes February 12, 2026

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

February 10, 2026

February 10, 2026

February 10, 2026

February 10, 2026

Taxes December 30, 2025

If passed by California voters in November 2026, the measure would impose a one-time tax of 5% on individuals with assets worth $1 billion or more.

Taxes December 29, 2025

In a new case, Alioto, TC Memo 2025-125, 12/4/25, a C corporation paid the personal expenses of its main shareholder, with adverse tax consequences.

Taxes December 26, 2025

As a result of the new stipulation, the date stamped on mailed items may be several days later than when the mail was actually deposited, raising concerns for taxpayers who rely on the postmark to document the timing of charitable gifts.

Taxes December 26, 2025

The IRS announced tax relief for individuals and businesses in Washington state affected by severe storms, straight-line winds, flooding, landslides, and mudslides that began on Dec. 9.

Taxes December 26, 2025

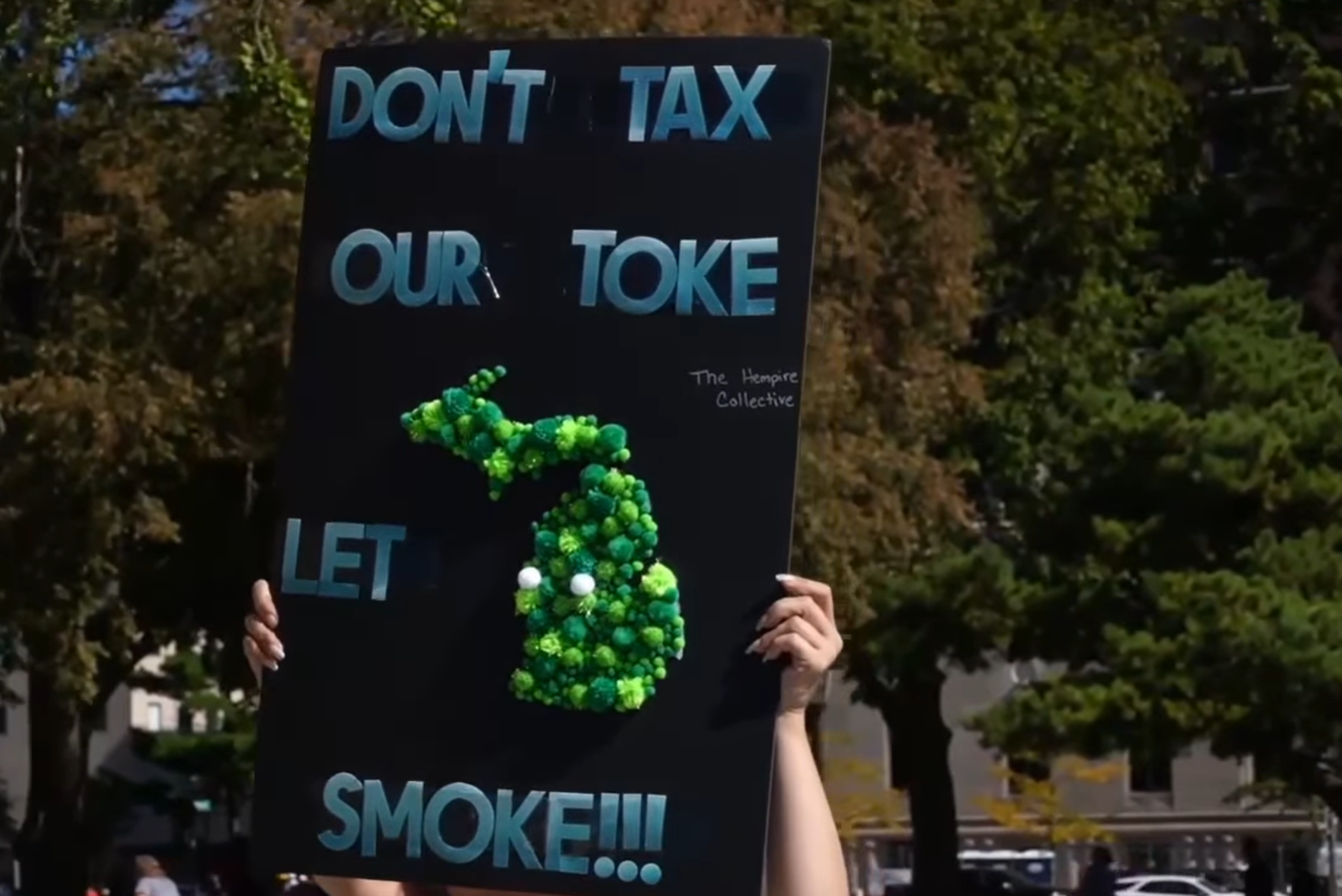

The Michigan Cannabis Industry Association on Tuesday appealed a lower court ruling that upheld the imposition of a new 24% wholesale tax on marijuana sales, set to take effect Jan. 1, 2026.

Taxes December 26, 2025

Gov. Bob Ferguson said Dec. 23 the proposal would be tied to reducing sales taxes on baby and hygiene items, expanding the working families tax credit, increasing K-12 school funding, and lowering the key tax rate for small businesses.

Taxes December 24, 2025

If you acquire permanent whole life insurance as opposed to term life insurance, your premium payments build up a cash value in the policy.

Taxes December 23, 2025

The IRS Whistleblower Office said Dec. 19 that it's making it easier for whistleblowers to report tax cheats to the IRS with the launch of the new digital Form 211, "Application for Award for Original Information."

Taxes December 23, 2025

Announcement 2026-01, which was issued on Dec. 22, notes that future IRS guidance will explain the process of how eligible taxpayers can submit a dyed fuel refund claim.

Accounting December 23, 2025

CPA Practice Advisor has announced the recipients of the ‘Most Powerful Women in Accounting’ awards. Now in their 14th year, the awards recognize leaders for their significant contributions to the profession.

Accounting January 20, 2026 Sponsored

Most firms focus on efficiency, automation, and AI, but the real challenges inside a tax workflow are often simpler and more human: unclear expectations, too many handoffs, information scattered across tools, and clients or staff feeling unsure about what comes next.

Taxes December 22, 2025

The IRS on Monday opened a 90-day public comment period, which ends March 22, for proposed updates to its voluntary disclosure practice, including a more streamlined penalty framework.