Taxes February 12, 2026

Senate Votes to Overturn D.C. Tax Decoupling, as Locals Push Back

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

Taxes February 12, 2026

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

February 10, 2026

February 10, 2026

February 10, 2026

February 10, 2026

Taxes May 20, 2024

Federal tax breaks aim to boost sustainable jet fuel production to curb emissions from commercial planes and meet climate targets.

Taxes May 16, 2024

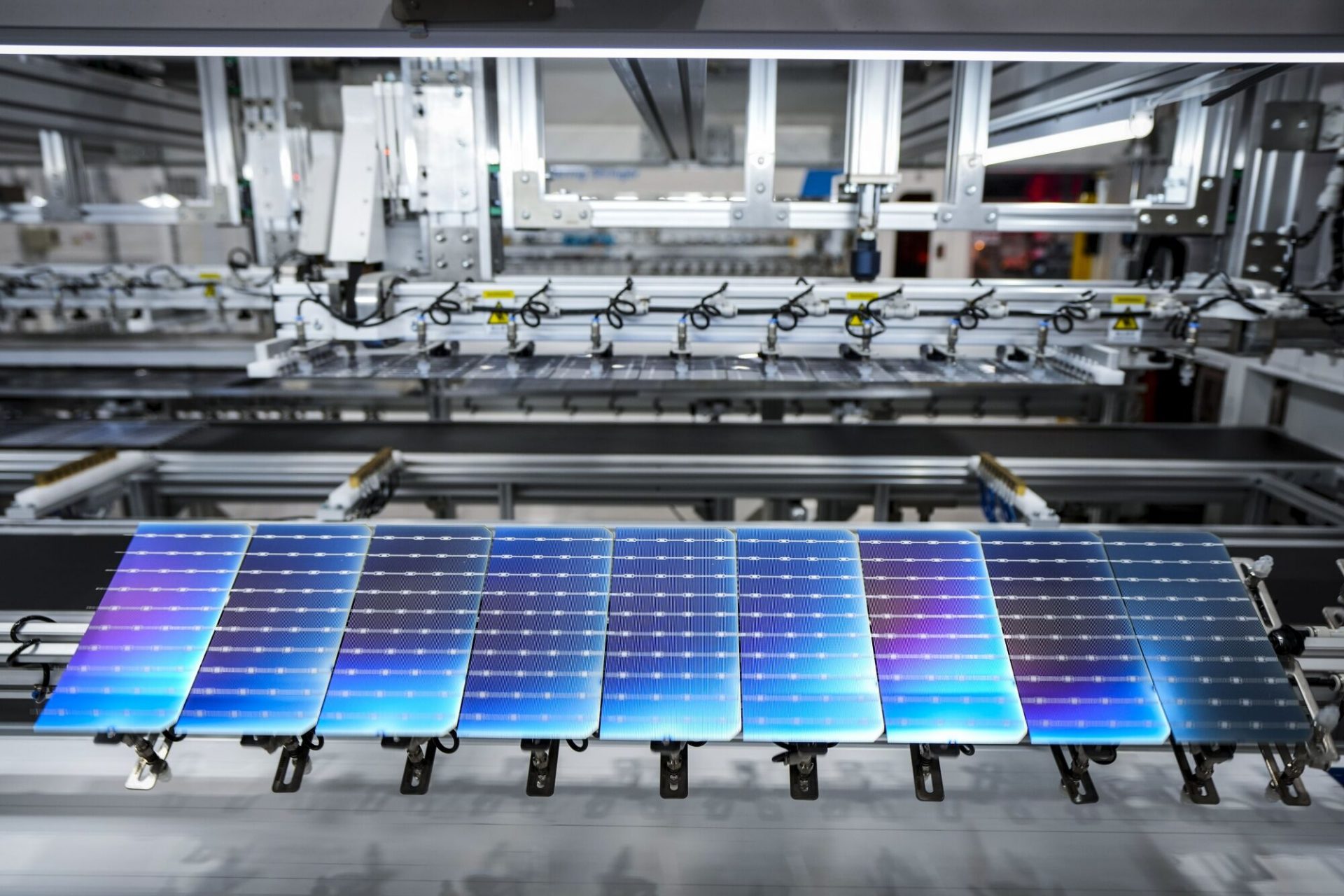

The measures include expanded tariffs, tax policy guidance, and promises of heightened vigilance for signs of unfair trade.

Taxes May 16, 2024

U.S.-based multinational companies can emerge not just compliant but better positioned in a post-global minimum tax world.

Legislation May 16, 2024

The rate on Chinese EVs will increase from 25 percent to 100 percent this year, while the rate on lithium-ion EV batteries will increase from 7.5 percent to 25 percent.

Advisory May 15, 2024

The Readers' Choice Awards give readers the chance to spotlight the technologies they most respect and trust to provide client services, manage their firms, and help their clients run their businesses.

Taxes May 15, 2024

The risk a compromised CAF number presents to practitioners and taxpayers is prompting these additional security measures.

Sales Tax May 14, 2024

The term “communications tax” often refers to a multitude of federal government charges, state and local taxes, fees, and regulatory contribution charges.

Taxes May 14, 2024

This year’s speaker line-up features nationally recognized experts who will guide participants through in-depth sessions and discussions...

Taxes May 13, 2024

During a rally Saturday on the New Jersey shore, Donald Trump pledged to double down on tax cuts if he wins a second term as president.

Taxes May 9, 2024

Starting on July 1, the rate for overpayments and underpayments for individuals will be 8% per year, compounded daily.

IRS May 9, 2024

Beginning in January, you'll be able to contribute more to your health savings account, based on the IRS's latest inflation adjustments.

Taxes May 9, 2024

That puts a massive price tag on what is likely to be a top issue in Washington next year as lawmakers grapple with the future of Trump’s tax cuts, which are slated to expire at the end of 2025.