Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 8, 2026

June 23, 2013

Nearly one-quarter of the 76,000 job commitments JobsOhio says it helped secure for Ohio in 2012 would not have counted under the scoring system the non-profit used the previous year, a Dayton Daily News analysis has found.

June 22, 2013

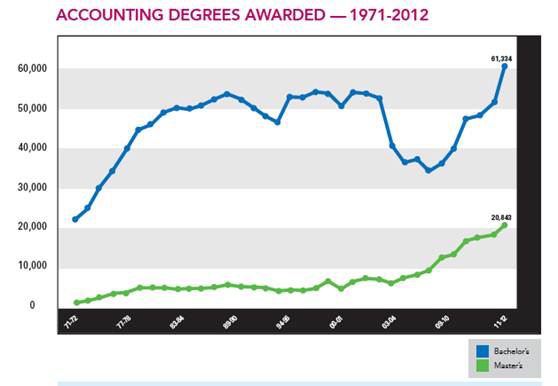

College students and those considering reshaping their professional paths frequently look for lists of what the best career choices are. Well, this isn't a list, but a hard fact: Accounting graduates are among the most in-demand professionals in America today.

June 21, 2013

Now, fellow employees at an Ashland marketing firm, who cooked meals for Mayhew and wished her well, are hoping she's jail-bound.

June 21, 2013

Miami's BrightStar Corp. tops HispanicBusiness.com's annual rankings for the third straight year

June 21, 2013

With rising gas prices and long commutes, more and more American workers are finding a way to beat the hassle of the daily trek to work: working from a home office.

June 20, 2013

New CalCPA Chair Urges Stronger Ties To CPA Firms, Outreach to New Members

June 20, 2013

She spent her days serving up Happy Meals, but when it came time to get paid, Natalie Gunshannon says a local McDonald's franchisee gave her an unhappy deal.

June 20, 2013

Philanthropic giving is inching its way back up, but the country has not returned to its pre-recession levels of generosity.

June 19, 2013

The Wisconsin State Legislature voted overwhelmingly this week to provide $25 million in taxpayer money to start-up companies, sending Gov. Scott Walker a measure that he has long sought.

June 19, 2013

An investment fund owner and operator that defrauded investors of approximately $6 million has agreed to plead guilty to securities fraud charges filed by the U.S. Attorney for the Western District of North Carolina.

June 19, 2013

Amazon and other e-commerce firms are responding to a change in Minnesota tax law by cutting ties with bloggers in the state who earn money by posting links that refer shoppers to online stores.

June 19, 2013

CCH has opened the registration period for the CCH: Connections: User Conference 2013. This year’s conference will take place October 27-30 at the JW Marriott Desert Ridge Resort & Spa in Phoenix, Arizona, offering tax and accounting professionals educational sessions, demonstrations of the most advanced industry solutions and exciting networking events. CCH, a part of...…