Taxes February 12, 2026

Senate Votes to Overturn D.C. Tax Decoupling, as Locals Push Back

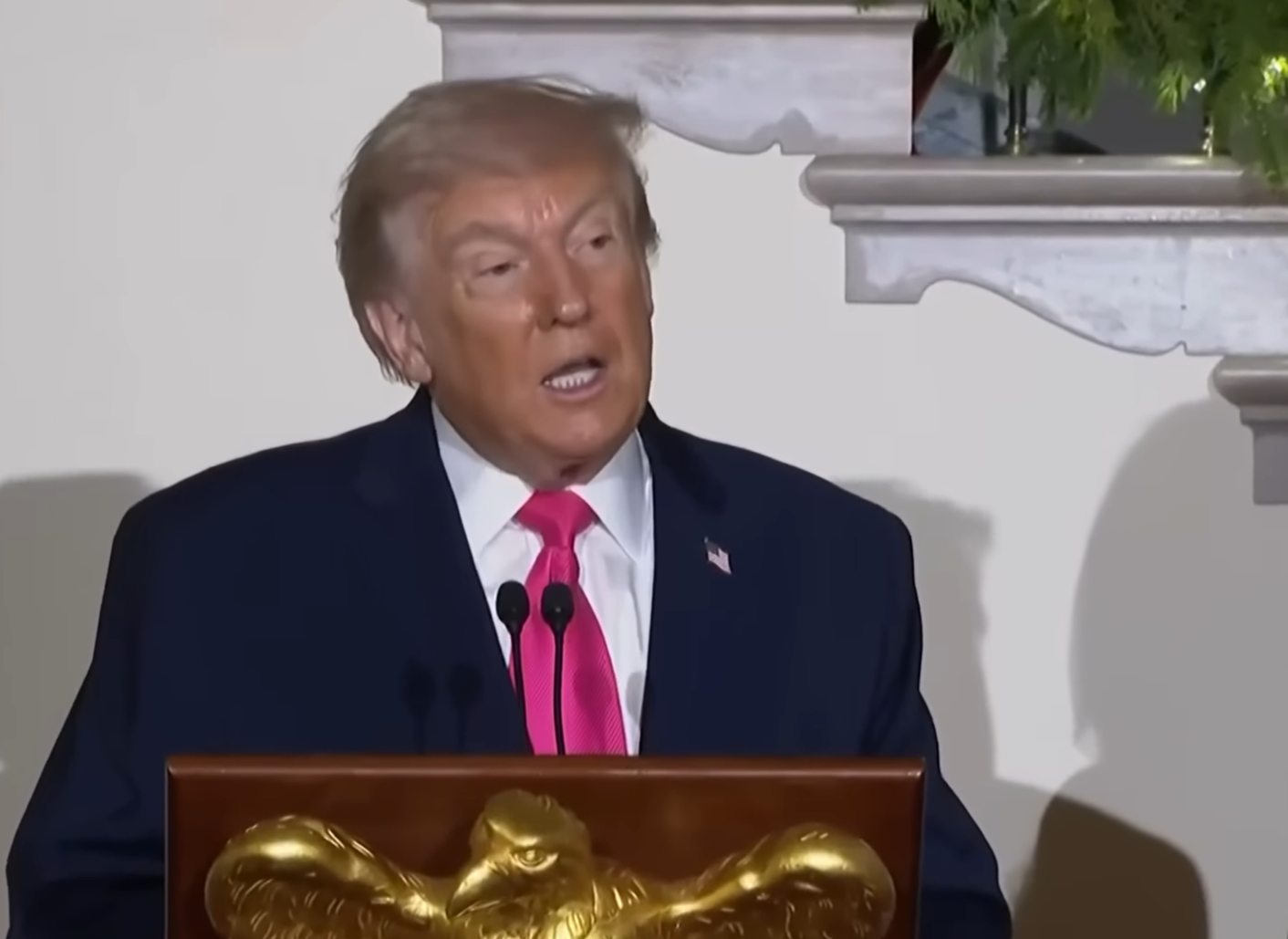

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

Taxes February 12, 2026

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

February 10, 2026

February 10, 2026

February 10, 2026

February 10, 2026

Taxes December 22, 2025

Notice 2026-01 provides a safe harbor for businesses that wish to claim the Section 45Q tax credit for qualified carbon oxide captured and disposed of in secure geological storage occurring during calendar year 2025.

Taxes December 22, 2025

This new credit, established under the One Big Beautiful Bill Act, is for contributions to scholarship granting organizations that serve elementary and secondary school students from low- and middle-income families.

Taxes December 19, 2025

This series of articles spotlights key tax issues and changes made to tax law in 2025 and the years to come as a result of the OBBBA.

Taxes December 18, 2025

The confirmation follows Monday’s posting of a draft IRS Form W-2G, reflecting changes mandated by the OBBBA, which amended federal information-reporting requirements for certain payments, including casino gambling winnings.

Taxes December 18, 2025

Among the most immediate impacts of rescheduling marijuana as a Schedule III drug would be relief from IRS Code 280E, which prevents businesses that handle Schedule I or II substances from deducting routine expenses such as rent, payroll and equipment.

![natural_disasters_list_1_.56117a5e5df03[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/12/natural_disasters_list_1_.56117a5e5df03_1_.61c1db14bf0ea.png)

AICPA December 18, 2025

The act offers taxpayers impacted by disasters more opportunities to meet their tax obligations without additional confusion, stress, and anxiety.

Taxes December 17, 2025

The "Warrior Dividend" President Donald Trump announced Dec. 17 is $1,776 and will be sent to service members before Christmas.

Taxes December 17, 2025

Recent tax legislation imposed by President Donald Trump and enacted by the One Big Beautiful Bill Act is at the heart of the increase, the White House said.

Taxes December 17, 2025

In a major blow to House Speaker Mike Johnson, four Republicans—Reps. Brian Fitzpatrick (Pa.), Mike Lawler (N.Y.), Robert Bresnahan (Pa.) and Ryan Mackenzie (Pa.)—signed Minority Leader Hakeem Jeffries' (D-N.Y.) discharge petition to force a House vote on a bill extending Affordable Care Act subsidies.

Taxes December 17, 2025

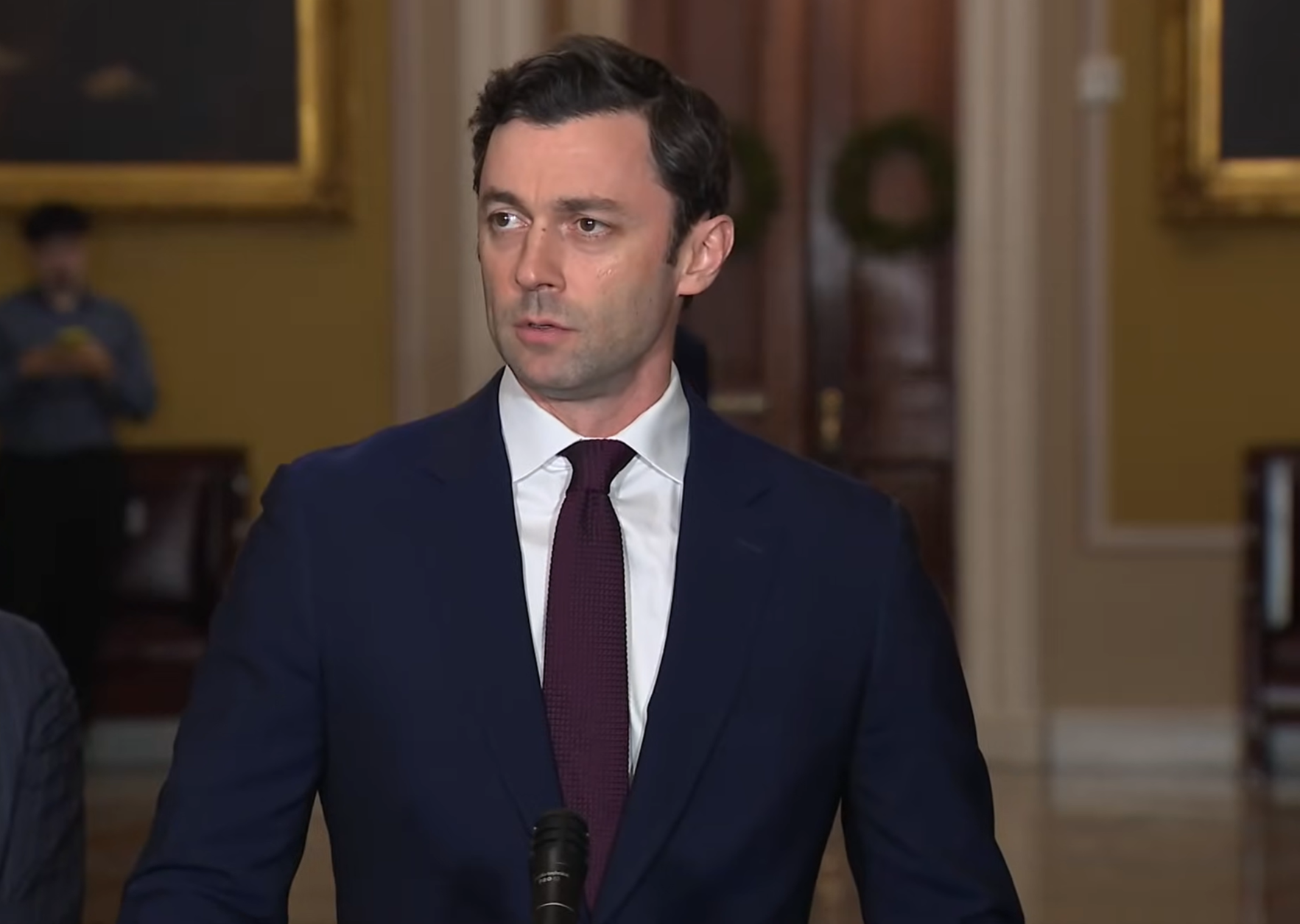

Sen. Jon Ossoff (D-GA) has teamed up with Republican Sen. Cindy Hyde-Smith of Mississippi on legislation to cut income taxes for qualifying small businesses with up to 15 employees.

Taxes December 17, 2025

An obstacle to New York City Mayor-elect Zohran Mamdani’s plan to expand free child care is its reliance on lawmakers in Albany and tax revenue from wealthy New Yorkers, though a new survey indicated broad support for that approach.

Taxes December 15, 2025

Forecasts of a bump in the average tax refund coming in the new year mask the uneven distribution of new tax breaks in President Donald Trump’s signature legislation, said Adam Michel, director of tax policy studies at the Cato Institute.