Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

Taxes March 7, 2025

Even though the Tax Court is commonly thought of as the forum of last resort for appealing tax bills and other IRS issues, there is a way to appeal a Tax Court ruling. However, the chances of success of these appeals are often relatively low.

Taxes March 6, 2025

These criteria provide a framework to stablecoin issuers for presenting and disclosing information related to the tokens they issue.

Payroll March 5, 2025

The National Association of Tax Professionals said it's trying to bridge the gap between recently displaced IRS workers and tax and accounting firms in need of skilled professionals.

Accounting March 5, 2025

Gordian A. Ndubizu was sentenced to two years in prison after being convicted on Aug. 15 of four counts of tax evasion and four counts of filing false tax returns in tax years 2014 through 2017.

Taxes March 4, 2025

The IRS said Feb. 27 that it's adding the two information return documents to its IRS Individual Online Account tool, which the agency said will consolidate important tax records into one digital location.

Taxes March 4, 2025

The IRS reports the average tax refund in 2025 is up $240 through the week ending Feb. 21, with more than 42 million returns processed so far.

IRS March 3, 2025

Dismissal notices went out Saturday to about 85 employees of 18F, a federal agency that works on improving government technology—effectively shutting down an office hailed a decade ago as Uncle Sam’s new tech startup.

Small Business March 2, 2025

The Treasury Department announced March 2 that it will no longer enforce the Corporate Transparency Act or the associated beneficial ownership information reporting requirements.

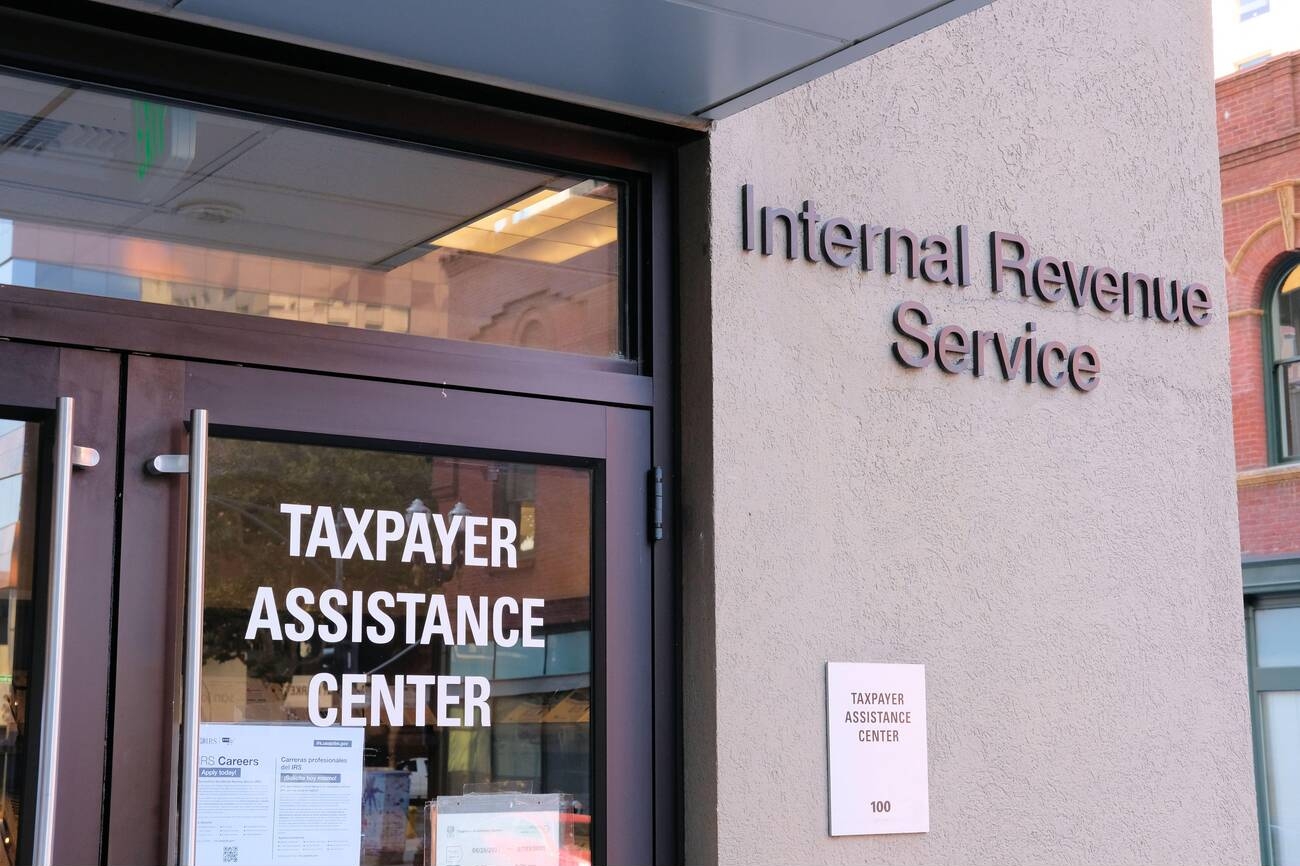

Taxes February 28, 2025

More than 100 IRS offices that host taxpayer assistance centers appear to be on the chopping block as the Trump administration continues efforts to cut waste from the federal government. But any closures likely won't take place until after tax season.

Taxes February 28, 2025

A Florida man pleaded guilty today to orchestrating a nearly decade-long scheme to promote an illegal tax shelter and commit wire fraud. He also pleaded guilty to assisting in the preparation of false tax returns for tax shelter clients.

Taxes February 28, 2025

Each year, the Internal Revenue Service puts together a Dirty Dozen list warning taxpayers, businesses, and tax professionals of tax scams to watch out for, and common schemes that threaten their tax and financial information.

Taxes February 26, 2025

The tax data was stolen and leaked to the media by Charles Littlejohn, a former government contractor who was convicted and sentenced last year to five years in prison.