Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

February 21, 2026

February 20, 2026

February 20, 2026

February 20, 2026

February 19, 2026

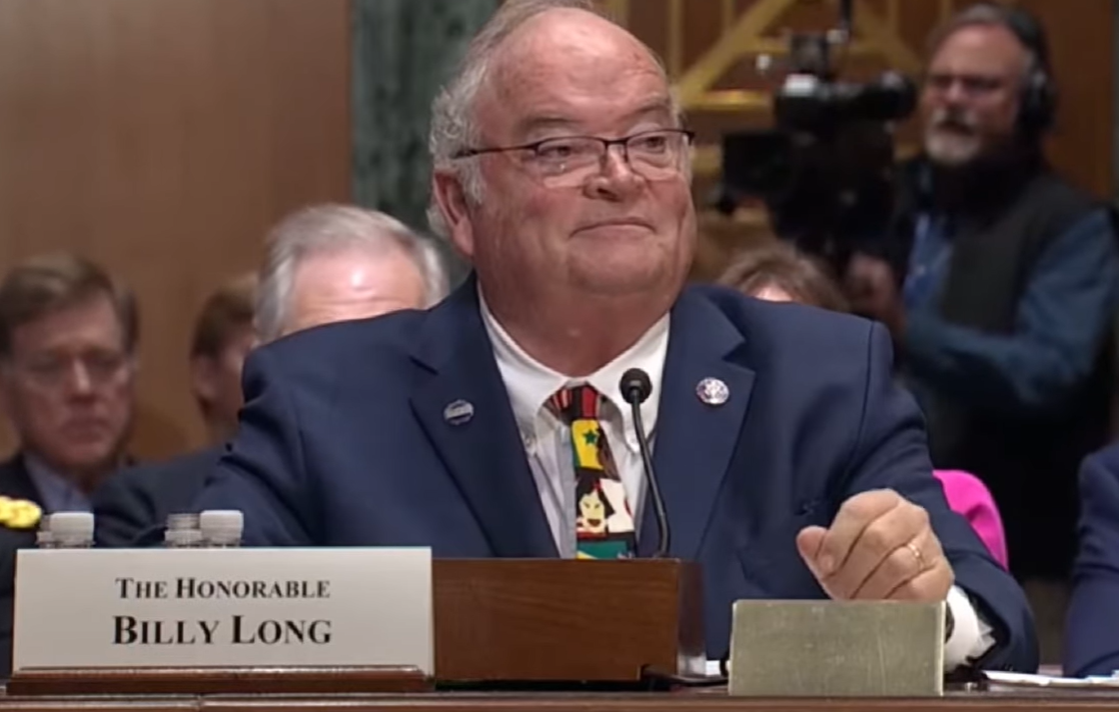

IRS June 12, 2025

The former Missouri lawmaker won confirmation on June 12 to be the next commissioner of the IRS, leading an agency that will play a key role in administering new tax breaks if Congress passes the “big, beautiful” reconciliation package.

Taxes June 12, 2025

The reconciliation bill passed by the House would most benefit high earners and reduce financial resources available to the lowest-income households, the Congressional Budget Office said on June 12.

IRS June 12, 2025

A coalition representing tax professionals urged the Treasury Department in a letter to take immediate steps to preserve core IRS functions—for both taxpayers and practitioners—amid workforce reductions at the tax agency.

Taxes June 12, 2025

The Treasury Department is considering changing rules to revoke tax-exempt status for colleges that consider race in student admissions, scholarships, and other areas.

IRS June 11, 2025

Danny Werfel, who served as IRS commissioner during the Biden administration, has joined the strategic advisory board of alliant, a Houston-based professional services and consulting firm formerly known as alliantgroup.

Taxes June 11, 2025

The need for fixes risked derailing the reconciliation package containing most of President Donald Trump’s agenda, from tax cuts and border security to spending cuts and a major increase in the nation’s borrowing limit.

Taxes June 10, 2025

A company that sells automobiles through an auction house claimed a software glitch outside of its control led to the non-filing of Form 8300. Did the Tax Court give the company a pass?

Taxes June 10, 2025

Those impacted by the wildfires that destroyed at least 530 homes and businesses in parts of Oklahoma last March will now have until Nov. 3, 2025, to file various federal individual and business tax returns and make tax payments.

State and Local Taxes June 6, 2025

Senate Majority Leader John Thune (R-SD) has suggested the upper chamber will have to make some changes to the massive tax breaks and spending package passed by the House—including to the SALT cap.

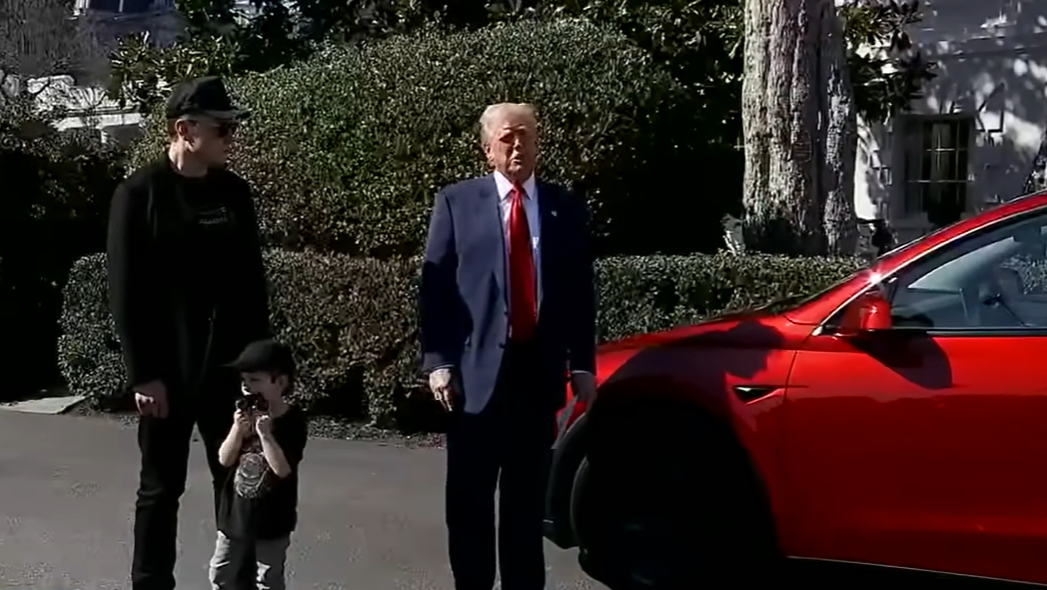

Taxes June 5, 2025

The president hit back at the Tesla CEO over his criticism of Republicans' massive budget proposal, suggesting the tech mogul is primarily upset over provisions that slash government support for electric vehicles.

Taxes June 5, 2025

The IRS just released its annual “Data Book” providing vital information about the agency’s activities for its 2024 fiscal year (FY2024) spanning October 1, 2023, through September 30, 2024 .

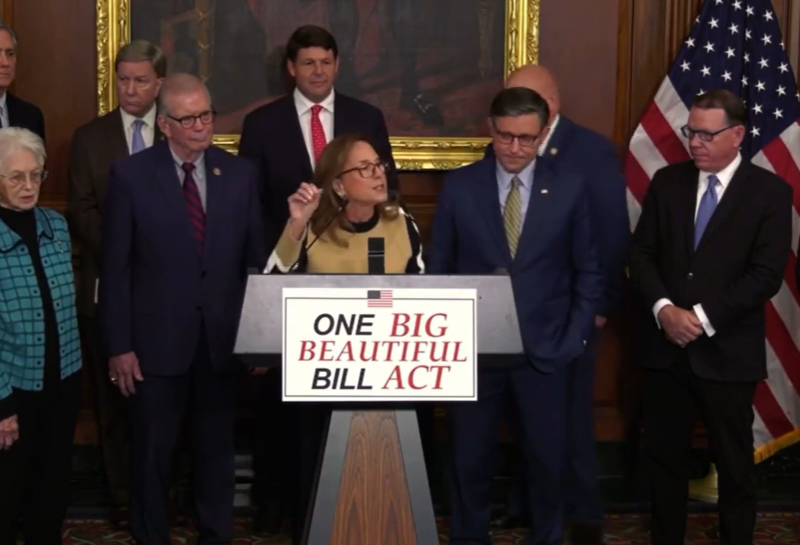

Taxes June 4, 2025

If President Donald Trump’s “big, beautiful bill” passes, taxes will be cut by roughly $3.75 trillion but it will add $2.4 trillion to the overall deficit over the next decade, according to a new report from the Congressional Budget Office.